10 February 2015

3QFY15 Results Update | Sector:

Metals

Nalco

BSE SENSEX

28,356

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Free float (%)

S&P CNX

8,566

NACL IN

2,577.2

69/32

-5/-24/11

19.1

CMP: INR50

TP: INR87 (+74%)

Buy

Strong operating performance; valuations compelling

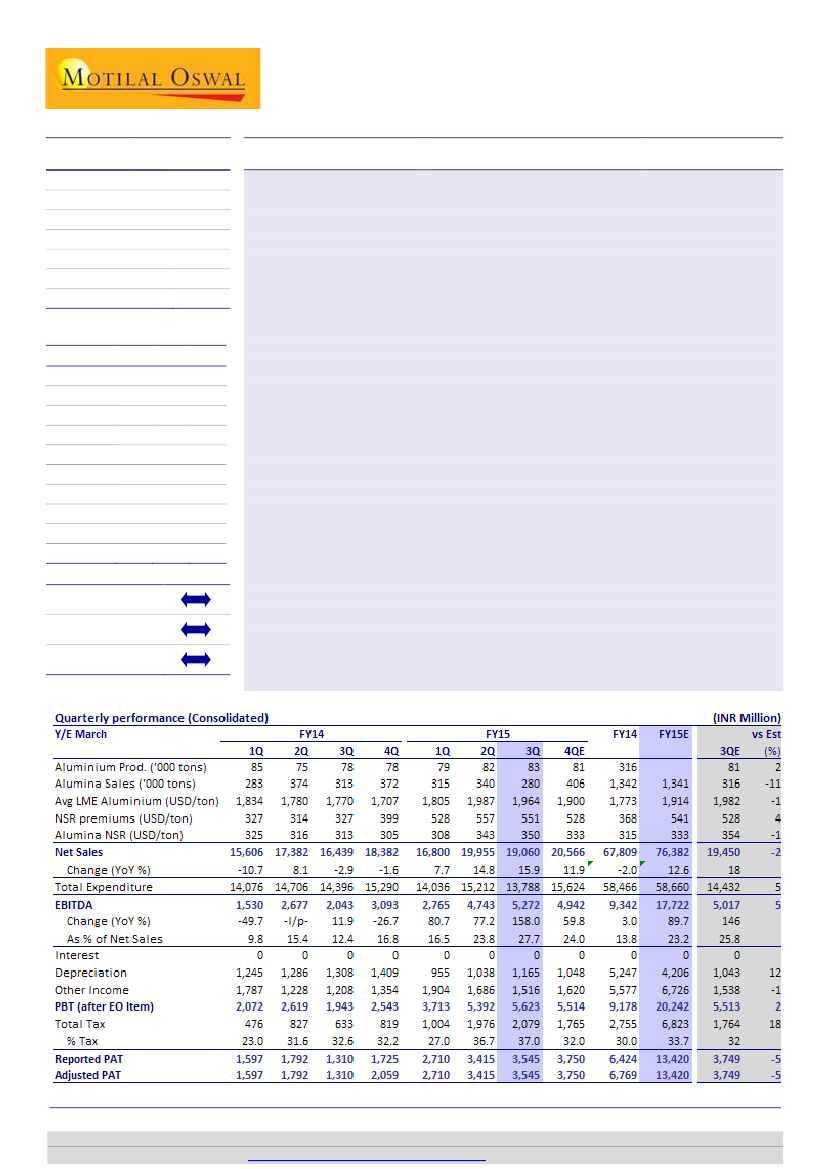

EBITDA grew 11% QoQ to INR5.25b, 5% ahead of our estimate on lower raw material

and seasonally lower coal cost, despite lower than expected alumina exports (at 280kt,

11% miss).

n

Sales down 4% on lower alumina volumes:

Net sales declined 4% QoQ to

INR19.1b, driven by lower alumina volumes. Alumina production was down 6%

QoQ to 460kt, but sales volumes declined 18% QoQ to 280kt, as the Hudhud

cyclone disrupted dispatches in mid-October. Aluminum sales grew 1% QoQ (5%

YoY) to 82kt. Alumina realization grew 2% QoQ to USD350/ton, while aluminum

realization was down 1% QoQ to USD2,515/ton.

n

Strong EBITDA performance on lower CoP:

Despite weak sales, EBITDA grew 11%

QoQ (1.5x YoY) to INR5.2b. Raw material cost as a percentage of sales declined

250bp QoQ, while power and fuel cost was down 50bp QoQ. Caustic soda and

carbon cost are declining. We believe seasonally lower coal cost drove EBITDA

beat.

n

Higher tax rate, depreciation dragged PAT growth:

PAT growth was slower at 4%

QoQ to INR3.5b (5% miss), driven by higher than expected tax rate (37% v/s our

estimate of 32%) and increase in depreciation cost (+12% QoQ).

n

Valuations compelling:

The stock is currently trading at an EV of 2.1x FY16E

EBITDA (LME at USD2,000/ton), which we believe is significantly cheap compared

to Metals peers. Even at spot LME aluminum of USD1,850/ton, the stock would

trade at 3.1x. We value NACL at INR87 (LME: USD2,000/ton, 75% upside). We

believe alumina prices will inch up, as China depletes bauxite inventories and start

boosting imports gradually over 2015 and 2016. LME prices too will be supported

by higher cost of production. Reiterate

Buy.

M.Cap. (INR b) / (USD b) 128.9/2.1

Avg Val (INRm)/Vol ‘000 163/2,983

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

NP

Adj. EPS (INR)

EPS Gr(%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA (x)

2015E 2016E 2017E

77.3

18.7

14.1

5.5

107.7

50.7

11.2

15.7

9.2

3.3

86.3

22.8

17.3

6.7

22.8

55.7

12.6

17.4

7.5

2.1

88.3

23.0

17.4

6.7

0.5

60.7

11.6

16.1

7.4

1.5

Estimate change

TP change

Rating change

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.