12 February 2015

3QFY15 Results Update | Sector:

Consumer

Bajaj Electricals

BSE SENSEX

28,805

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

AvgVal(INRm)/Vol ‘000

Free float (%)

S&P CNX

8,712

BJE IN

100.0

22.2/0.4

385/191

-12/-30/-45

98/362

34.4

CMP: INR222

TP: INR300 (+35%

Buy

Results below expectations; E&P turnaround likely in FY16

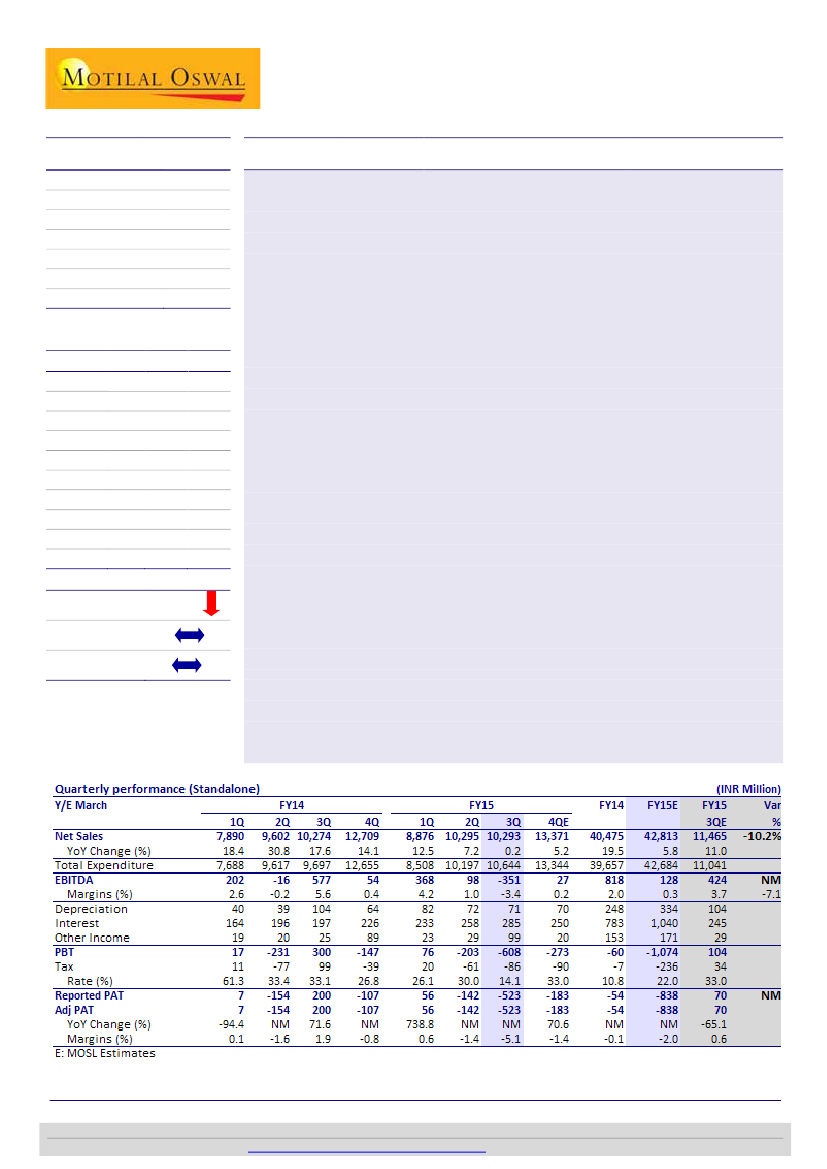

Revenue declined 0.4% YoY to INR10.3b (our estimate: INR11.5b). EBITDA was

negative INR351m (our estimate: INR424m). EBITDA margin was -3.4% (our estimate:

3.7%) against 5.6% in 3QFY14. Lighting division margins were 4.6% against 5.2%,

Durables margins were 6.7% against 9.6%, while E&P margins were -26.2% against -

4.7%. PAT was -INR523m (our estimate: INR70m) against INR200m in 3QFY14.

Consumer and Lighting divisions report degrowth:

Lighting business degrew 6.2% YoY

to INR2.3b, while Consumer Durables degrew 2% to INR5.1b. While CFL lamps

continued to exert pressure on Lighting growth, the management is incrementally

focusing on introducing and promoting new LED products, which should offset CFL

business decline to some extent. We expect Lighting business to remain flat over FY15-

17. With the implementation of replenishment-based distribution structure, primary

sales for the Consumer division was impacted during the quarter, driving 2% YoY

degrowth. With 80% of the distribution transition likely in FY16, we expect meaningful

growth recovery in FY17 (15% growth in FY17 against 8% in FY16 and 4% in FY15).

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

2015E 2016E 2017E

42.8

0.1

-0.8

-8.4

60.3

-12.8

-0.3

47.4

3.1

1.2

12.3

69.7

18.9

27.8

54.3

3.8

1.7

16.5

34.8

83.0

21.7

31.5

1,478 -246.4

E&P performance still under pressure, turnaround on track:

E&P revenue grew 8.9%

P/E (x)

-26.5

18.1

13.4

YoY to INR2.9b. During the quarter, BJE provided INR830m towards doubtful

P/BV (x)

3.7

3.2

2.7

receivables, which drove down margins to -26%. In 9MFY15, BJE has made provisions

of INR1.6b. With most legacy projects completed and most provisions for receivables

already made, the management expects a turnaround in FY16. We believe, with a

Estimate change

27%/14%

strong book of INR34.9b for E&P and concerted efforts by the management towards

TP change

timely execution, E&P turnaround is on track for FY16. We expect margins in the E&P

division to improve from -10% in FY15 to +5% in FY16.

Rating change

Valuation and view:

With expected delay in E&P turnaround along with worsening

growth and profitability in the core Lighting and Consumer business, we cut our EPS

estimates for FY16 and FY17 by 27% and 14%, respectively. Maintain

Buy.

Our target

price is INR300 (18x FY17E EPS of INR16.5).

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.