16 February 2015

4QCY14 Results Update | Sector:

Automobiles

Eicher Motors

BSE SENSEX

29,136

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INR M)/Vol

Free float (%)

S&P CNX

8,809

EIM IN

27.1

435.0/7.0

16,895/4,810

1/49/189

506/47

45.0

CMP: INR16,109

TP: INR17,674 (+10%)

Buy

Above estimate driven by VECV; RE on track for 0.45m in CY15

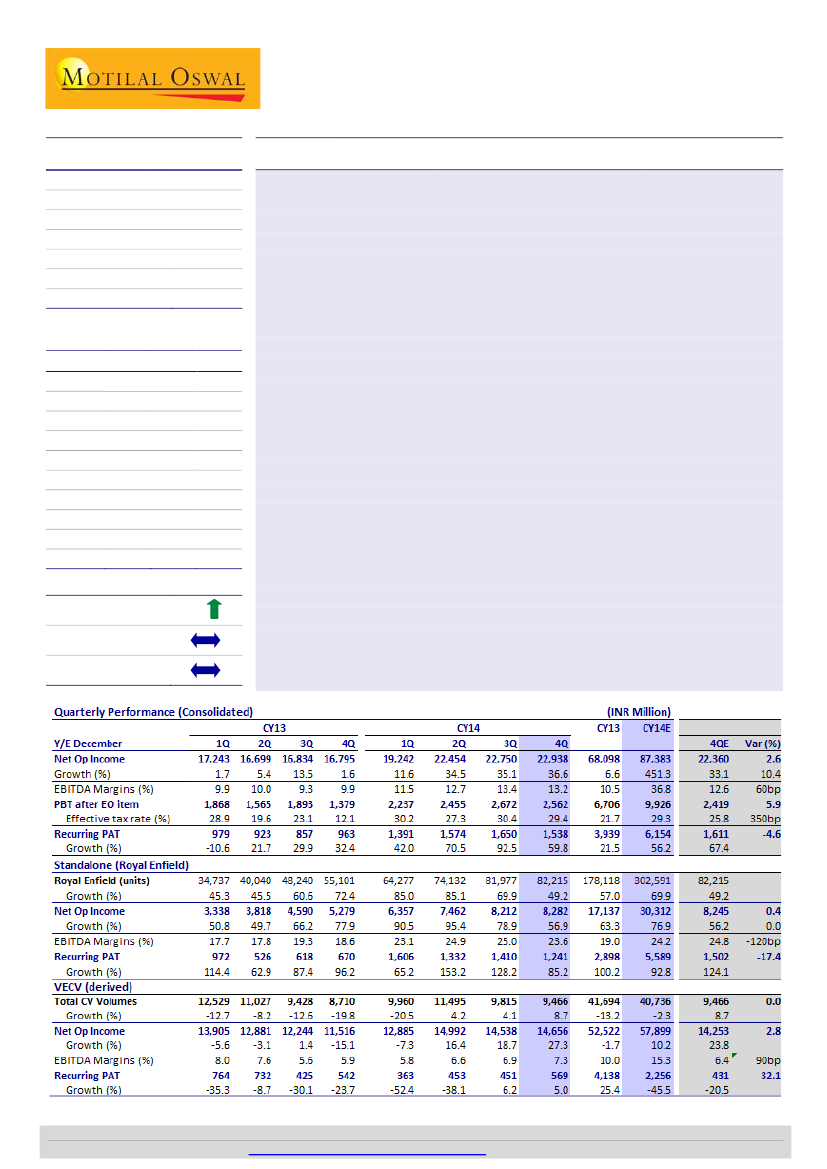

Consolidated operating performance was above estimate driven by a beat in EBITDA

margin to 13.2% (v/s est. 12.6%). EBITDA was at INR3.03b (v/s est. INR2.8b) driven

by strong VECV performance but diluted by weaker RE performance. Tax rate was

higher at 29.4% (v/s est. 25.8%), resulting in PAT of INR1.54b (v/s est. INR1.6b),

growth of 60% YoY (-7% QoQ).

Royal Enfield performance below estimate:

While volumes and realization both

grew 49% and ~5% YoY respectively, EBITDA margin was lower at 23.6% (v/s est.

~24.8%) on account of higher other expenses (up 120bp QoQ). Higher tax rate at

33% further restricted PAT to INR1.24b.

VECV’s strong realizations and EBITDA margin:

VECV’s realizations improved ~4.5%

QoQ (17% YoY) to ~INR1.55m (v/s est. ~INR1.5m). EBITDA margin of 7.3% (+40bp

QoQ, +140bp YoY) was above our expectation of 6.4%.

Earnings call highlights:

1) EIM expects producible capacity of ~450,000 in CY15

(largely from old plant + phase 1 of Oragadam plant), although ramp-up would not

be linear. Oragadam phase 2 capacity to start operations from 3QCY15 and on full

ramp-up, will increase production to ~60,000/month by mid-CY16, 2) currently, RE

enjoys around five-month waiting period, 3) investing in two technology centers --

main center at Chennai (to be ready by 2QCY16) and satellite center at UK (by end-

CY15), 3) price increase of 2% in January 2015, along with ~4% excise duty increase

and 4) capex (CY15): Royal Enfield - INR5b (including R&D and front-end stores etc)

and VECV ~INR5b.

Valuation and view:

We raise CY15E/16E/17E EPS by 5.2%/5.6%/2.4% respectively.

EIM trades at 39.2x/24.4x CY15E/16E EPS of INR411/660 respectively. Maintain

Buy

with a target price of INR17,674 (CY16E SOTP-based).

Financials & Valuation (INR Billion)

Y/E Dec

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2015E

130.0

19.8

11.1

411

74.6

39.2

42.6

39.2

13.1

2016E

183.6

32.0

17.8

659.6

60.5

1,825

43.2

51.1

24.4

8.8

2017E

218.4

37.6

21.5

796.5

20.8

2,553

36.4

43.9

20.2

6.3

BV/Sh.(INR) 1,226

Estimate change

TP change

Rating change

5%

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.