Sector Update | 28 April 2015

Technology

Is the party over?

Revenue miss across top tier; pricing pressure, and a contrarian perspective

n

n

n

n

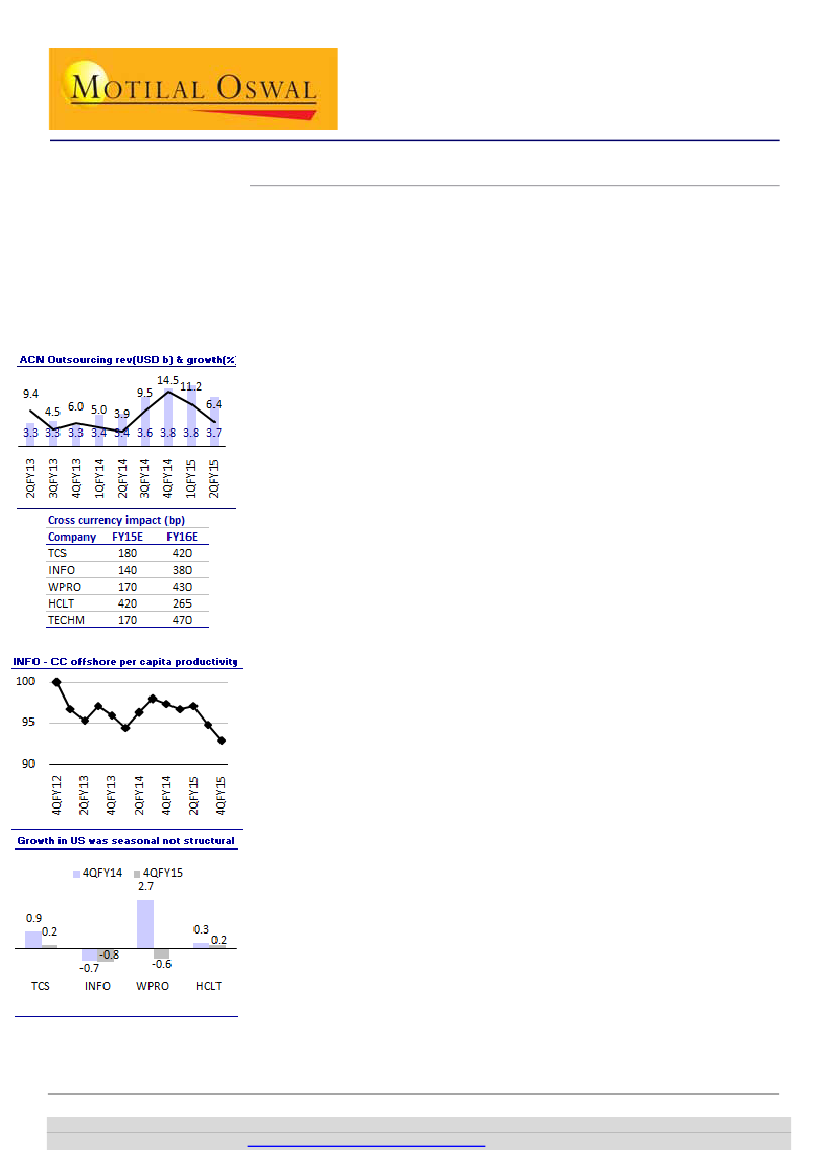

Weak revenue trends suggest pressure to growth from new technologies at tier-I. But

Accenture’s example suggests capabilities can drive sanguine growth

Currencies and seasonal US weakness seem to be key factors dragging revenues,

than any structural concerns

Pricing pressure is increasingly evident, but its impact on margins not yet

Currency-led earnings pressures may weigh on near-term valuations

Digital is BIG, but is it for the BIG?

That is the question coming up after the revenue miss across top tier in 4QFY15,

with noticeable pricing pressure in at least two of the top four and the consequent

fear that Digital may be cannibalizing more existing revenue than adding new ones.

But we do not believe it is a absolute gloomy scenario for larger companies in the

long run yet. Those gunning to aggressively build capabilities will still flourish –

Accenture, ~2x size of TCS, proved this recently (2 quarters of guidance uptick).

Growth dismal but not falling off a cliff, currencies are!

Constant currency (CC) growth in 4QFY15 came below expectations across the

board. But we note that YoY CC growth in 4QFY15 decelerated at TCS, has been the

same as 3Q at INFO, within a range at WPRO and has accelerated at HCLT in the last

two quarters. Even weak Americas was more seasonal than structural – growth

band was same as 4QFY14, with the exception of WPRO.

Pricing is a trend to watch for; factors protecting OPM

INFO’s pricing declined 1.7% QoQ in CC in each of the last two quarters, but margin

performance remained strong. TCS’ realization has been trending down, without

hurting its margin band, and likewise for WPRO. Currency and then utilization have

had offsetting impact at TCS, INFO and WPRO. This quarter we heard lot of

commentary on progress in automation, which is encouraging and imperative.

Prefer change resilience, though near term stress may prevail

n

n

INFO guided for 380bp impact from cross currency to USD revenue growth, and

has greater exposure to USD bookings. Thus, WPRO, TECHM and TCS may suffer

~450bp hit in FY16E, with marginally higher impact on earnings too. Hence, EPS

growth across tier-I will likely be in high single digits, with leaders managing low

double digits, at best. That will likely weigh on near-term valuations.

As the new order establishes itself, industry growth may struggle to overcome

low double digits in the foreseeable future. In this shift, betting in the sector is

getting increasingly selective than being secular. Our preference is for

companies that are more resilient to these pressures either due to quicker

adoption of new offerings going forward (INFO – build and buy), or growth

drivers insulated due to lower penetration (HCLT – Engineering Services and

TECHM – Network Services).

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.