28 April 2015

4QFY15 Results Update | Sector:

Financials

Andhra Bank

BSE SENSEX

27,396

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float (%)

S&P CNX

8,286

ANDB IN

602.8

46.2/0.7

110 / 61

-2/-1/-7

410/4755

39.0

CMP: INR77

TP: INR120 (+56%)

Buy

Strong core performance; Positive asset quality guidance by management

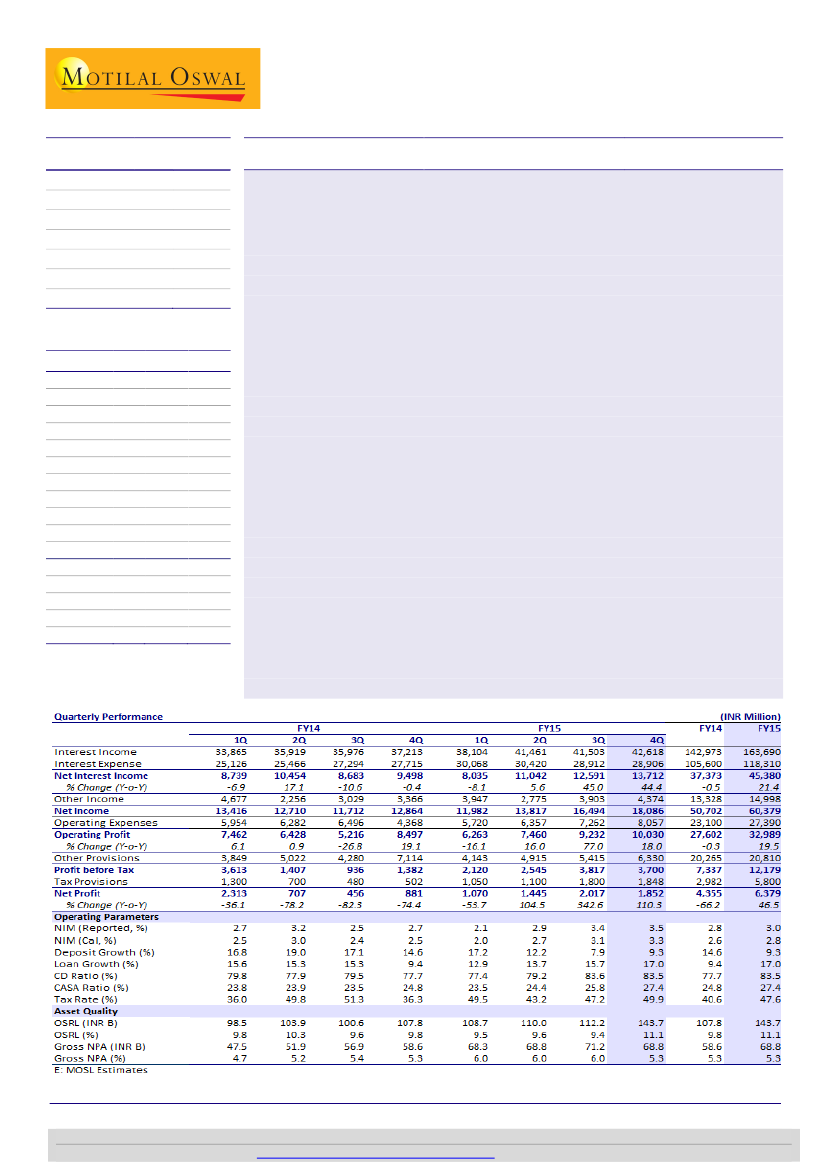

Andhra Bank’s (ANDB) 4QFY15 PAT was at INR1.9b (2x YoY on a lower base),

driven by healthy NIM (3.5%, 12 quarter high), strong loan growth (+17% YoY) and

lower credit costs (1.6% vs. 2.5% in 4QFY14).

Slippages during the quarter declined to a 4 quarter low of INR7.7b vs. INR9b in

3QFY15. Agriculture GNPA declined 20% QoQ to INR10.6b led by strong recoveries

(INR3b+ in 4Q) in AP/Telangana. Management is confident of recovering another

INR5-6b over the next couple of quarters (Agri NPA target of 3% by 2QFY16 vs.

5.2% currently and 7.2% in 1QFY15).

Bank continued to report healthy NIM (3.5%, +5bp QoQ) led by interest write-back

on Agriculture NPA recoveries (INR300m) from AP/Telangana. Management

guided that the margins would remain at similar levels over the next few quarters.

Other highlights:

(1) fees grew 21% QoQ (only 2% YoY on higher base) led by

strong traction in processing fees (INR1,132m) led by pickup in growth in 4QFY15,

(2) PCR, including technical write-offs, improved 580bp QoQ to 59%, (3) Bank

restructured INR31.3b in 4Q vs INR22.9b in 9M and (4) CASA ratio improved 151bp

QoQ to 27.4% (growth of 21% YoY and 15% QoQ). (5) CET 1 at 7.5%. Bank to raise

Tier I bonds in 1Q; equity raising unlikely in near term

Valuation and view:

Declining trend in slippages and zero restructuring pipeline

were the key positives. Over FY13-14, ANDB's earnings were severely hit due to

rising NPAs and further impacted in 1QFY15 due to a spike in Agriculture NPAs.

With clarity emerging on the farm loan waiver scheme and management’s focus

on recoveries, we believe earnings would improve gradually going forward

(INR5b+ of interest write-back and upgrade/recoveries of INR5-6b Agri related

NPAs). We expect RoA/RoE to improve to 0.7%/14% by FY17E led by normalized

tax rate and healthy margins. Maintain

Buy

with a TP of INR120 (0.6x FY17E BV).

Financials & Valuation (INR Billion)

2016E

NII

55

OP

40

NP

12

NIM (%)

3.0

EPS (INR)

20.6

EPS Gr. (%) 94.8

BV/Sh. (INR) 170

ABV/Sh.(INR) 145

ROE (%)

12.2

ROA (%)

0.6

D. Payout(%) 29.0

Valuations

P/E(X)

3.7

P/BV (X)

0.45

P/ABV (X)

0.5

Div. Yield (%) 6.7

Y/E MAR

2017E 2018E

62

74

43

52

15

19

2.9

2.9

25.5

31.4

23.6

23.0

188

210

172

193

14.2

15.7

0.7

0.7

29.0

29.0

3.0

0.41

0.4

8.3

2.4

0.36

0.4

10.2

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Vallabh Kulkarni

(Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.