29 April 2015

1QCY15 Results Update | Sector:

Cement

Ambuja Cements

BSE SENSEX

27,226

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val(INRm)/Vol‘000

Free float (%)

S&P CNX

8,240

ACEM IN

1,549.8

370.2/5.8

287/192

-3/6/-3

473/2,078

49.7

n

Financials & Valuation (INR Billion)

Y/E Dec

2014 2015E 2016E

Sales

EBITDA

NP

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA (x)

99.1

18.6

13.2

8.5

25.9

65.6

13.4

18.7

28.0

98.8 113.0

17.8 24.1

12.2 17.2

6.1

8.7

-27.9 41.5

94.9 99.3

8.4

9.0

11.9 12.7

27.4 19.4

1.8

17.9

172

1.7

13.0

165

CMP: INR239

n

TP: INR260 (+9%)

Neutral

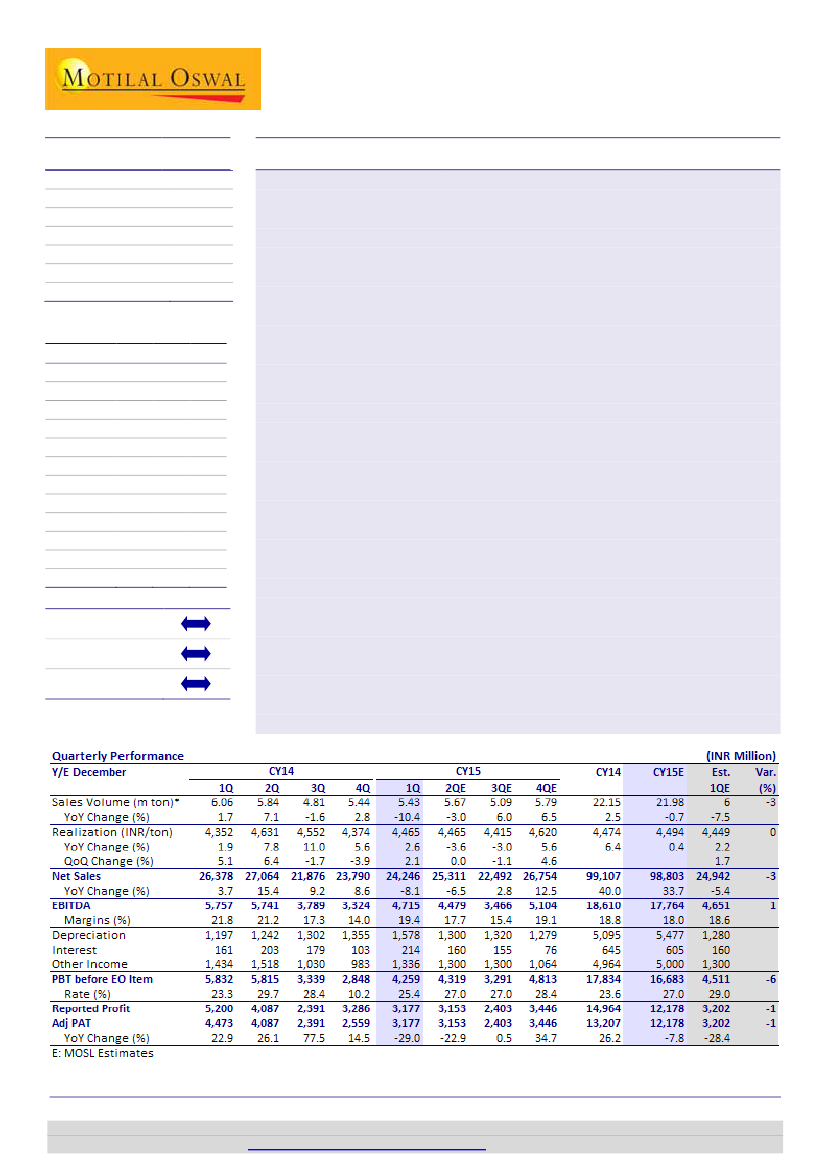

Double digit volume whammy; cost benefits protects margins; Neutral

Double digit volume dip led weakest March-Q volume since CY11:

ACEM’s

1QCY15 cement volume de-grew 10.4% YoY (flat QoQ) at 5.43mt (est. of ~8%

de-growth), with the western region being the weakest contributor.

Realizations stood in line at INR4,465/ton (+2.1% QoQ), with worst trend in

north. Revenue down 8.1% YoY (+1.9% QoQ) to INR24.2b (v/s est. of INR24.9b).

Cost benefits percolate; freight cost was dampener:

Cost benefits came from

(1) lower energy cost due to mix-optimization (higher imported coal) and 4-5%

QoQ moderation in pet coke price, (2) 15-20% QoQ decline in packaging cost

(lower of crude prices) and (3) lower advertisement expenses and spares.

However, the benefits were negated by higher freight (+10% QoQ) due to high

inter-unit clinker logistics and increase in rail freight cost.

Good margins despite volume cliff:

EBITDA de-grew 18% YoY (42% QoQ) to

~INR4.7b (in-line), translating into better-than-expected EBITDA margin of

19.4% (-2.4pp YoY). EBITDA/ton improved by INR257 QoQ (-INR81 YoY) to

INR868 (v/s est. of ~INR829). PAT stood at INR3.17b (v/s est. of INR3.2b), as

lower tax rates (25% v/s est. of 29%) offset the higher depreciation.

Modest cost push ahead; CY15 margins can expand on 1% YoY price rise:

With

the benefits of lower input cost and savings in packaging cost, ACEM is likely to

witness no major inflationary push in CY15 (~1% YoY). Thus, realizations growth

of >1% YoY (v/s est. of flat) would trigger an expansion in profitability.

Maintain Neutral on sub-normal volume lever, fair valuation:

We cut

CY15E/16E EPS by 5%/1% to INR6.1/INR8.7. With limited expansion plan and

weak industry demand growth, ACEM is likely to underperform in volume

growth over the near term. Anticipated synergy befits are delayed. We value

ACEM at USD175/ton (25% discount to UTCEM’s target valuation), translating

into a target price of INR260 (implied EV/EBITDA of 13.3x CY16E), with 9%

upside to CMP. Maintain

Neutral.

n

3.6

18.3

EV/Ton (USD) 185

Estimate change

TP change

Rating change

n

n

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.