5 May 2015

4QFY15 Results Update | Sector:

Financials

Kotak Mahindra Bank

BSE SENSEX

27,440

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Free float (%)

Financials & Valuation (INR b)

Y/E Mar

NII

OP

NP

NIM (%)

EPS (INR)

EPS Gr. (%)

Cons. BV.

( ) RoE

Cons.

( )

RoA (%)

Payout (%)

Valuations

P/E(X)

(

)

P/BV (X)

2016E 2017E 2018E

72.4

86.2 103.8

49.5

28.3

4.1

46.9

370.7

13.5

1.5

2.7

30.4

61.7

35.8

4.1

57.9

23.6

427.4

14.5

1.6

2.9

24.6

75.6

43.7

4.0

70.3

21.4

496.1

15.2

1.6

2.9

20.3

2.9

0.1

S&P CNX

8,325

KMB IN

911.6

1,474/785

8/29/54

60.0

CMP: INR1,424

TP: INR1,355 (-5%)

Neutral

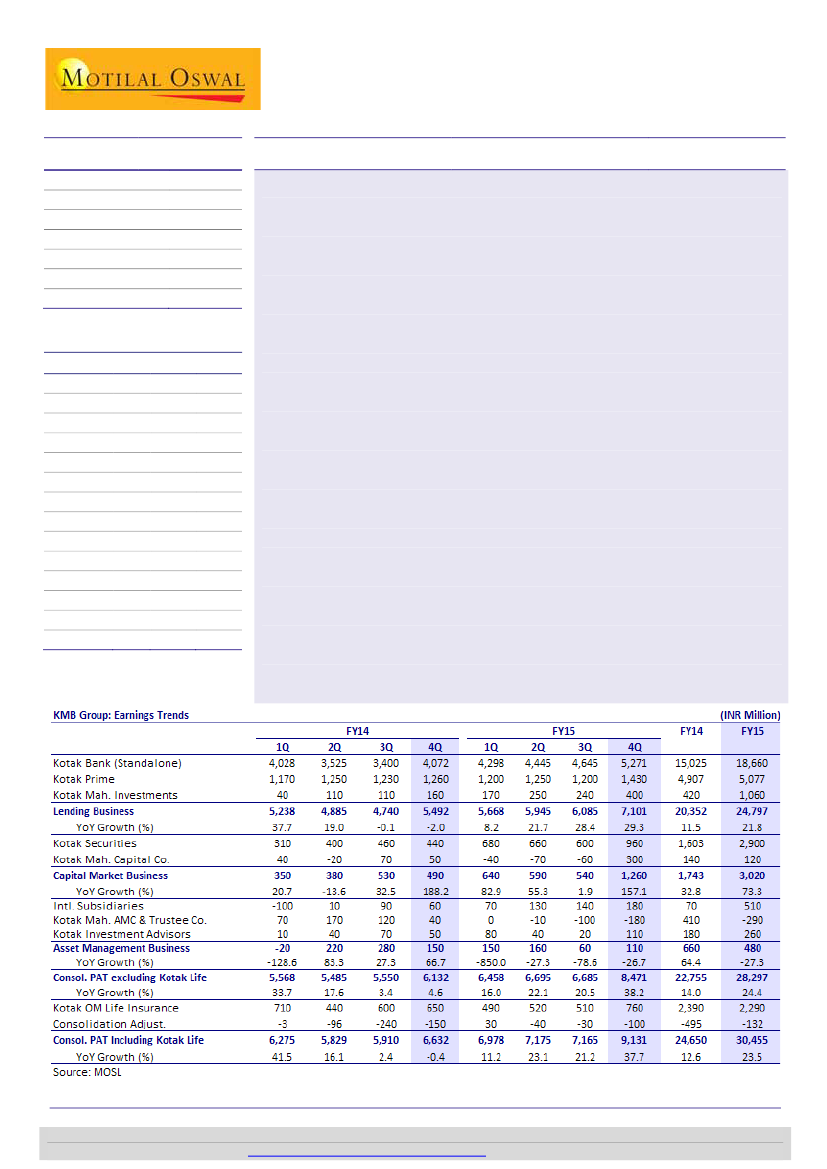

Strong beat on lending PAT; other verticals show improvement

KMB’s consolidated PAT for 4QFY15 beat our estimate by 18%, led by (a) strong fee

income (+41% YoY, +19% QoQ), (b) higher non-core income (INR2.8b v/s INR0.6b in

4QFY14), and (c) healthy asset quality (NSL stable QoQ at 1.2%) in banking business.

Capital market related business also reported strong beat (INR1.26b v/s our estimate

of INR0.7b) – its share in consolidated PAT rose to a 16-quarter high of 14%.

n

Banking business:

Standalone PAT grew 30% YoY (on a lower base) to INR5.3b

(11% beat). Total income grew 37% YoY, driven by healthy fees (+41% YoY) and

higher non-core income. KMB accounted for INR0.54b of integration-related

expenses, adjusted for which opex grew 25% YoY and PAT grew 39% YoY. Loan

growth (ex-CV) remains healthy at 28% YoY, driven by unsecured retail loans

(10% of loans, +35% YoY), mortgages (22% of loans, +22% YoY) and corporate

banking (31% of loans, +41% YoY). Share of retail deposits (CASA+TD less than

INR50m) grew 700bp YoY to 70%.

n

Other highlights:

(1) K-Sec’s market share improved 10bp QoQ to 2.9%, (2)

domestic AMC AUM increased 9% QoQ to INR395b, but reported a loss of

INR180m (higher distribution commission, in line with competition), (3) NIM

(consolidated) was flat YoY at 4.9%, and (4) the bank announced 1:1 bonus

shares and dividend of INR0.9/share.

Valuation and view:

Merger with VYSB places KMB in a sweet spot, with strong

presence across geographies and products, and continued healthy capitalization

(CET 1 of 16.5%). The merged entity will be India’s fourth-largest private sector bank,

with a loan book of INR1.3t and loan market share of 1.8%+. KMB’s premium

multiples are likely to sustain, considering the strong growth and operating leverage

available across businesses. While we are positive on the business, at 3.3x

consolidated BV and 25x EPS, upside is limited. Reiterate

Neutral;

our SOTP-based

TP is INR1,355 (pro-forma merged).

M.Cap. (INR b) / (USD b) 1,298.1/20.5

Avg Val(INR m)/Vol ‘000 1,474/1,324

3.8

3.3

(C

)

Div. Yield (%)

0.1

0.1

* Proforma merged (KMB+VYSB)

Investors are advised to refer through disclosures made at the end of the Research Report.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Vallabh Kulkarni

(Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.