13 May 2015

4QFY15 Results Update | Sector: Consumer

Emami

BSE SENSEX

27,251

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD

b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val(INRm)/Vol‘000

Free float (%)

Financials & Valuation (INR b)

Y/E MAR

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

22.2

5.4

4.9

21.6

21.7

54.3

45.3

44.0

43.6

17.3

25.9

6.9

6.1

27.0

25.1

66.0

44.9

44.8

34.9

14.3

30.7

8.4

7.5

32.9

22.0

80.8

44.8

45.4

28.6

11.6

n

n

S&P CNX

8,235

HMN IN

227.0

213.6/3.3

1,140/429

-10/22/100

157/209

27.3

n

CMP: INR941

n

TP: INR1,060 (+13%)

Buy

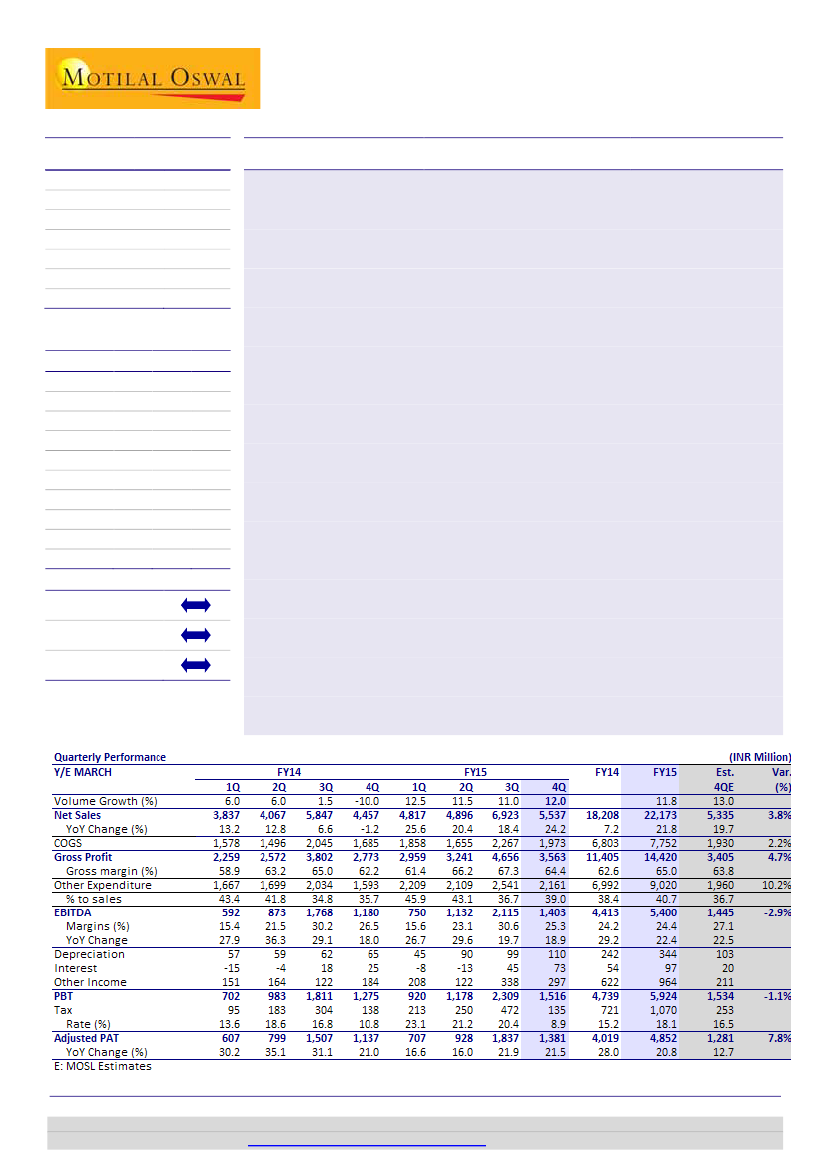

Strong operational performance with market share gains

Emami’s (HMN) 4QFY15 sales and PAT beat estimates,

with sales up 24.2% to

INR5.5b (est. of INR5.3b) and PAT up 21.6% to INR1.4b (est. of INR 1.3b). EBITDA

was up 18.9% YoY to INR1.4b (est. of INR1.4b). The performance was aided by soft

base (sales decline of 1.2% in 4QFY14). Underlying domestic volumes recorded

healthy 12% growth while overall volumes were up 13.3%. HMN registered broad-

based growth with market share gains in key categories. New product launches

contributed 8% to revenue growth during 4Q.

Solid gross margin expansion:

Gross margin expanded 220bp YoY to 64.4%, led by

benign RM prices and price hikes. However, higher ad spends (up 380bp YoY,

primarily on account of soft base and new launch momentum) resulted in EBITDA

margin contraction of 110bp YoY to 25.3% (est. of 27.1%). Thus, EBITDA was up

18.9% YoY to INR1.4b (est. of INR1.4b). PAT grew 21.6% to INR1.4b (est. of INR

1.3b), aided by higher other income and lower tax rates.

Acceleration in new launches:

Emami launched five products during FY15 which

contributed ~5% to revenue growth—driven by strong performance in Zandu Ultra

Power and F&H face wash. Boroplus face wash and SHE Comfort did not perform

well and are expected to see corrective action. The management has guided for

continued new launch activity (5% of revenues in FY16).

Concall highlights-FY16 guidance:

a) Revenue growth of 17-18%, with

International segment posting 20-25% growth, b) A&P-to-sales to be ~18%, c) tax

rate to be MAT and d) capex to be INR1.5b each for FY16 and FY17.

Valuation and view:

We largely retain our estimates and model for robust 25%

and 24% EBITDA and EPS CAGR, respectively, over FY15E-17E. Maintain Buy with a

target price of INR1,060 (P/E of 32x FY17E EPS, 20% premium to average three-

year P/E—given the strong earnings growth ahead). We expect the rich valuations

to sustain as Emami’s earnings momentum is led by strong topline delivery

compared with the benign commodity cost-led earnings uptick of the rest of the

universe. Our long-term structural BUY thesis on Emami remains unchanged.

Estimate change

TP change

Rating change

n

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(Manish.Poddar@MotilalOswal.com); +91 22 3027 8029

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.