20 May 2015

4QFY15 Results Update | Sector:

Consumer

Pidilite Industries

BSE SENSEX

27,837

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val INRm/Vol ‘000

Free float (%)

S&P CNX

8,423

PIDI IN

512.6

292.2/4.6

638/286

-1/33/61

188/392

30.3

n

CMP: INR570

n

TP: INR560 (-2%)

Neutral

Volume growth decelerates; Margin miss led by one-time higher ad spends

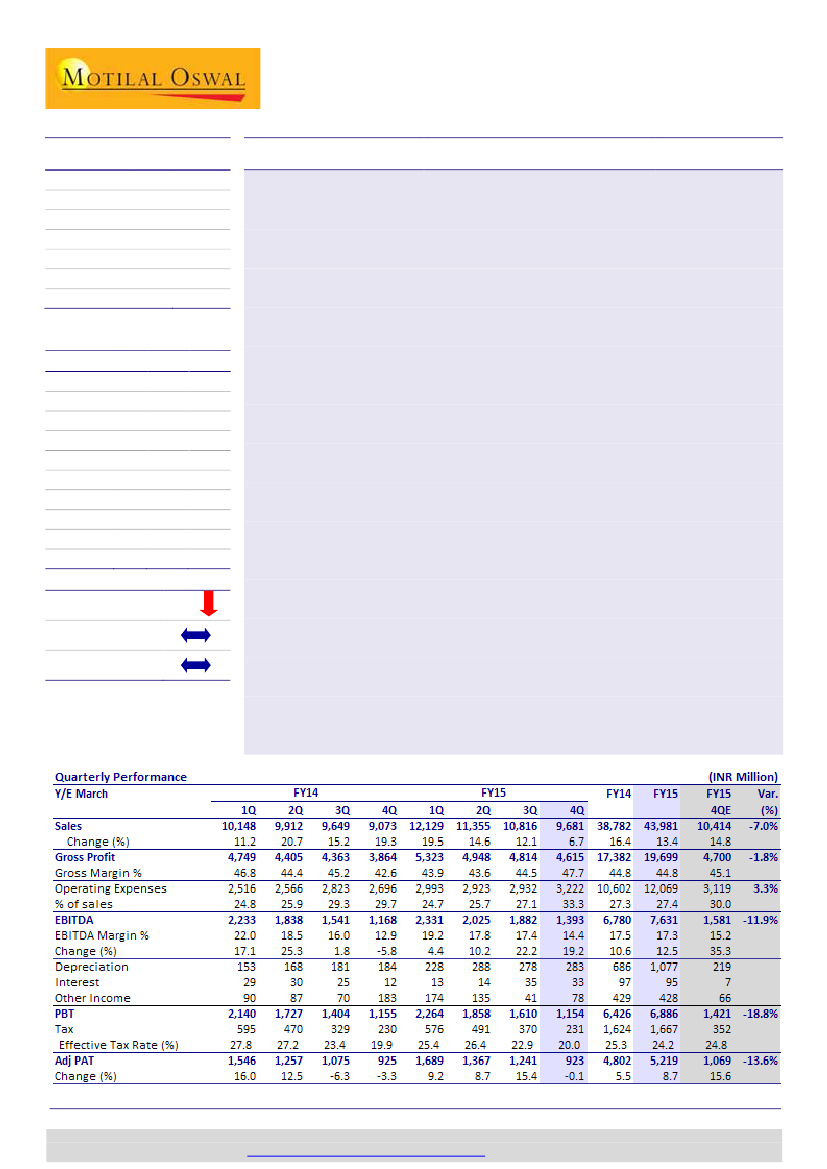

PIDI’s 4QFY15 results

were below estimates, with standalone sales up 6.7% to

INR9.7b (est. of INR10.4b) and muted 3.1% overall volume growth (5.5% volume

growth in consumer bazaar segment). EBITDA was up 19.2% YoY to INR1.4b (est.

of INR1.6b), aided by gross margin expansion. Adj. PAT was flat YoY at INR923m

(est. of INR1b) despite benign base (4QFY14 adj. PAT declined 3.3% YoY).

Gross margin expanded 510bp YoY

to 47.7% (est. of 45.1%), led by benign input

cost and carryover of earlier price hikes. However, higher other expense (up

370bp YoY)—driven by higher brand spends (6.3% in 4Q15 v/s 4.3% in FY15)

during ICC World Cup ’15—curtailed EBITDA margin expansion to 150bp YoY to

14.4% (est. of 15.2%). The management has guided for similar gross margin

expansion in 1QFY16 and flattish ad spends for FY16. Also, it is not contemplating

any price cuts. Thus, we believe that 4Q15 EBITDA miss was a blip due to event-

driven ad spends.

Consolidated performance:

Sales, EBITDA and adj. PAT posted 5.3%, 30% and

10.3% growth, respectively. Imputed subsidiary EBITDA loss declined 60% YoY.

Con-Call Highlights:

a) Rural growth > Urban; b) not contemplating any price cuts;

1QFY16 gross margins will be almost similar to 4Q15 numbers; c) excise duty to

increase 100bp YoY in FY16; d) ad spend to be at FY15 run rate (4.3%); e) FY16

capex to be INR1.75b-INR2b.

Valuation and view:

Barring this quarter, Pidilite’s volume growth in consumer

bazaar segment has remained consistent in the 9-10% band. We cut estimates by

5-6% to incorporate the 4Q miss, but still model for 31% EPS CAGR over FY15-

17E—driven by expected urban demand recovery, benign RM environment and

lower base (during the previous episode of RM deflation, Pidilite delivered an EPS

CAGR of 50% over FY09-11). We are building in 320bps gross margin expansion

over FY15-17E. However, we believe that valuations at 38.8x FY16E and 32.9x

FY17E EPS are rich. Maintain

Neutral

with revised target price of INR560 (32x FY17

EPS, 10% premium to three-year avg. P/E—given expected strong EPS CAGR).

Spike in input costs/currency depreciation is a key risk.

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

Adj. PAT

Adj. EPS

(INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

43.7

7.6

5.2

10.2

9.9

48.4

23.1

28.2

56.0

11.8

50.8

11.0

7.5

14.7

44.3

57.5

27.7

35.5

38.8

9.9

60.3

12.8

8.9

17.3

17.8

68.2

27.5

35.4

32.9

8.4

n

n

n

Estimate change

TP change

Rating change

5-6%

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(Manish.Poddar@MotilalOswal.com); +91 22 3027 8029

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.