21 May 2015

4QFY15 Results Update | Sector:

Consumer

Britannia Industries

BSE SENSEX

27,809

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val. (INRm)/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E MAR

Sales

EBITDA

Adj. PAT

Adj. EPS(INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

77.8

7.8

5.7

47.8

47.0

61.9

58.8

47.8

25.9

89.2 103.9

11.2

7.9

66.0

38.1

62.4

66.8

34.7

18.5

13.1

9.4

77.9

18.2

54.0

60.1

29.3

13.8

S&P CNX

8,421

BRIT IN

119.5

273/4.3

2,405/829

6/38/158

285/176

49.2

CMP: INR2285

TP: INR2,600 (+14%)

Buy

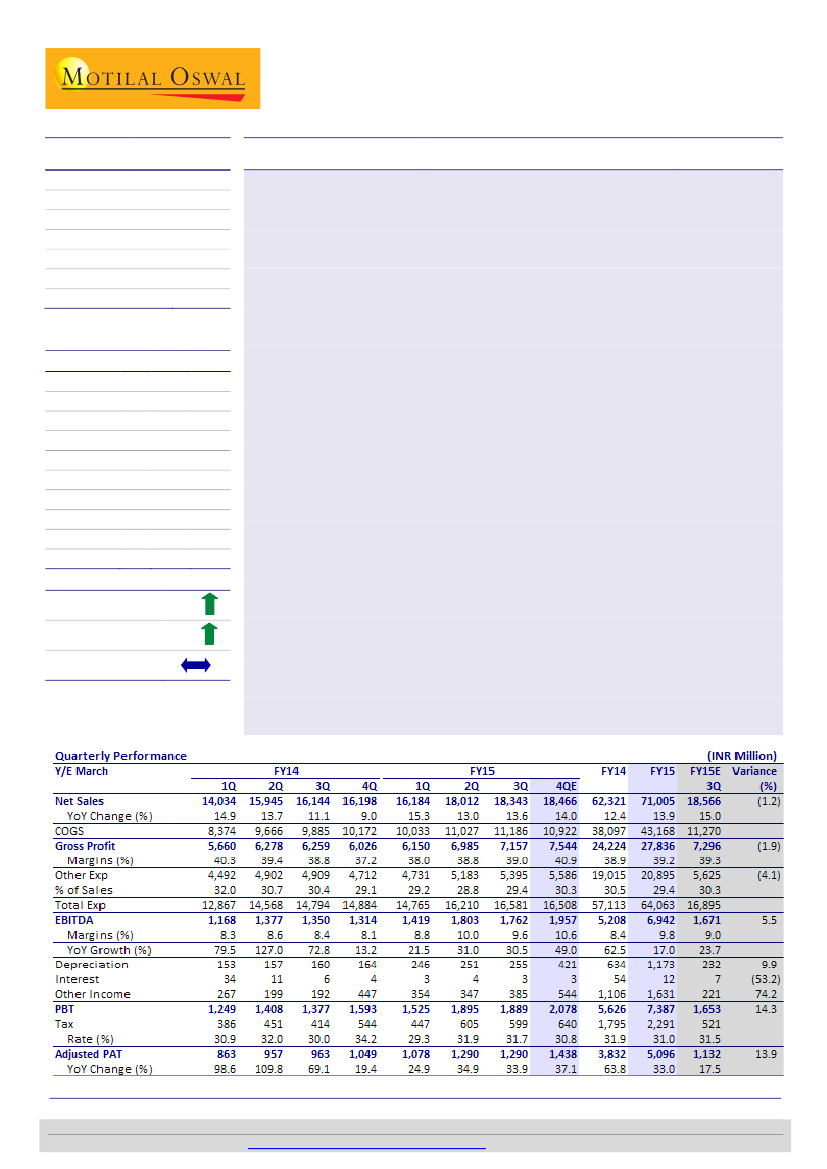

Significant EBITDA beat; consistent delivery of key strategic priorities

Handsome beat:

Britannia’s 4QFY15 performance was ahead of estimates and

once again underscored the superior execution of its premiumization and cost

containment strategy. Sales, EBITDA and PAT posted 14%, 49% and 37.2% growth

YoY to INR 18.5b, INR 1.96b and INR 1.43b vs. our expectations of INR 18.5b, INR

1.75b and INR 1.37b resp. We estimate Biscuits volume growth of ~7%, healthy in

the context of challenging demand environment. This solid performance was

despite of 50% increase in adspends (albeit on lower base) and near 2.6x increase

in depreciation expenses (additional impact of INR 270m for the quarter).

Quality of growth impeccable:

Performance was led by gross margin expansion of

360bp YoY to 40.9% (est. 38.7%). Adspends went up 50% on low base (up 220bp

to 9.2%) while operating leverage and tight control on fixed costs drove 40bp and

70bp decline in conversion cost and other expenses to 8% and 10.6%, resp.

Consolidated and subsidiary highlights:

Sales, EBITDA and Adj. PAT posted 14.3%,

66% and 55.4% YoY growth, respectively in 4QFY15. Gross margins (41.5%)

expanded 4300bp YoY while operating margins (10.9%) expanded 340bps YoY.

Britannia closed FY15 with sales, EBITDA and PAT growth of 13.8%, 43.3% and

43%, resp – best FY15 performance in our consumer universe.

Remains amongst our top two ideas:

We upgrade our estimates by 6-8% in

FY16/17E to factor in better than estimated margins. We expect FY16 to benefit

from premiumization (3 premium products launched in last 6 months, more

planned) and RM tailwinds (Wheat, Sugar). We also move our model to

consolidated numbers as subs. EBITDA is now 11% of consol EBITDA. We estimate

30% and 28% EBITDA and PAT CAGR over FY15-17E. Retain

Buy

with a revised TP

of INR2,600 (33x FY17 Cons. EPS, 10% premium to one year average P/E). Unlike

other companies in our universe we do not use 3 year average P/E for Britannia as

complexion of Britannia’s P&L has changed meaningfully since FY13. Valuations,

while rich, are backed by superior execution and consistent earnings delivery.

Upward spike in RM and slowdown in rural consumption are near term risks.

88.1 123.4 165.1

Estimate change

TP change

Rating change

6-8%

18%

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(Manish.Poddar@MotilalOswal.com); +91 22 3027 8029

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.