22 May 2015

4QFY15 Result Update | Sector: NBFC

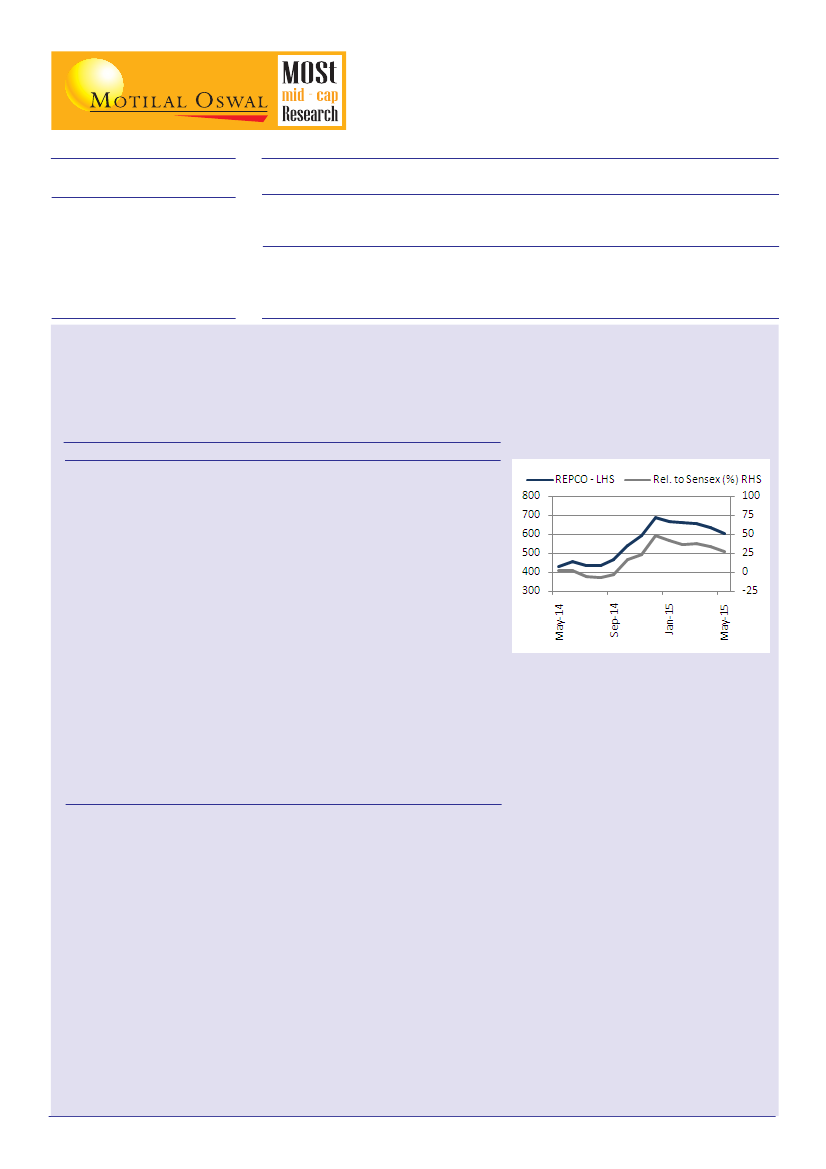

Repco Home Finance

BSE SENSEX

27809

Equity Shares (cr)

52-Week Range (Rs)

1,6,12 Abs.Perf.(%)

M.Cap. (Rs cr)

M.Cap. (US$ b)

S&P CNX

8421

6.2

725/369

-3/10/43

3,786

63.1

CMP: INR609

YEAR NET INC PAT

END

FY15E

FY16E

FY17E

(INRCr) (INRCr)

262

324

407

137

172

220

EPS

(INRCr)

22.0

27.6

35.2

EPS

TP: INR750

PE

(X)

27.7

22.1

17.3

ABV

(INR)

130

154

186

P/ABV

(INR)

4.7

4.0

3.3

ROAA

(%)

2.6

2.5

2.5

Gr.(%)

24

25

28

BUY

ROAE

(%)

17.5

18.9

20.3

Result Highlights - In line quarter

Net Income at INR 74.6cr grew 27% (est. INR 73.6cr); Pre Provisioning Profits grew 24% at INR 58.1cr (est. INR

57.4cr); Adj. PAT at INR 39.0cr grew 24% (est. INR 38.5cr)

Loan growth remains robust at 29%; Disbursements growth bounced back to 47% for the quarter due to spillover from

the previous quarter (3QFY15 growth at 7%); Absolute GNPAs have marginally risen, while GNPAs as % of loans

have declined 15bp YoY to 1.32%.

INRCr

Interest Income

Interest Expense

Net Interest Income

Other Income

Net Income

Pre Prov. Profit

Provisions

Profit Before Tax

Tax Provisions

Adj. PAT

Loan Growth (%)

NIMs (%)

Gross NPAs (%)

Net NPAs (%)

ROA (%)*

ROE (%)*

4QFY14

145

91

54

5

59

47

4

43

11

31

32

4.7

1.5

0.7

2.7

16.4

3QFY15 4QFY15

171

112

59

5

64

14

50

3

47

13

34

27

7

4.5

20.5

2.0

1.2

2.4

16.2

183

117

66

9

75

16

58

6

52

13

39

29

47

4.5

20.5

1.3

0.5

2.3

16.1

YoY

26%

29%

23%

66%

27%

37%

24%

21%

15%

24%

QoQ

7%

4%

13%

74%

17%

16%

18%

11%

2%

14%

FY14 FY15

511

325

186

24

211

39

172

23

149

39

110

32

47

4.7

18.4

1.5

0.7

2.7

16.4

669

432

237

24

262

55

207

186

49

137

27

27

4.5

20.5

1.3

0.5

2.6

17.5

YoY

31%

33%

27%

0%

24%

42%

20%

25%

25%

25%

Operating Expenses 12

52% 137%

20 -10%

Disbursement Gr (%) 31

Cost to Inc Ratio(%) 18.4

Note:* 2Q & 3Q FY15 ROA & ROE are based on reported PAT (incl. DTL exp.) and hence lower. Annual figs. are based on Adj. PAT

Valuation and view

Loan/Disbursement growth maintains momentum:

Disbursement growth durng the quarter was at +47% as much of the

loans which were sanctioned towards the end of 3QFY15 were disbursed during the current quarter and as a result

disbursement growth in 3QFY15 was at just 7%. Loan book grew by a healthy 29% to INR 6013cr. Further, management

has maintained its guidance of growing its loan book by 25-30% annnually in coming years.

Niche business model:

Repco's niche focus on lower ticket-size loans (average Rs 12 Lacs), non-salaried segment

(57% of loans) and smaller geographies (tier 2 & 3 cities) is likely to aid growth with minimal competition from banks in

this segment.

Strong growth combined with healthy profitability:

Operating with lean cost structure and manageable credit costs,

Repco has been consistently operating at ROA (Return On Asset) profile of around 2.5%. With visibility of limited risks to

its competitive advantages in the medium term, we expect RoAs to sustain at current levels. Given its high capitalisation

(20.3% CAR) Repco can grow at 25-30% CAGR for the next three years and achieve 20% ROE without requiring capital

infusion.

Valuation & View:

We expect the stock to give compounded returns of 25% over the next three years (i.e 2x in three years).

We maintain our target on the stock at INR 750 valuing the stock at a P/ABV of 4.0x based on FY17E ABV.

Jehan Bhadha

(jehan.bhadha@MotilalOswal.com); Tel: +91 22 33124915