22 May 2015

4QFY15 Results Update | Sector:

Consumer

ITC

BSE SENSEX

27,958

Bloomberg

Equity Shares (m)

MCap INR b/USD b

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INR M)/Vol

‘000

Free float (%)

S&P CNX

8,429

ITC IN

7,953.2

2,612.6/43.4

410 / 312

-5/-10/-19

2,958/8,401

100.0

CMP: INR328

TP: INR365 (11%)

Neutral

Another quarter of double digit Cig volume decline; EBITDA flat YoY

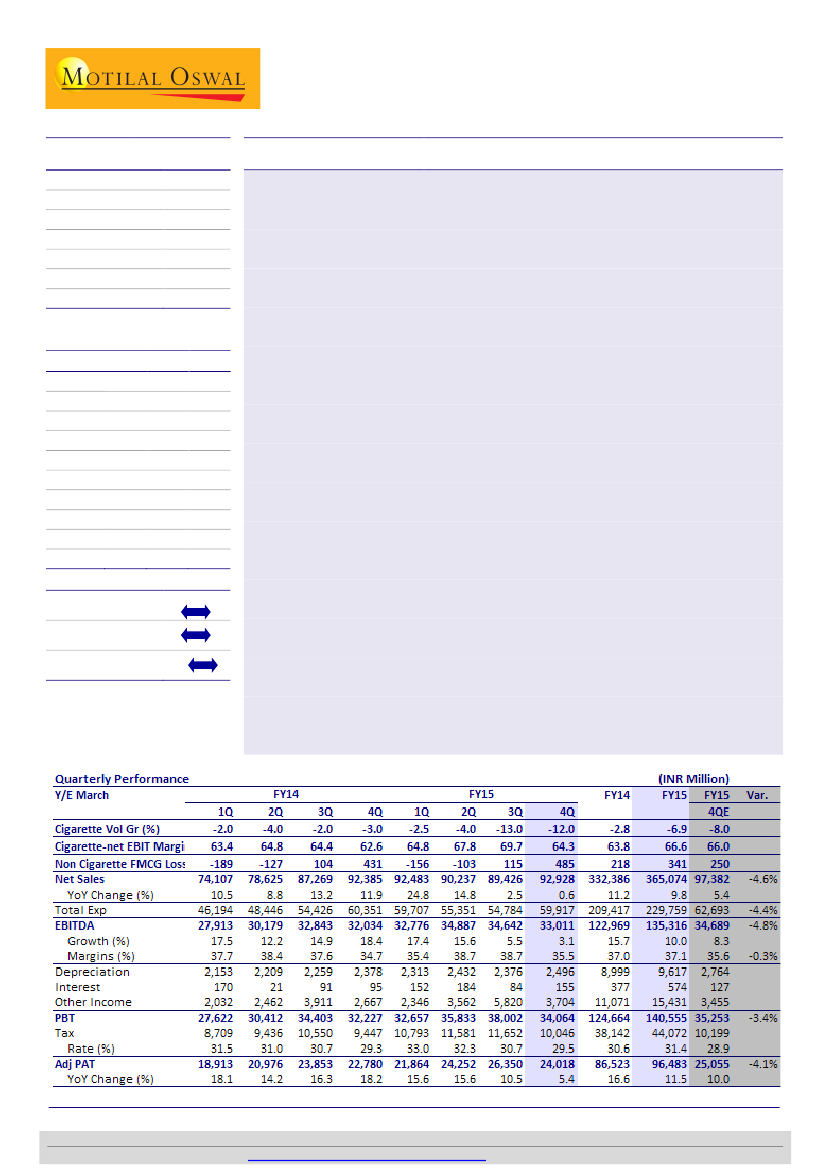

ITC’s 4QFY15 performance

was below expectations with muted sales growth of

0.6% YoY to INR92.9b (est. INR97.4b), EBITDA grew 1.2% YoY to INR32.4b (est.

INR34.7b) and Adj. PAT (adjusted for INR 580m impact on rationalization of Safety

Matches manufacturing operations) increased 5.4% YoY to INR24b (est. INR25.1b).

Cig volumes declined ~13% (same as 3QFY15)

while segment EBIT grew 6% and

posted 170bp margin expansion to 64.3% (20th consecutive quarter of margin

expansion). However margins declined 540bps QoQ. Cig volumes remained under

pressures owing to cumulative impact of higher excise duty lead price hikes (for

the quarter price hike component stood at ~24% in our view). We understand that

portfolio witnessed some downtrading to 64mm as maximum impact of price

hikes was felt in 69mm segment. Unabated rise in excise duties and consequent

price hikes is putting the demand inelasticity of Cig consumption/volumes at risk

and also impairing ITC’s ability to deliver consistent and healthy high teens Cig

EBIT growth.

Non-Cig FMCG posted 10.9% sales growth

and reported EBIT of INR485m, up 13%

YoY. Agri revenues declined 28.8% YoY due to absence of trading opportunities in

Soya while margins expanded 430bp due to improvement in mix. Hotels segment

posted 8.1% YoY revenue growth but margins contracted 650bp YoY. Paper

segment revenue declined 4.6% while segment EBIT grew 1.1% and margins

expanded 90bp to 15.8% due to better product mix.

FY15 Sales, EBITDA and PAT grew 9.8%, 9.6% and 11% resp. Cig sales registered

modest 8.7% growth while segment EBIT grew 13.6% YoY. Dividend at INR6.25/sh.

Maintain Neutral:

We cut our earnings for FY15-17E by 1-2% and model for 9% Cig

volume decline in FY16E. We expect the Cig volumes to remain under pressure for

few more quarters as consumer absorb the higher prices. At 24.3x FY16E and

21.5x FY17E EPS, ITC trades at a discount of ~35% to the sector average. However

lack of Cig volume growth and overhang of potential ban on loose sticks as well as

expanded pictorial warnings precludes re-rating. Maintain

Neutral

with a revised

TP of INR 365 (24x FY17 EPS, 15% discount to three year average).

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS

(INR)

Gr. (%)

2015

360.8

135.3

96.5

12.1

9.8

2016E 2017E

397.0

149.0

107.4

13.5

11.3

40.7

34.9

43.3

24.3

8.1

441.7

167.4

121.7

15.3

13.4

45.3

35.6

44.2

21.5

7.3

BV/Sh.(INR) 36.7

RoE (%)

34.8

RoCE (%)

P/E (x)

P/BV (X)

43.3

26.8

9.0

Estimate change

TP change

Rating change

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(Manish.Poddar@MotilalOswal.com); +91 22 3027 8029

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.