29 May 2015

4QFY15 Results Update | Sector:

Utilities

NTPC

BSE SENSEX

27,828

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Free float (%)

S&P CNX

8,434

NTPC IN

8,245.5

169/127

-11/-1/-25

25.0

CMP: INR137

n

TP: INR178 (+30%)

Buy

Robust core business performance; raising earnings estimates

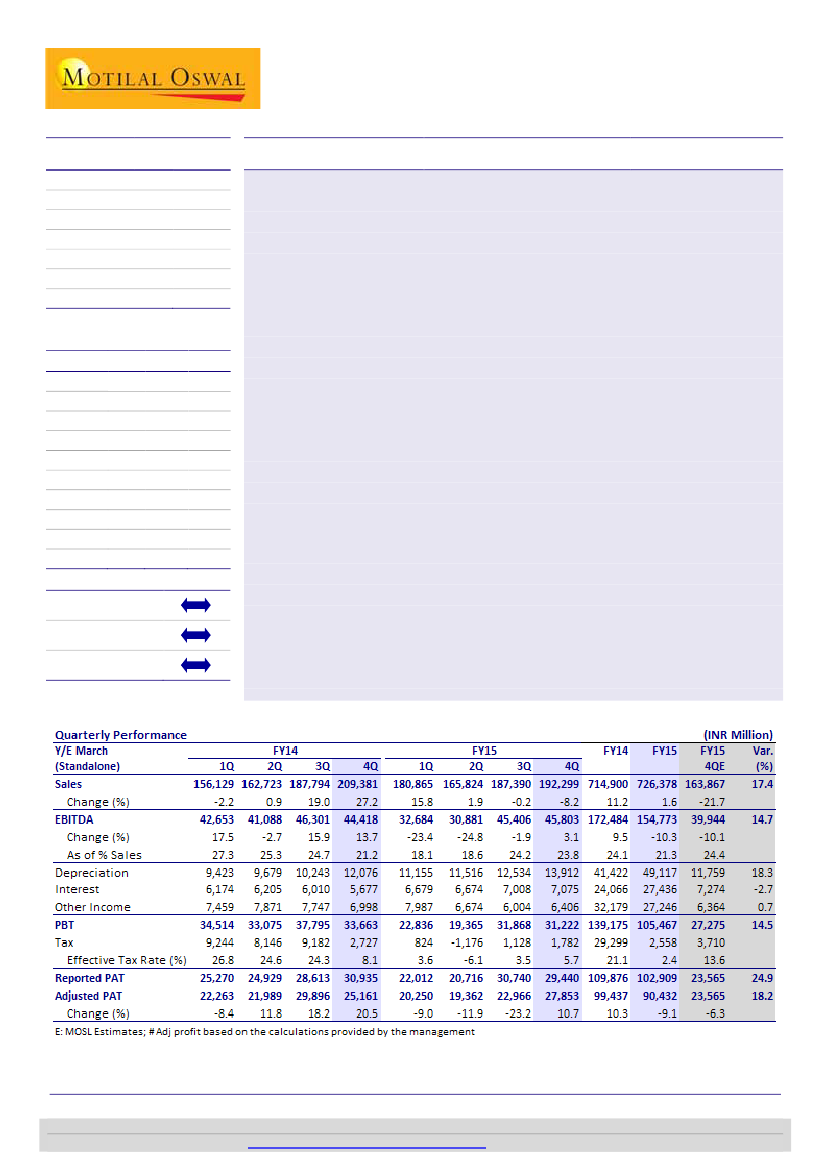

4QFY15 earnings ahead of estimates:

NTPC reported revenue of INR192.2b,

down 8% YoY, but higher than our estimate of INR164b. Revenue growth was

impacted by higher base and new regulation. EBITDA grew 3% YoY to INR45.8b,

15% beat. This is credible, given lower profitability in 1HFY15 owing to new

regulation. Net profit declined 5% YoY to INR29.4b.

Core business performance robust:

NTPC booked prior period revenue of

INR2.4b (above EBITDA) and tax refund of INR834m (below PBT) for the quarter.

Recurring EBITDA was ~INR44b, as the management indicated that all stations

attained normative PAF of 83%+. Recurring PAT was INR28b, 18% beat despite in-

line other income of INR6.4b. Higher fixed charge recovery than incentive

contributed to better performance, in our view, as generation/PLF was muted.

Operational performance broadly in-line:

For 4QFY15, generation was 61.4BUs

(down 2% YoY) versus our estimate of 60.7BUs and sales were 57.5BUs (up 3.5%

YoY) versus our estimate of 55BUs. Coal and gas project PLFs were in-line at

82.7% (600bp lower YoY) and 27% (900bp lower), respectively. Capacity addition

for FY15E is 1.3GW, while FY16 target is 2.6GW.

M.Cap. (INR b)/(USD b) 1,130/17.7

Avg Val (INRm)/Vol ‘000 1152/7816

n

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

726.4

160.9

90.4

11.0

-8.9

99.0

10.8

8.4

12.5

1.4

716.4

186.3

98.5

12.0

9.0

93.0

12.4

9.7

11.4

1.5

756.5

219.1

111.3

13.5

12.9

100.3

14.0

11.3

10.1

1.4

n

Estimate change

TP change

Rating change

Raising estimates; reiterating Buy:

NTPC is our top pick, given its relatively robust

business model, strong cash flows, and low leverage. It would be a key beneficiary of

improved demand/generation and valuations are comfortable. We upgrade our

FY16/17 estimates by ~4% and expect net profit of INR98.5b in FY16 (up 10%) and

INR111.3b in FY17 (up 13%). The stock trades at 10.1x FY17E EPS and 1.4x FY17E BV

(RoE of 14%). Bonus debentures and dividend payout provide comfort.

Buy.

Nalin Bhatt

(NalinBhatt@MotilalOswal.com); +91 22 3982 5429

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.