29 May 2015

4QFY15 Results Update | Sector: Metals

SAIL

BSE SENSEX

27,828

Bloomberg

Equity Shares (m)

M.Cap. (INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float

Financials & Valuation (INR b)

Y/E Mar

Sales

EBITDA

NP

Adj. EPS

EPS Gr(%)

BV/Sh.INR

RoE (%)

P/E (x)

P/BV

EV/EBITDA

( )

2015 2016E 2017E

461.2

51.8

21.1

5.1

106.9

4.8

0.7

11.3

500.5

44.3

-1.4

-0.3

104.2

-0.3

0.7

14.8

578.4

69.5

10.3

2.5

104.3

2.4

30.4

0.7

10.2

S&P CNX

8,434

SAIL IN

4,130.1

313.5/5.1

113/65

-12/-23/-40

516/6091

25.0

CMP: INR66

TP: INR41 (-38%)

Sell

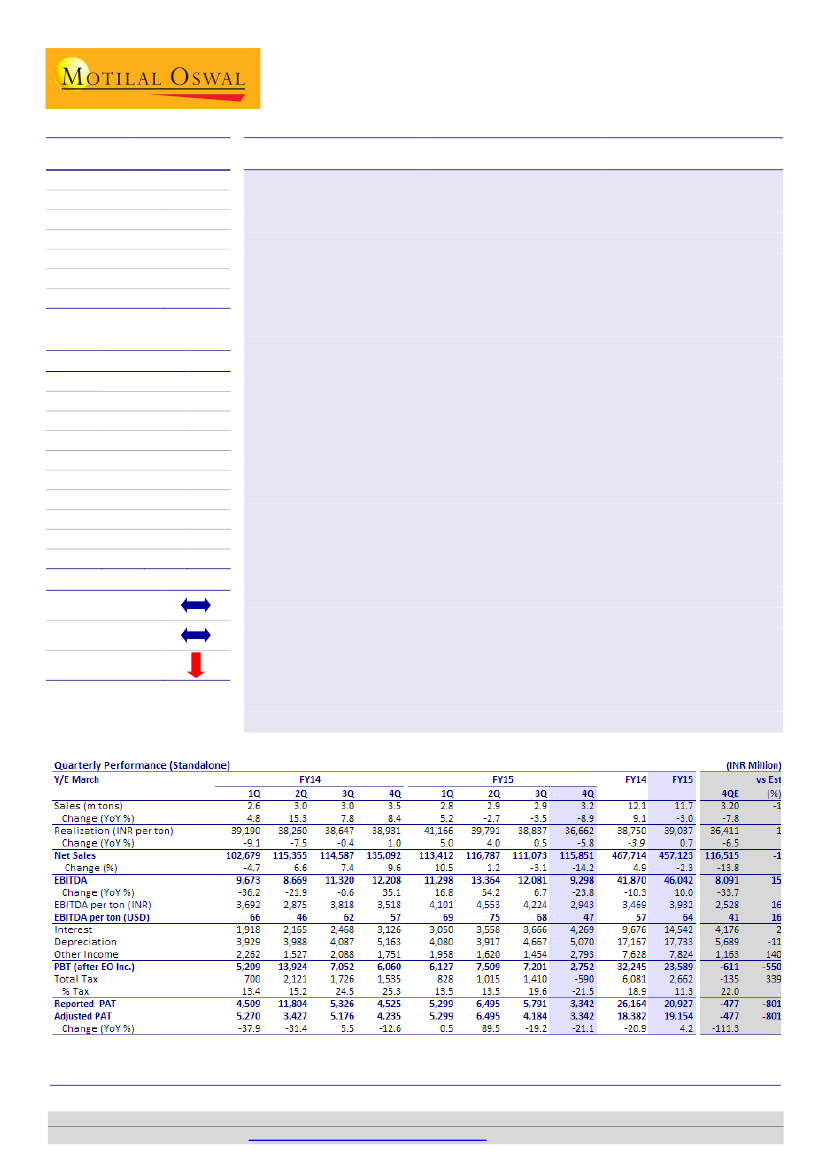

Above estimates on lower cost; price and volume headwinds continue

Standalone EBITDA at INR9.3b (down 23% YoY/24% QoQ) was 15% ahead of our

estimate on lower cost. PAT was down 26% YoY (-42% QoQ) to INR3.3b as against our

estimate of a loss of INR477m due to higher other income (INR2.9b v/s est. of

INR1.1b) and tax credit of INR590m.

Volume down 9% YoY:

Steel sales volume declined 9% YoY to 3.16mt on poor

demand. Finished steel inventories increased 90kt QoQ. Saleable steel production

was up 5% YoY (8% QoQ) to 3.4mt. ISP, which was commissioned in 3QFY15,

continues to operate at low levels due to lack of downstream capacities and

typically 9-12 months of stabilization phase. The management is guiding for 2mt

overall volume growth in FY16E to 13.7mt (our est. 14.2mt).

Realization fell 6% QoQ; further downside in 1QFY16:

Net sales realization (NSR)

declined by ~INR2,000/t QoQ (-6%) to INR33,183/ton. The management expects

further cut to the tune of INR1,000-1,500/ton based on the run-rate in April/May.

EBITDA/ton declined INR1,280 QoQ to INR2,943:

Lower realization was partly

offset by INR800/ton QoQ savings in cost. We expect EBITDA/ton to fall further in

1QFY16 to INR1,920 on likely price cut. With lower coking coal prices and volume

leverage, we expect EBITDA/t to improve to ~INR4,260/ton by FY17E. SAIL did not

provide for DMF (MMDRA Act, 2015) unlike Tata Steel, which would have further

impacted profitability.

Interest cost continues to rise; FY16E capex at INR75b:

Interest cost rose 16%

QoQ to INR4.3b as capacities get commissioned while borrowings continue to rise

(INR20b higher QoQ). Capex was INR65b in FY15 and is expected to increase to

INR75b in FY16.

Target price INR41; maintain Sell:

Our FY16E/17E EBITDA is cut by 20%/2% on

lower steel realization partly getting offset by lower coking coal prices in

FY17E,.Our EV/EBITDA-based (6.5x FY17E) target price is INR41 (INR38 earlier).

11.1 -106.9 -814.5

14.9 -217.3

Estimate change

TP change

Rating change

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.