23 June 2015

Update | Sector: Technology

MindTree Consulting

BSE Sensex

27,804

S&P CNX

8,382

CMP: INR1,351

TP: INR1,300 (-4%)

Neutral

Digital-ready

Capabilities, references in fast-growing Digital drive growth confidence

Stock Info

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

M.Cap. (INR b)

M.Cap. (USD b)

Avg Val(INRm)/Vol‘000

Free float (%)

MTCL IN

83.7

1,589/834

-6/10/41

113.1

1.8

255/214

86.3

Financial Snapshot (INR Billion)

Y/E Mar

2015 2016E 2017E

Net Sales

35.6 41.8 49.7

EBITDA

Adj PAT

EPS (INR)

Growth (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

7.1

5.4

63.9

18.6

29.4

32.8

21.2

5.6

8.4

6.1

72.7

13.8

27.5

31.8

18.6

4.7

10.7

7.7

91.7

26.1

28.7

33.9

14.7

3.9

Shareholding Pattern (%)

As on

Mar-15 Dec-14 Mar-14

Promoter

DII

FII

Others

13.7

7.9

37.7

40.7

13.7

7.9

39.9

38.4

16.6

10.1

36.0

37.3

MTCL cited that the opportunity size in Digital-led IT services is expected to grow

to USD220b by 2020. The company has built significant capabilities and

references in Digital, and remains confident of continuing industry-leading

growth on the back of Digital push.

MTCL’s growth endeavor is focused on pillars of consultative selling, enabling

clients’ Digital transformation, focused acquisitions, and global expansion.

While pricing in Digital in the experimental stage is not at a premium, deal sizes

get significantly bigger as the programs move beyond the proof-of-concept stage.

MTCL expects traditional services (67% of the business) to continue driving

majority revenues despite faster growth in Digital. Its endeavor in traditional is to

differentiate every offering, aptly illustrated by its mWatch platform for IMS.

At 18.6x FY16E and 14.7x FY17E EPS, the stock trades well above the average

across its listed history (seven years). We believe that premium is justified, given

the execution over the last few years, but see limited upside to CMP at current

levels.

239.5 288.1 350.9

“Locally local”, mining-focused, Digital approach

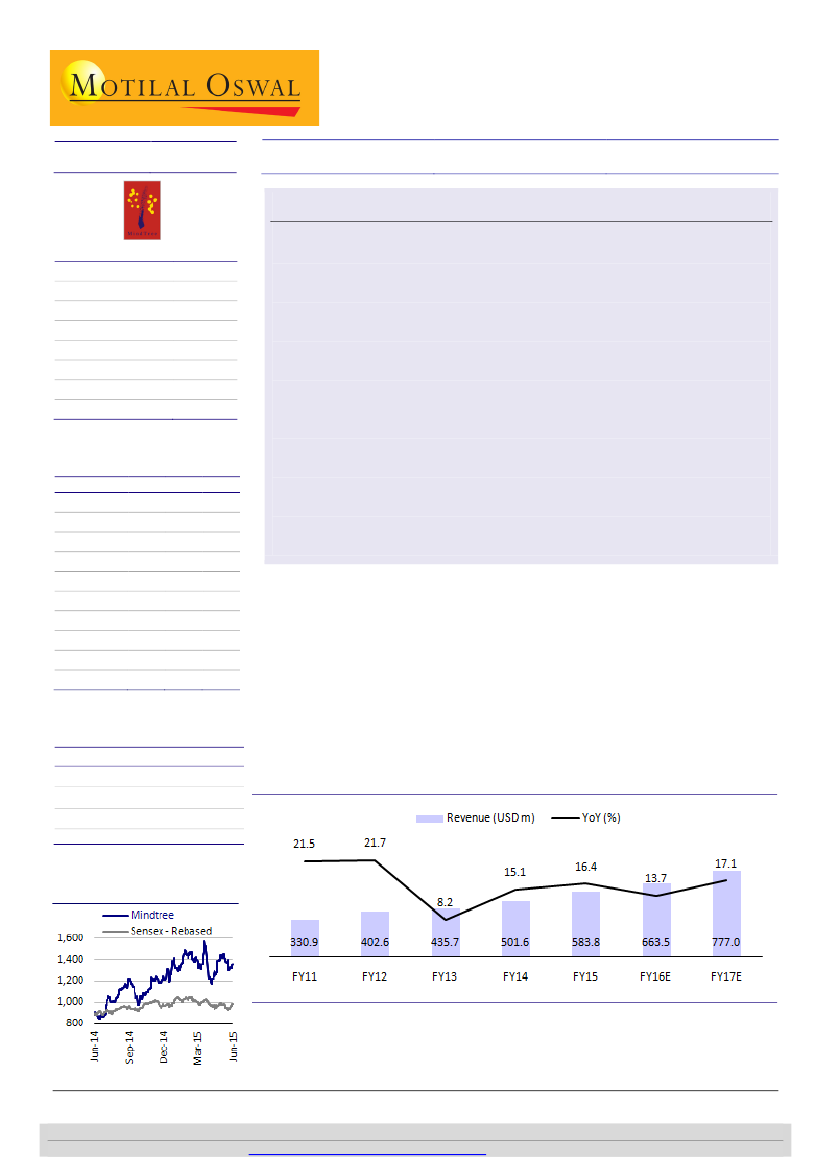

MTCL’s 16.4% USD revenue growth in FY15 was well ahead of the industry and

contributed by the company’s healthy execution of client mining, along with the

capabilities in Digital. Strategic mining approach led to 22% growth in key

accounts, above the overall company growth.

MTCL remains confident of growing above the industry with its mining-focused,

“locally local” and Digital-based approach. The approach to client relationships

is changing too—from delivery excellence-led to business expertise-led.

Exhibit 1: Healthy execution has helped drive growth leadership

Notes:

FII incl. depository receipts

Stock Performance (1-year)

Source: Company, MOSL

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.