08 July 2015

1QFY16 Results Update | Sector:

Technology

TCS

BSE SENSEX

27,574

Bloomberg

Equity Shares (m)

S&P CNX

8,329

TCS IN

1,958.7

CMP: INR2,521

TP: INR2,550 (+1%)

Neutral

CC revenue growth below estimate; USD2b Digital revenue run rate

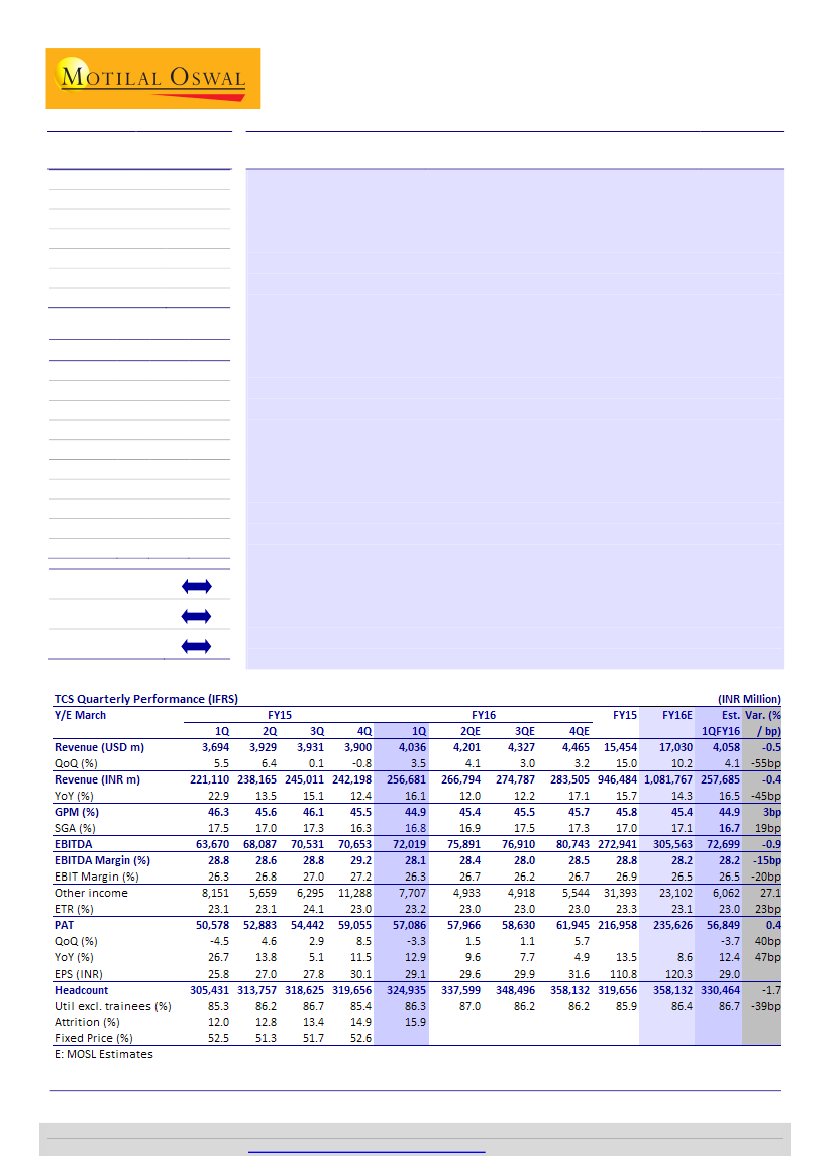

Lowest 1Q CC growth in six years:

TCS’ 3.5% QoQ growth (lower than our

estimate of 4.4%) in Constant Currency was the key highlight for the quarter; this

is the lowest growth in seasonally strong 1Q in the last six years. Volume growth

of 4.8% was sanguine and in line, but greater uptick in hardware & equipment

segment would have contributed partly toward the same.

In-line operating profitability and PAT:

EBIT margin for the quarter is 26.2%,

down 90bp QoQ and in line with our estimate of 26.5%. PAT was INR57.1b, -3.3%

QoQ and in line with our estimate of INR56.8b.

USD2b run rate in Digital:

For the first time, TCS shared its scale in Digital (at

12.5% of revenues) and cited that the segment is growing well above the

company average. Revenue share implies annualized run rate of USD2b from the

Digital segment; this compares with estimated Digital scale at ACN’s ~USD6b and

CTSH’s USD600m+, though definitions may vary across companies.

Cutting earnings by 2%:

We have cut our USD revenue estimate for FY16 by 1pp,

and our assumed CQGR of 3.4% over 2Q-4QFY16 implies FY16 USD revenue

growth of 10.2% (v/s 11.4% earlier). Consequently, our earnings estimates for

FY16/17 are lower by 2%.

Outperformance delta waning; maintain Neutral:

Despite traction in Digital,

softness/volatility in select segments and the base in large verticals limit the

likelihood of bettering 3.3-3.4% ask rates to meet our FY16/17 revenue estimates.

We expect USD revenue CAGR of 12.2% over FY15-17E and earnings CAGR of

12.5% during this period. Our Price Target of INR2525 discounts FY17E EPS by 18x.

Maintain Neutral.

M.Cap (INR b)/(USD b) 4,938/78.3

52-Week Range (INR) 2,834/2,300

1, 6, 12 Rel. Per (%)

-6/1/-3

Avg Val/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.INR)

RoE (%)

P/E (x)

2015 2016E 2017E

946 1,082 1,246

273

217

13.5

38.5

23.0

306

236

8.6

38.0

21.2

15.5

1.7

353

274

16.5

36.7

18.2

13.2

1.9

3,083/1,207

26.1

110.8 120.3 140.1

293.4 340.3 422.4

EV/EBITDA(x) 17.6

Div.Yld (%)

3.1

Estimate change

TP change

Rating change

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.