SECTOR: CAPITAL GOODS

Triveni Turbine

STOCK INFO.

BLOOMBERG

BSE Sensex:27,961

S&P CNX:8,460

TRIV:IN

REUTERS CODE

14 July 2015

Initiating Coverage

(INR CRORES)

Buy

INR120

TRVT.BO

Y/E MARCH

Revenue

EBITDA

EBITDA Margin

NP (Adj.)

EPS (Adj.)

EPS Growth

BV/share

ROE (%)

ROCE (%)

P/E (x)

P/BV (x)

FY15E

651

123

18.8%

75

2.3

11%

7

33

47

52.5

17.3

FY16E

836

155

18.5%

98

3.0

30%

9

34

50

40.6

13.8

FY17E

1117

217

19.5%

139

4.2

42%

12

37

55

28.5

10.4

We recommend a BUY on Triveni Turbine with a target of INR

150 - valuing the company on DCF basis.

Triveni Turbines, a company with a strong moat, is currently at an

inflection point wherein its exports, aftermarket and JV with GE together

have increased their contribution to 60% of revenues and are expected

to decouple Triveni from the vagaries of the domestic product market.

Widening its moat:

Triveni enjoys a strong moat in the 0-30MW

turbine industry both domestically as well as in export markets. The

domestic market is a duopoly wherein Triveni enjoys a 60% market

share with Siemens having the balance. Complex technology, high level

of customization, pan India servicing footprint and a small market size

that discourages entry of larger players; are the key reasons that have

enabled Triveni in maintaining its leadership over the last 4 decades.

On the exports front, Triveni competes against a couple of large EU

and Japanese companies along with smaller local players. Triveni offers

products which are at par in terms of quality at a lower price than its

competitors as the company possesses a lower cost structure owing

to its manufacturing presence in India along with significant economies

of scale compared to smaller local players globally.

Exports to drive growth:

Although international markets have much

higher number of competitors than the domestic market, Triveni offers

strong value proposition to its international clients who are mainly based

in EU, S.E.Asia, MENA and LatAm. Triveni has been seeding these

markets by opening sales offices and service centers in an attempt to

service the customers from close proximity and gain their confidence.

Triveni's exports have risen from INR 84cr in FY12 (13% of sales) to

INR 264cr in FY15 (42% of sales) growing at a CAGR of 47%. We

expect exports to grow at a CAGR of 40% over FY15-17E and

constitute 53% of sales in FY17E.

Valuations & View:

A sustainable moat combined with profitable

growth opportunities in exports and aftermarket should drive 31%/

36% CAGR in topline/bottomline over FY15-17E. Triveni's business

generated best in class ROCE/ROE of 47%/33% in FY15 which are

likely to improve going forward with an increase in capacity utilisation.

This is supported by low asset intensity (asset turnover of 2.6x) with

negative working capital and a high degree of bought outs/outsourcing

(60%) combined with EBITDA margins of 19%. Debt free balance

sheet, robust free cash generation and low capex intensity results in a

dividend payout ratio of 40% which is likely to rise in future. We value

the company at INR 150 on DCF basis (implied P/E of 35x based on

FY17E EPS).

KEY FINANCIALS

Diluted Shares (cr)

Market Cap. (Rs cr)

Market Cap. (US$ m)

33.0

3960

619

STOCK DATA

52-W High/Low Range (INR)

Major Shareholders (as of March 2015)

Promoter

Non Promoter Corp Holding

Public & Others

Average Daily Turnover(6 months)

Volume

Value (Rs cr)

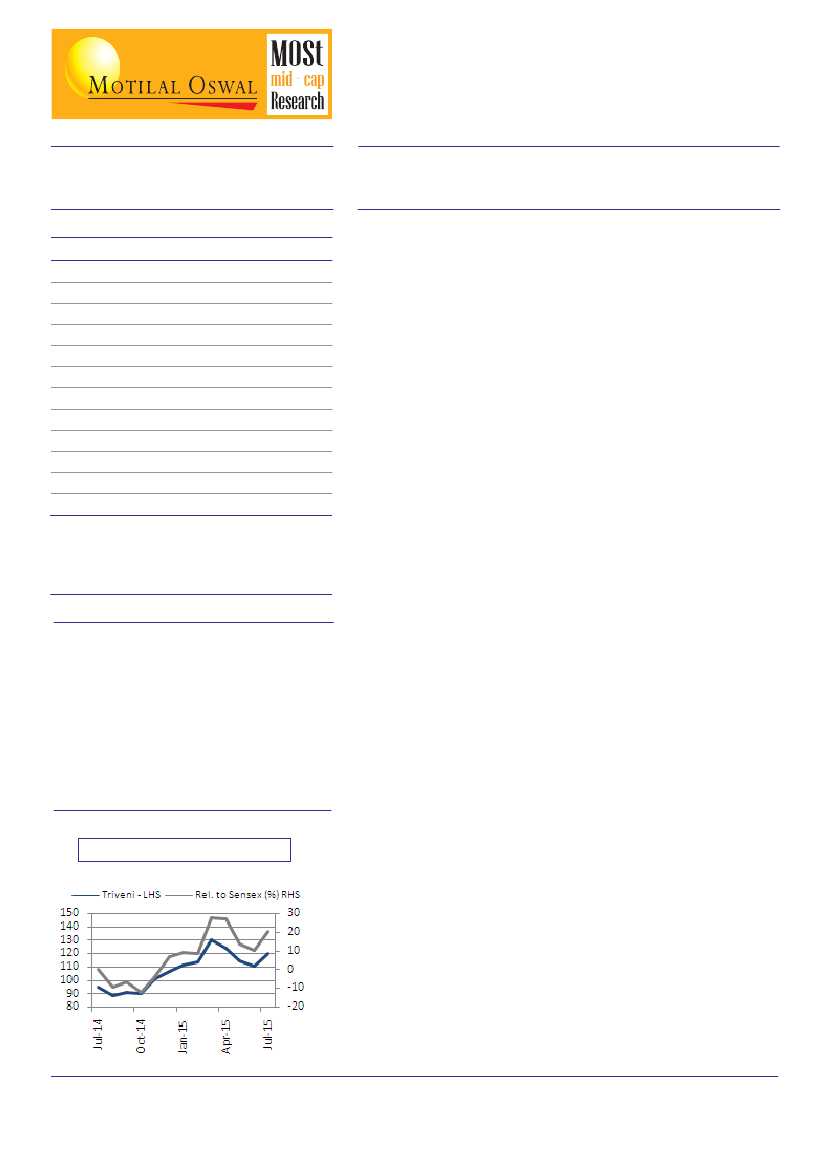

1/6/12 Month Rel. Performance (%)

1/6/12 Month Abs. Performance (%)

152/81

70.0

23.1

6.9

108806

1.3

11/6/18.

14/7/27.

Maximum Buy Price :INR130

Jehan Bhadha (jehan.bhadha@MotilalOswal.com); Tel: +91 22 33124915