13 July 2015

1QFY16 Results Update | Sector:

Financials

IndusInd Bank

BSE SENSEX

27,961

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float (%)

S&P CNX

8,460

IIB IN

580.7

538.3/8.5

967 / 528

9/14/61

769/993

85.0

CMP: INR924

TP: INR1,140 (+23%)

Buy

Financials & Valuation (INR b)

Y/E Mar

2016E 2017E 2018E

NII

OP

NP

NIM (%)

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

ABV/Sh.(INR)

RoE (%)

RoA (%)

Payout (%)

Valuations

P/E (X)

P/BV (X)

P/ABV (X)

Div. Yield (%)

44.1

41.6

24.3

4.0

41.8

23.5

287.1

285.4

18.0

2.0

14.0

22.2

3.2

3.2

0.5

54.8 69.8

51.9 66.3

30.2 38.7

4.1

4.2

52.1 66.6

24.5 27.8

331.9 389.2

329.1 385.3

16.8 18.5

2.1

2.2

14.0 14.0

17.8

2.8

2.8

0.7

13.9

2.4

2.4

0.9

Results in line: Strong core operating performance; fueled to fly; best-in-class RoA

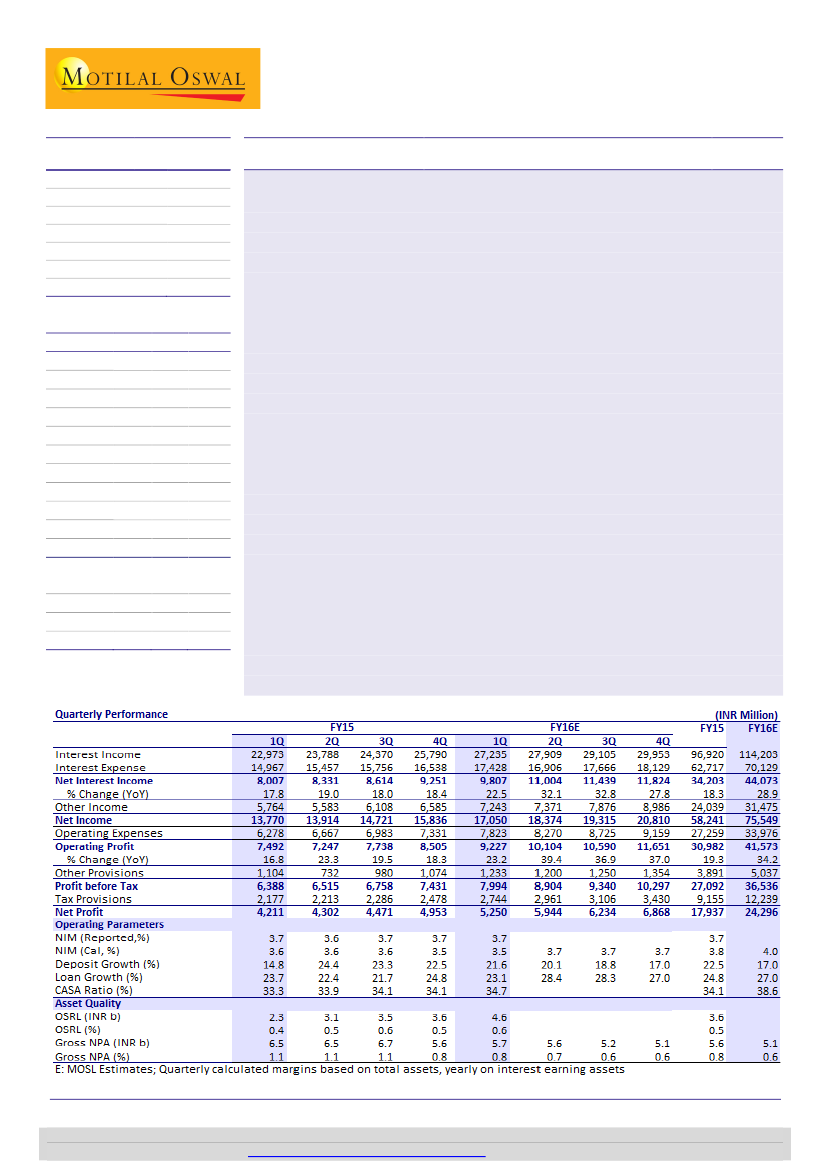

IIB’s 1QFY16 PAT was in line with our estimates (+25% YoY) at INR 5.2b, driven by

strong operating performance (23% YoY) and stable credit costs (52bp).

Consumer finance division (CFD) grew by 6% QoQ (18% YoY) and accounted for

46% of incremental credit growth v/s 28% in 4QFY15; this was partly helped by

recovery in CV loans (~25% of incremental growth), which returned to double

digits after seven quarters. Increasing share of CFD would lead to higher NIMs,

RoA/RoE and lower risk density (credit RWA was flat QoQ despite 5% loan growth).

SA customer acquisition remains healthy at 0.18mn/quarter despite reduction in

SA rates. Strong customer acquisition and deepening of relationships led to SA

deposits growth of 33% YoY (+8% QoQ). SA ratio improved to 18% (17.5% in 4Q).

Overall CASA ratio improved to 34.7% v/s 33.3% in 1QFY15.

Post the QIP issuance (INR43.3b), CET1 ratio has increased to 16.3%. Including the

INR7.5b equity issuance to promoters, CET1 would be >17%—the highest amongst

Indian banks. We expect 27% loan CAGR in FY15-18 and CET1 of ~14% in FY18.

Other highlights:

a) FX and IB fees continue to drive overall fee growth (accounted

for 47% of fees), b) NSL remained one of the best at 94bp (+10bp QoQ).

Maintain estimates; FY15-18E earnings CAGR of 25%+:

In planning cycle 3, IIB’s

key focus is to build scale with 3Ds strategy—Dominate (among the top three

banks in home markets), Differentiate (extensive use of technology and cross sell)

and Diversify (new product addition, payment solution, etc). Strong core

profitability (2.9% of avg. assets v/s private banks’ average of 2.5% and HDFCB’s

2.7%), improving CASA ratio (best among mid-sized private banks) and healthy

return ratios (RoA of 2%+ and RoE of 18-19%) are key positives. Delay in CV cycle

revival and sharp moderation in FX and IB fees remain the key risks to our

estimates.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Vallabh Kulkarni

(Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.