16 July 2015

1QFY16 Results Update | Sector:

Media

HT Media

BSE SENSEX

28,446

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val INRm/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E MAR

Net Sales

EBITDA

Adj. NP

Adj. EPS (INR)

Adj.EPS Gr.(%)

BV/Sh (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

Estimate change

TP change

Rating change

2015 2016E 2017E

22.9

2.8

1.8

8.5

14.9

9.9

10.5

10.3

1.0

24.3

2.9

1.8

7.7

-9.0

8.1

9.7

11.3

0.9

5-8%

26.4

3.2

2.1

9.2

18.4

8.7

10.4

9.5

0.8

n

n

S&P CNX

8,608

HTML IN

232.8

20.3/0.3

145/87

-12/-32/-36

21/187

30.5

n

CMP: INR87

n

TP: INR100 (+15%)

Neutral

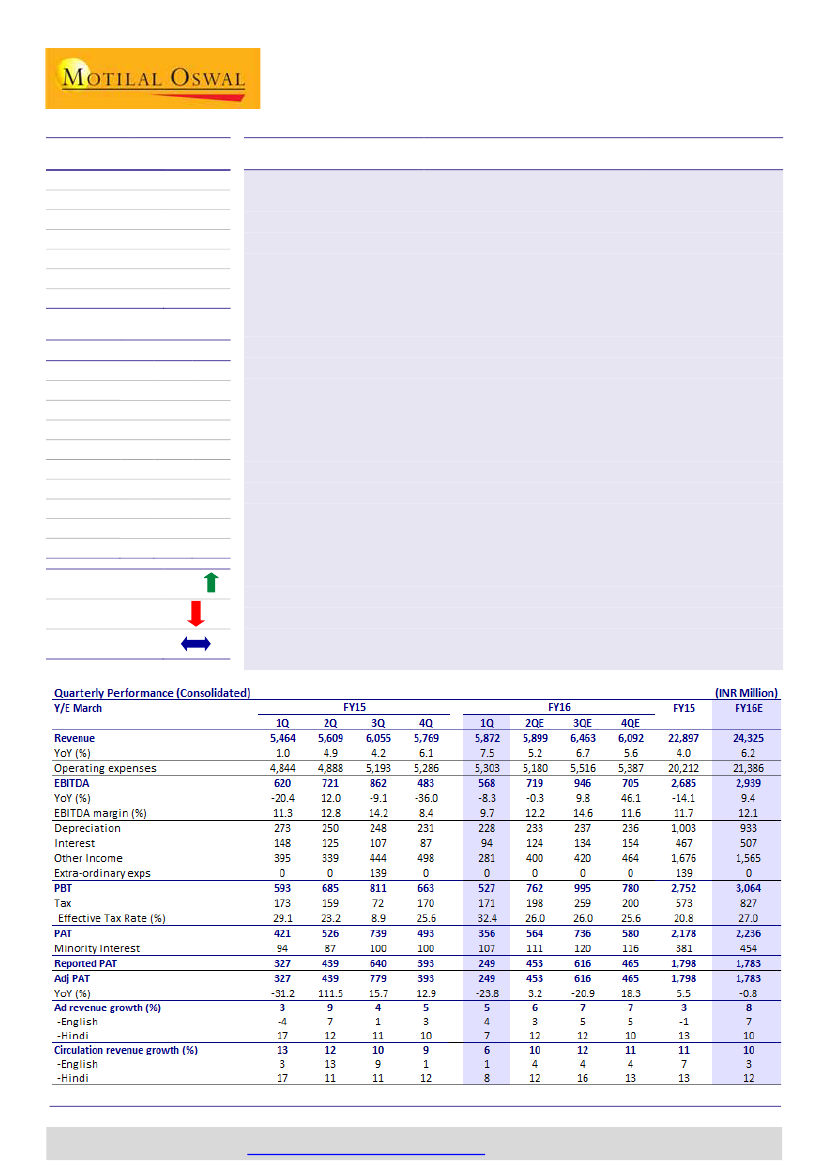

EBITDA and ad growth in line; lower other income impacts PAT

EBITDA down 8%, PAT down 24% (YoY):

HTML’s 1QFY16 PAT declined 24% YoY to

INR393m, led by 1) continued sluggishness in ad growth, 2) front-ended digital

investments for the year (Shine.com), 3) lower other income due to MTM impact

of increased interest rates on mutual fund investments, and 4) higher tax rate. The

impact was partially offset by continued benign raw material prices (down 5% YoY)

Ad and circulation revenue up 5-6% YoY; broadly in line:

Revenue grew 7% YoY to

INR5.87b (est: INR5.74b). Ad revenue increased 5% YoY to INR4.43b (~7% adjusted

for election billing in 1QFY15), with Hindi up 7% YoY and English up 4% YoY.

Circulation revenue grew 6% YoY (English up 1%; Hindi up 8%).

EBITDA margin down 170bp despite favorable newsprint prices:

EBITDA margin

declined 170bp to 9.7%. While raw material costs were favorable (down ~400bp),

the company incurred higher other expenses (up ~500bp YoY)—largely toward

advertising and sales promotion in the digital business. HTML has front-ended the

investments in digital business, with EBITDA loss at INR239m for 1QFY16

compared with its target of INR500m-600m loss for the full year.

Maintaining EBITDA estimates but upgrading earnings 5-8%; Neutral:

HT Media’s

1QFY16 operating performance was broadly in line. While we remain positive on

the regional business (HMVL), sluggish English ad growth, losses in the digital

segment and low dividend pay-out are the key concerns. We are maintaining our

EBITDA estimates but upgrading earnings 5/8% in FY16/FY17 on lower

depreciation and finance costs. The stock trades at a P/E of 11.3x FY16E and 9.5x

FY17E. Maintain

Neutral

with a revised target price of INR100/sh based on 11x

FY17E EPS.

90.0 100.2 111.1

Shobhit Khare

(Shobhit.Khare@MotilalOswal.com); +91 22 3982 5428

Jay Gandhi

(Jay.Gandhi@MotilalOswal.com); +91 22 3089 6693

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.