22 July 2015

1QFY16 Results Update | Sector:

Consumer

TTK Prestige

BSE SENSEX

28,371

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val INRm/Vol ‘000

Free float (%)

Financials & Valuation (INR B)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr (%)

2015

13.9

1.5

0.9

77.8

-15.0

2016E 2017E

15.5

18.0

1.9

1.2

103.2

32.8

624.7

17.5

25.2

38.5

6.4

2.4

1.6

140.6

36.2

718.6

20.9

30.2

28.2

5.5

S&P CNX

8,590

TTKPT IN

11.7

43.8/0.7

4,830/2,989

3/7/-9

80/21

29.6

CMP: INR3,987

TP: INR4,500 (+13%)

Buy

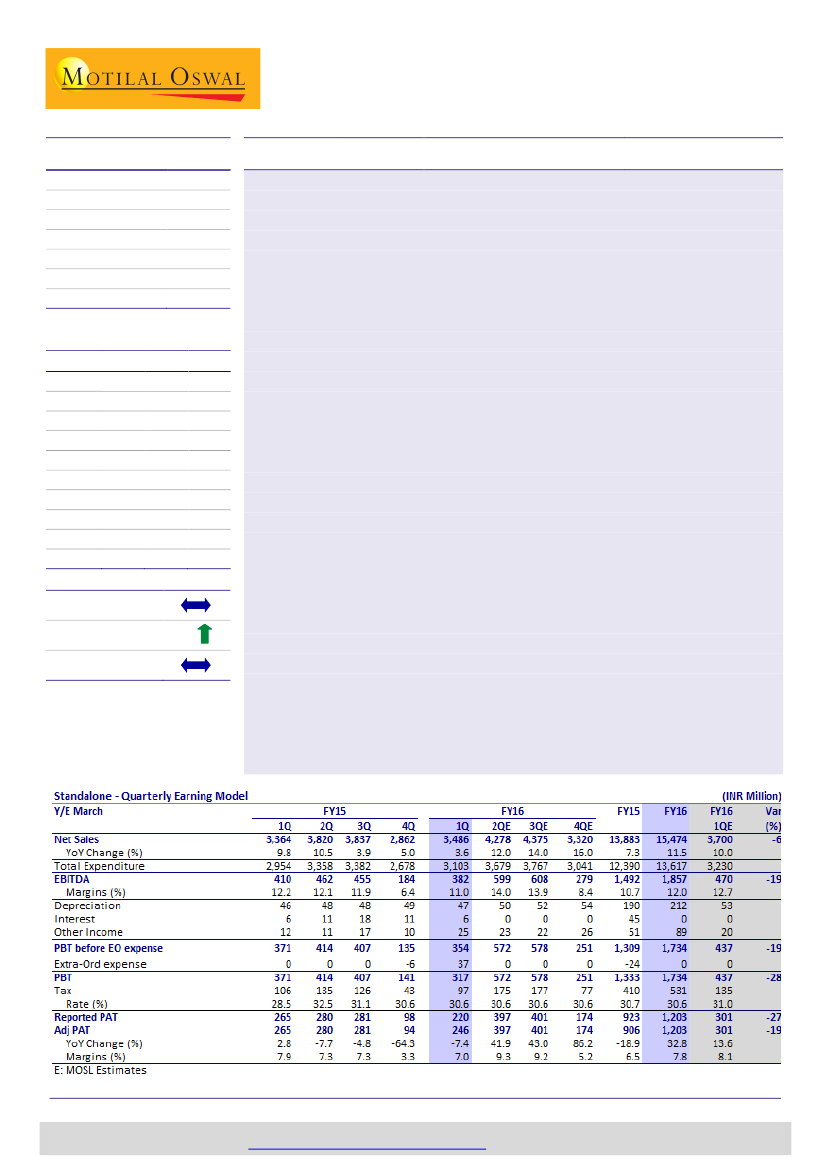

Results below estimates; new launches to drive growth

Results below estimates:

TTKPT reported overall revenue of INR3.5b (est. of

INR3.7b) as against INR3.4b in 1QFY15, marking a 3.6% YoY growth. Cookers

revenues de-grew 3% during 1QFY16 to INR1,310m, cookware revenues grew 14%

YoY to INR640m, and appliances revenues grew 6% YoY to INR1,490m. EBITDA

margins declined 120bps to 11% in 1QFY16 (est. of 12.7%). Adjusted PAT de-grew

7.4% YoY—from INR265m in 1QFY15 to INR246m in 1QFY16 (est. of INR301m).

Weak consumer sentiment resulted in muted growth; TTKPT gaining market

share over peers:

The management highlighted that weak consumer sentiment

has been responsible for sector’s slow growth; however, TTKPT has been

outperforming the market and witnessed market share gain of 200bp in pressure

cooker segment and 300bp in induction cooktop segment over the past one year.

Amongst channels, Prestige Smart Kitchen (PSK) has been outperforming other

channels and posted 10% growth for the quarter. The management is focusing on

driving higher footfalls and throughputs from the existing PSK stores and will add

new stores moderately.

Product innovation and direct tie-ups with e-commerce players to drive higher

growth:

New launches like “Signature” cookware, upcoming new product

launches in cookers and induction cooktops will act as a strong growth lever for

TTKPT. Post opening its first fulfillment center for e-commerce in Hosur, TTKPT

plans to extend this on a pan-India basis. Direct tie-ups with major e-commerce

players along with uniform pricing will prevent channel conflicts with traditional

retailers, complementing its already strong distribution structure.

Valuation and view:

With innovative product launches, e-commerce-led growth

and ramp-up of export opportunity, TTK will post 14% revenue CAGR over FY15-

17. We expect higher capacity utilization to drive significant operating leverage,

with margins expanding 280bps over FY15-17 (driving 34% PAT CAGR). Better

asset utilization and minimal reinvestment needs should drive strong free cash

flow generation (INR1.2b free cash flow) and improve return ratios (30% RoCE)

over FY15-17E. Maintain

Buy

(PT of INR4,500—32x FY17E EPS).

BV/Sh.INR 554.2

14.7

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

21.5

51.1

7.2

Estimate change

TP change

Rating change

5%

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.