28 July 2015

1QFY16 Results Update | Sector: Technology

Info Edge (India)

BSE SENSEX

27,561

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,361

INFOE IN

120.2

97.3/1.6

1015 / 689

2/20/23

139/168

56.3

CMP: INR887

TP: INR1,050 (+19%)

Buy

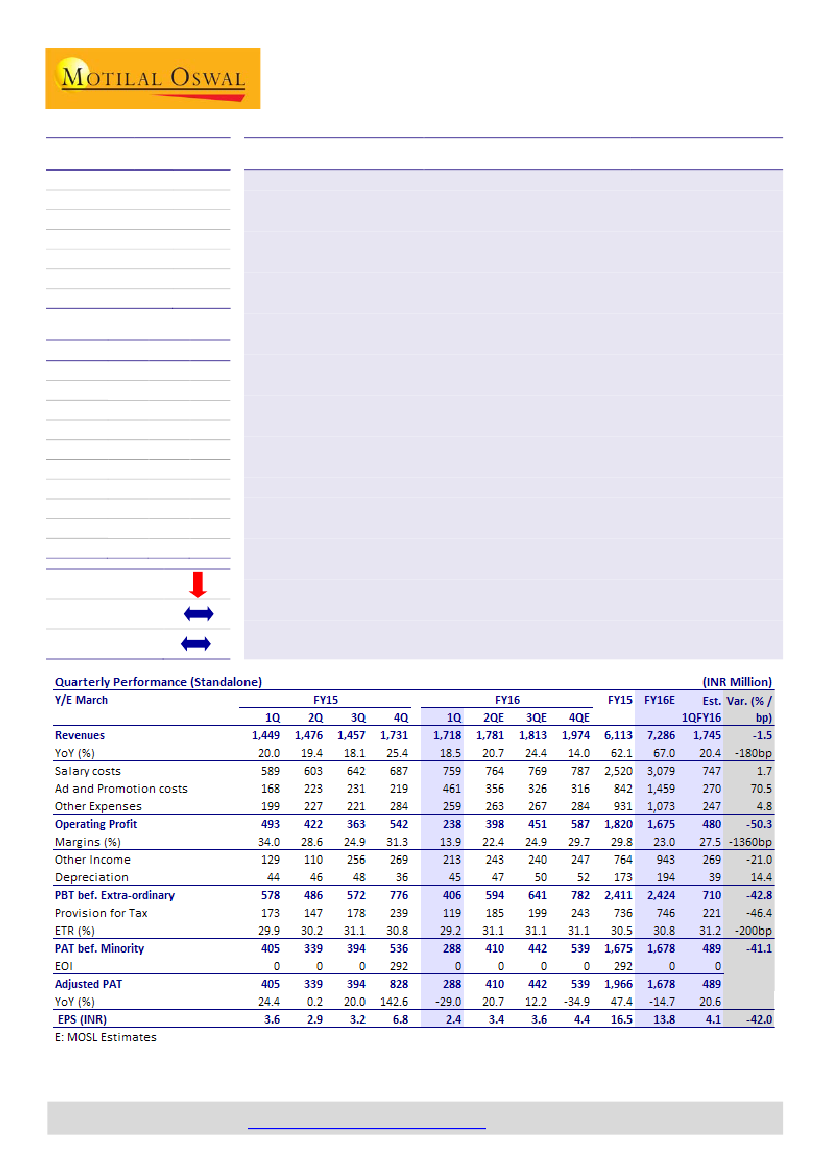

Burn in 99acres.com drives sharp miss in profitability

Competitive intensity in online real estate portals take toll:

INFOE’s advertising

expenses in 1QFY16 shot up to INR461m, or 27% of revenues (v/s estimate of

15.5%), compared to 13.8% in FY15, driving plummet in EBITDA margin to 14%,

compared to estimate of 27.6%. Consequently, standalone PAT came at

INR287.5m, drop of 28% YoY, sharply below our estimate of INR491m.

Real estate remains soft, momentum in other segments intact:

INFOE’s 1QFY16

revenue at INR1.72b grew 18.5% YoY, in line with our estimate of INR1.74b.

Revenues in recruitment segment (naukri.com) grew 20% YoY to INR1.25b,

marginally below our estimate of INR1.275b. 99acres.com posted revenues of

INR252.8m, +10% YoY, below our estimate of INR282.6m

Outlook on businesses:

Growth in

recruitment

portal may have been impacted

by higher collections in the previous quarter. That, and pick up in non-IT

segments could drive improvement in recruitment segment’s revenue growth.

99acres.com

revenues are impacted mainly in the Delhi/NCR region, while other

regions continue to grow. Ad spends will remain responsive to competitive

intensity. Intensity has been lower in June.

Zomato’s

early results from pilot in

food ordering are encouraging.

Valuation view:

We have cut our standalone earnings in FY16 by 16% on the

back of higher ad spends in 99acres.com. INFOE’s strategy of matching

aggression to sustain traffic and listings share is the imperative in our view. We

see Naukri.com, 99acres.com and Zomato.com as the key drivers of valuation at

INFO. Our SOTP price target of INR1050 implies 18% upside. Maintain

Buy.

Financials & valuation (INR b) SA

Y/E Mar

Sales

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.INR

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA

( )

EV/Sales (x)

2015 2016E 2017E

6.1

7.3

8.7

1.9

13.7

16.4

13.6

13.6

59.6

49.2

14.7

1.7

13.8

1.0

9.8

8.6

59.1

52.8

12.1

2.3

19.3

39.7

12.7

12.5

42.3

33.9

10.0

138.3 146.1 158.9

Estimate change (%)

16/4

TP change

Rating change

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.