28 July 2015

1QFY16 Results Update | Sector:

Capital Goods

Thermax

BSE SENSEX

27,459

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,337

TMX IN

119.2

1,315/790

0/0/11

60/58

38.0

n

CMP: INR1,035

n

TP: INR1,275 (+23%)

Buy

Operating performance in-line; intake remains constrained

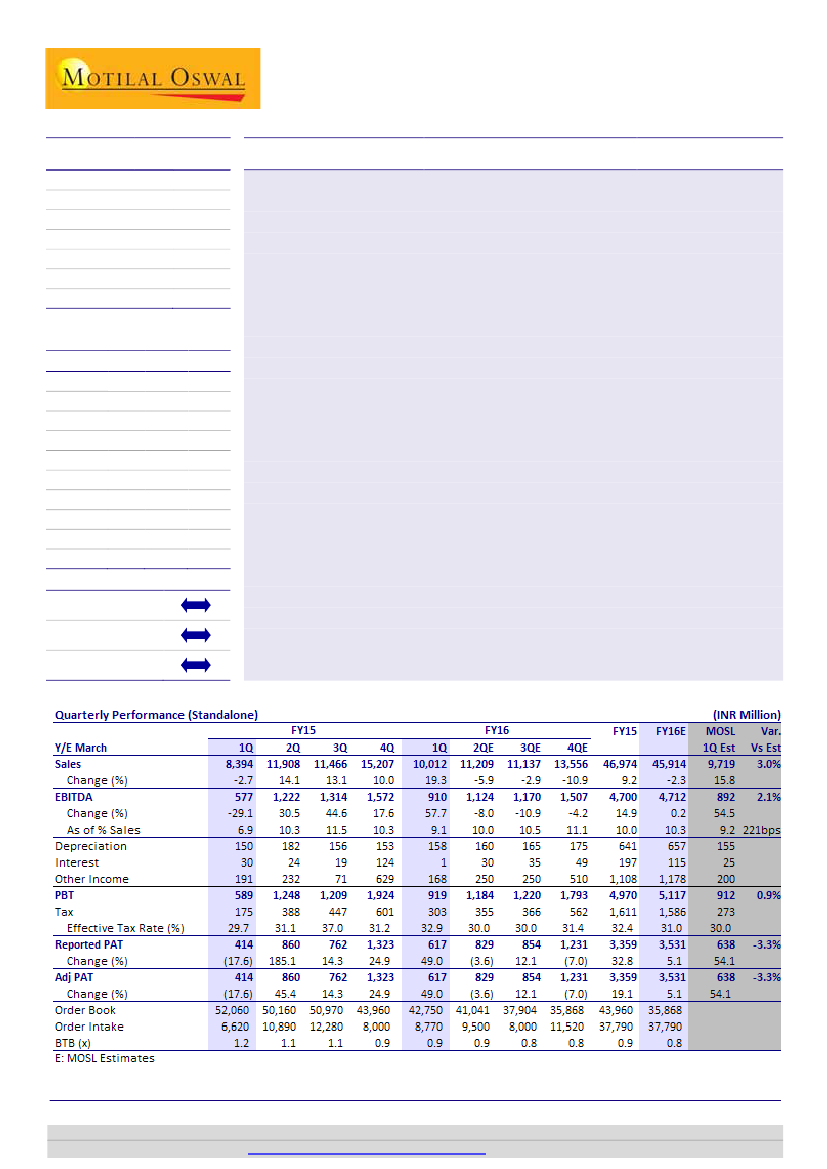

TMX reported in-line operating performance for 1QFY16. Revenue grew 19% YoY

to INR10b, EBITDA margin expanded 221bp YoY to 9.1%, and net profit grew 49%

YoY to INR617m. Consolidated revenue grew 23.9% YoY to INR12.5b; net profit

grew 234% YoY to INR578m.

The Energy segment reported 25% YoY revenue growth, led by execution of the

Reliance order. The Environment business reported revenue decline of 1.8% YoY,

impacted by constrained intake in the Water segment. EBIT margin in the Energy

business expanded 440bp YoY to 11%. Environment segment EBIT margin

expanded 190bp YoY to 6.4%, largely supported by base effect. Energy segment

margins were impacted, as the Reliance project had not crossed the margin

recognition threshold; Environment segment margins were impacted by losses in

water projects in 1QFY15.

Subsidiary losses

narrowed to just INR39m, the lowest since 3QFY14. This

indicates that losses pertaining to European business have been curtailed and that

execution has possibly improved in Thermax-Babcock JV (received orders of

INR6b+ from Babcock & Wilcox overseas wins).

Standalone

order inflow

in 1QFY16 was just ~INR9b. Domestic intake has

remained constrained at just INR7b-8b in the last 6-7 quarters, reflecting that

activity on the ground is yet to pick up. The order book has shrunk 18% YoY.

M.Cap. (INR b) / (USD b) 123.3/1.9

Financials & Valuation (INR Billion)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

EPS Gr. (%)

RoE (%)

RoCE (%)

P/E (X)

P/BV (X)

2015 2016E 2017E

53.4

4.6

2.6

21.8

-6.0

12.1

16.3

44.1

5.4

59.7

5.2

3.3

28.1

29.2

194.1

14.5

18.0

36.8

5.3

67.6

6.6

4.4

37.3

32.8

214.6

17.4

21.5

27.7

4.8

n

n

BV/Sh.(INR) 179.3

Estimate change

TP change

Rating change

Valuation and outlook:

We maintain

Buy

with a target price of INR1,275 (30x FY17E

EPS plus INR141/share for subsidiaries).

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3982 5410

Amit Shah

(Amit.Shah@MotilalOswal.com); +91 22 3029 5126

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.