3 August 2015

1QFY16 Results Update | Sector:

Retail

Shoppers Stop

BSE SENSEX

28,187

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,543

SHOP IN

82.2

32.9/0.5

624 / 330

3/-10/-8

29/64

32.8

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

Adj. PAT

2015 2016E 2017E

30.4

1.9

0.4

35.0

2.2

0.5

6.4

31.6

97.0

6.7

9.3

62.3

4.1

41.3

2.7

0.8

9.3

44.8

104.2

9.1

11.3

43.0

3.8

CMP: INR401

TP: INR380 (-5%)

Neutral

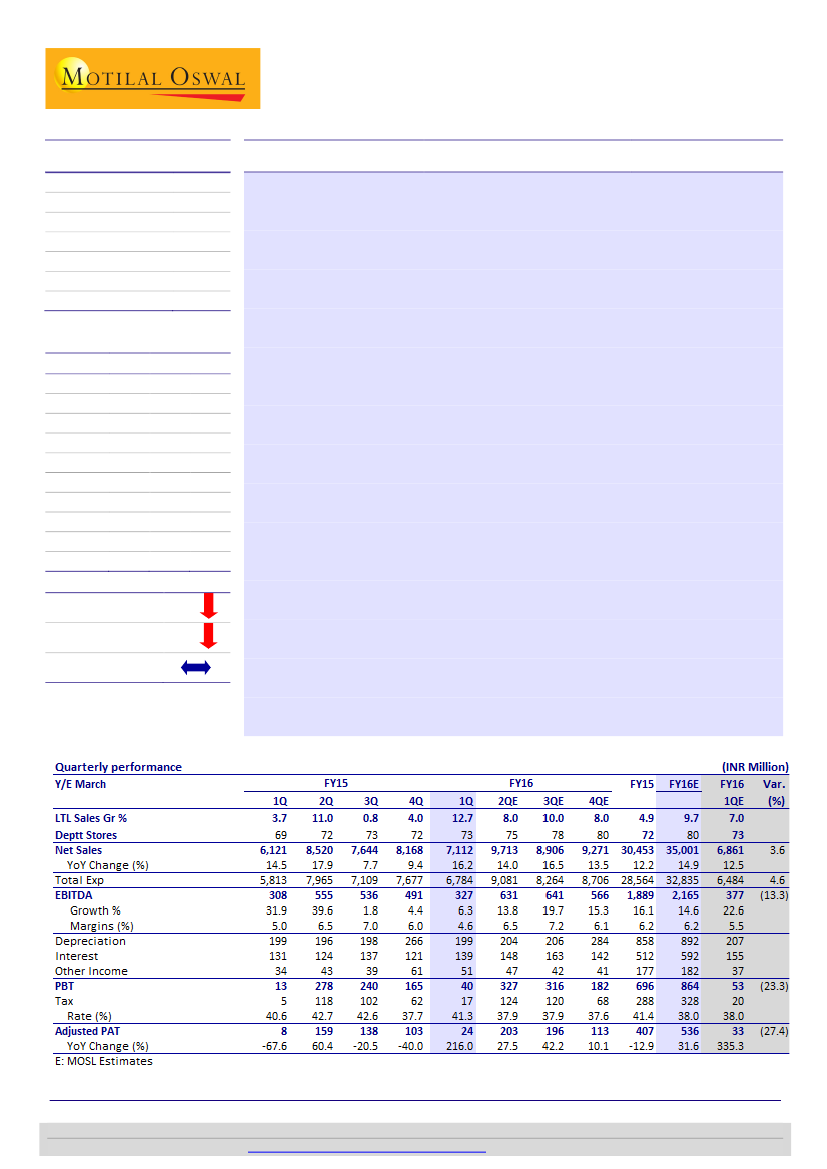

Double-digit SSSG comes at the cost of margins

Standalone performance highlights:

In 1QFY16, standalone sales grew 16.2% to

INR7.1b (est. INR6.9b). LTL sales grew 12.7%, with LTL volumes up 10.6%. Gross

margin contracted 200bp to 39.2% while EBITDA margin contracted 40bp to 4.6%

(est. 5.5%). EBITDA was up a modest 6.3% YoY to INR327m and missed our

estimates by 13%. Recurring PAT tripled to INR24m on an extremely favorable

base and missed our estimates by 27% (1QFY15 PAT declined 67%).

HyperCITY—operating leverage plus cost control drive 60bp EBITDA margin

expansion at store level:

HyperCITY reported sales of INR2.5b, up 3.4%, with weak

underlying SSSG performance. LTL sales posted 1.9% YoY growth and LTL volume

declined 6%. Net margin expanded 30bp to 21.2%. Store operating expenses

stayed flattish. Store EBITDA margin expanded 60bp to 6%, with underlying store

EBITDA up 22% to INR95m. HyperCITY posted a loss of INR159m (10% YoY and

37% QoQ decline in losses). We note that HyperCITY continues to reel under the

impact of low SSSG, notwithstanding the sequential improvement in store-level

EBITDA. Consistent high single-digit and low double-digit SSSG is essential for

HyperCITY to turn profitable, in our view.

Concall highlights:

(a) SHOP has reduced the “SALE” period from eight to six

weeks; will close by August 16. (b) Guidance: 2Q16 will be muted; 2Q+3Q run-rate

will be around 8% LTL growth (2Q and 3Q combined last year was around 5-6% LTL

growth).c) Activations and certain base-related variations led to gross margin

decline. d) Investment of INR600m on online platform spread over three years;

plans to increase contribution to revenue to 10% from the current 1%.

Valuation and view:

While standalone performance represents the typical

“SSSG

v/s margin”

dilemma confronting traditional retailers, HyperCITY continues to

remain a drag on consolidated profitability. We cut our estimates 17-18% as we

bake in muted margin expansion guidance and maintain

Neutral,

with a revised

SOTP-based target price of INR380 (17x standalone EV/EBITDA; 0.5x P/sales for

HyperCITY).

Adj.EPS(INR) 4.9

EPS Gr. (%) 7.9

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

93.1

5.3

8.0

82.0

4.3

Estimate change

TP change

Rating change

-18%

-7%

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(Manish.Poddar@MotilalOswal.com); +91 22 3027 8029/

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com)

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.