8 August 2015

1QFY16 Results Update | Sector:

Automobiles

BSE SENSEX

28,236

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val,INRm/Vol‘000

Free float (%)

S&P CNX

8,565

MM IN

598.6

820.7/12.9

1441 / 1106

5/17/1

1343/1064

74.4

CMP: INR1,388

Mahindra & Mahindra

TP: INR1,408 (+2%)

Neutral

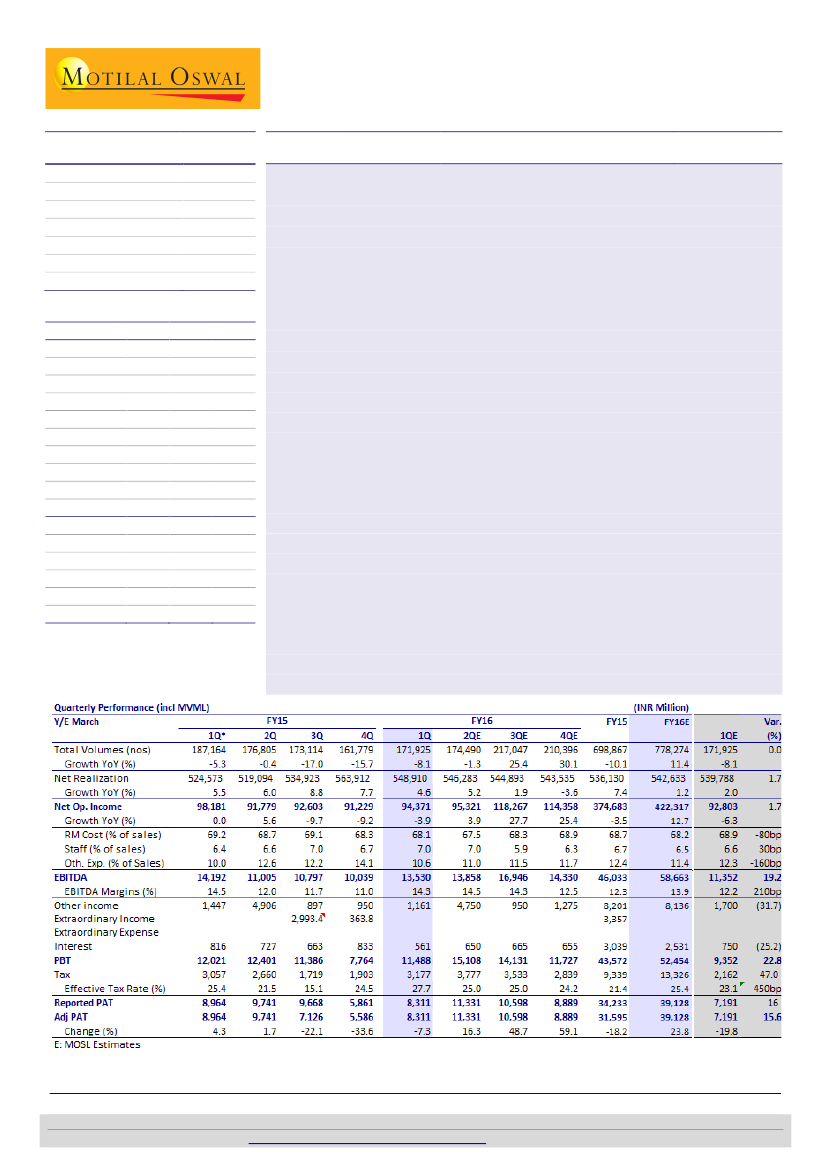

Above-est. EBITDA margins at 14.3% (v/s est. 12.2%) on the back of lower

commodity cost

Volumes declined 8% YoY (up 6.3% QoQ), while realizations grew 4.6% YoY (down

2.7% QoQ) to ~INR549k (v/s est. ~INR540k)—driven by mix improvement. Net

revenue declined 3.9% YoY (up 3.4% QoQ) to INR94.3b (v/s est. INR92.8b). EBITDA

margin was up 330bp QoQ (down 20bp YoY) to 14.3% (v/s est. 12.2%), driven by

lower commodity cost and lower other expense. Auto segment PBIT margin

declined ~20bp YoY (up 150bp QoQ) to 10.3%. Tractor business PBIT margin was

up 60bp YoY (650bp QoQ) to 17.7%, highest since 3QFY11. Lower other income

and higher tax rate restricted adj. PAT to INR8.3b, down 7% YoY (up 49% QoQ).

Management commentary:

(a) It expects 5% growth in tractors for FY16, with

pressure continuing in 2QFY16 and 2HFY16 seeing volumes similar to 2HFY14

levels (implying ~35% growth in 2HFY16); b) in the automotive segment, inventory

has gone higher by one week compared with end of June (but has reduced by two

day days in July and the target is to reduce further by two days in August); c) TUV-

3OO would be launched in mid-September, and the company plans to launch S101

(crossover) in 2HFY16; d) in 1QFY16, there was a 1.8% YoY improvement in gross

margins (due to favorable mix and material cost benefit); e) recently launched SCV

Jeeto is targeted to do ~2,500 units/month; f) maintained guidance for capex of

~INR75b and investments of INR25b over three years.

Valuation and view:

We raise our standalone EPS estimates by 2.5%/2.7% for

FY16/FY17 on better-than-estimated margins, despite volume cut of 3.4% in FY16.

However, consolidated EPS of FY16/17 is cut by 4%/2%, impacted by estimate cut

for subsidiaries—particularly for Ssangong. The stock trades at 19.3x FY16E and

14.2x FY17E consolidated EPS. Valuations reflect structural challenges in both

businesses. Maintain

Neutral,

with FY17E-based SOTP target price of ~INR1,408.

Financials & Valuation (INR b)

y/e MAR

2015 2016E 2017E

Sales

389.5 440.0 532.1

EBITDA

41.7

53.1

66.5

NP (incl.MVML) 31.6

39.1

49.2

Adj. EPS (INR) * 52.8

65.4

82.2

EPS Gr. (%)

(18.2) 23.8

25.7

Cons.EPS (INR) 47.8

71.9

97.7

BV/Sh (INR)

326

374

438

RoE (%)

15.9

16.9

18.0

RoCE (%)

16.3

18.7

20.2

Payout (%)

25.5

27.6

22.1

Valuations

P/E (x)

26.3

21.2

16.9

Cons. P/E (x)

29.0

19.3

14.2

P/BV (x)

4.3

3.7

3.2

EV/EBITDA (x)

19.7

15.3

12.0

Div. Yield (%)

0.9

1.1

1.1

* Incl MVML

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Jay Shah

(Jay.Shah@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.