11 August 2015

1QFY16 Results Update | Sector: Oil & Gas

HPCL

BSE SENSEX

27,866

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E MAR

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

Estimate change

TP change (%)

Rating change

n

11.8

2.0

7.8

2.6

9.7

1.8

6.0

3.1

9.4

1.6

5.6

3.2

n

n

2015 2016E 2017E

2,064 1,836 1,762

54.2

27.3

80.6

57.6

473

17.6

11.0

35.6

67.0

33.3

98.3

21.9

543

19.3

14.5

35.6

68.2

34.5

101.8

3.6

609

17.7

13.6

35.1

n

S&P CNX

8,462

HPCL IN

323/5.0

991/391

18/66/124

1174/1932

48.9

CMP: INR953

TP: INR1,190 (+25%)

Buy

Significant beat; subsidy fully compensated; expect re-rating with profit

339

normalization and sustained high RoEs

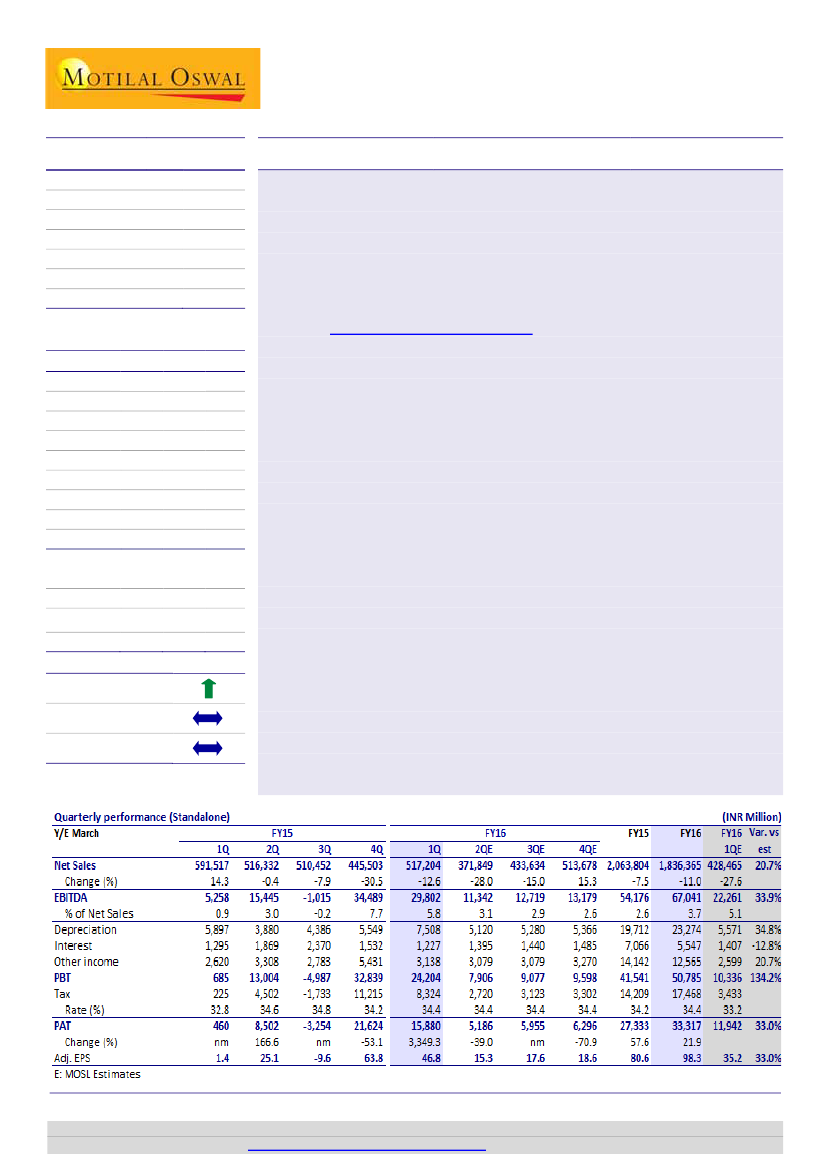

HPCL reported 1QFY16 EBITDA of INR29.8b (est. 22.3), led by GRM at USD8.6/bbl (est. 6.5)

and product inventory gain of INR5.8b. PAT stood at INR15.9b (est. 12b), implying EPS of

INR47/sh. While 2QFY16 could be moderate due to GRM/inventory fluctuations, we

believe HPCL is now a structural investment play—led by (a) higher earnings predictability

and (b) increase in profitability leading to higher RoEs. Commensurate re-rating is pending,

in our view (Refer

our report - OMCs in new era).

Maintain Buy.

n

Above estimates:

HPCL reported 1QFY16 EBITDA of INR29.8b, led by superior

(a) GRM at USD8.6/bbl (v/s USD2/bbl in 1QFY15 and USD7.47/bbl in 4QFY15),

(b) fully compensated subsidy and (c) product inventory gain of INR5.8b. We

estimate gross auto fuel (petrol/diesel) marketing margin of ~INR1.5/ltr in

1QFY16 (v/s INR3/ltr in 4QFY15). Impact of higher-than-estimated depreciation

(led by one-time charge of INR1.5b) was partly compensated by higher other

income, leading to a PAT of INR15.9b (EPS of INR47/sh).

OMCs received full subsidy for 1QFY16:

HPCL’s 1QFY16 gross under-recovery

stood at INR6.7b, of which upstream shared INR2.2b and government INR4.5b.

Similar to previous years, quarterly subsidy sharing is ad-hoc. In line with the

announced FY16 subsidy, we now model OMCs’ sharing at nil in FY16/FY17.

Mumbai shutdown impacts throughput; debt flat QoQ:

While, the marketing

sales stood at 8.6mmt (+3% YoY, +5% QoQ), refiney throughput at 3.8mmt

(+14.3% YoY, -15.7% QoQ) was impacted QoQ by shutdown in Mumbai. HPCL’s

gross debt as of 1QFY16 stands at INR180b (largely flat QoQ).

Of the three OMCs, HPCL’s earnings are more sensitive to a change in the

marketing margin—given its higher ratio of marketing-to-refining volume.

Hence, it would be the largest beneficiary of higher auto fuel margins.

Valuation and view:

We are increasing our FY16 earnings, led by actual 1QFY16

performance, by ~15%. We value HPCL at 5.5x for refining and 8x for marketing

to arrive at a fair value of INR1,190 implying a 25% upside. The stock trades at

9.4x FY17E EPS of INR102 and 1.6x FY17E BV. Maintain

Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.