11 August 2015

1QFY16 Results Update | Sector:

Media

Hathway Cable & Datacom

BSE SENSEX

27,866

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,462

HATH IN

830.5

40.1/0.6

77/46

0/-20/-25

37/281

56.5

CMP: INR48

n

TP: INR70 (+46%)

Buy

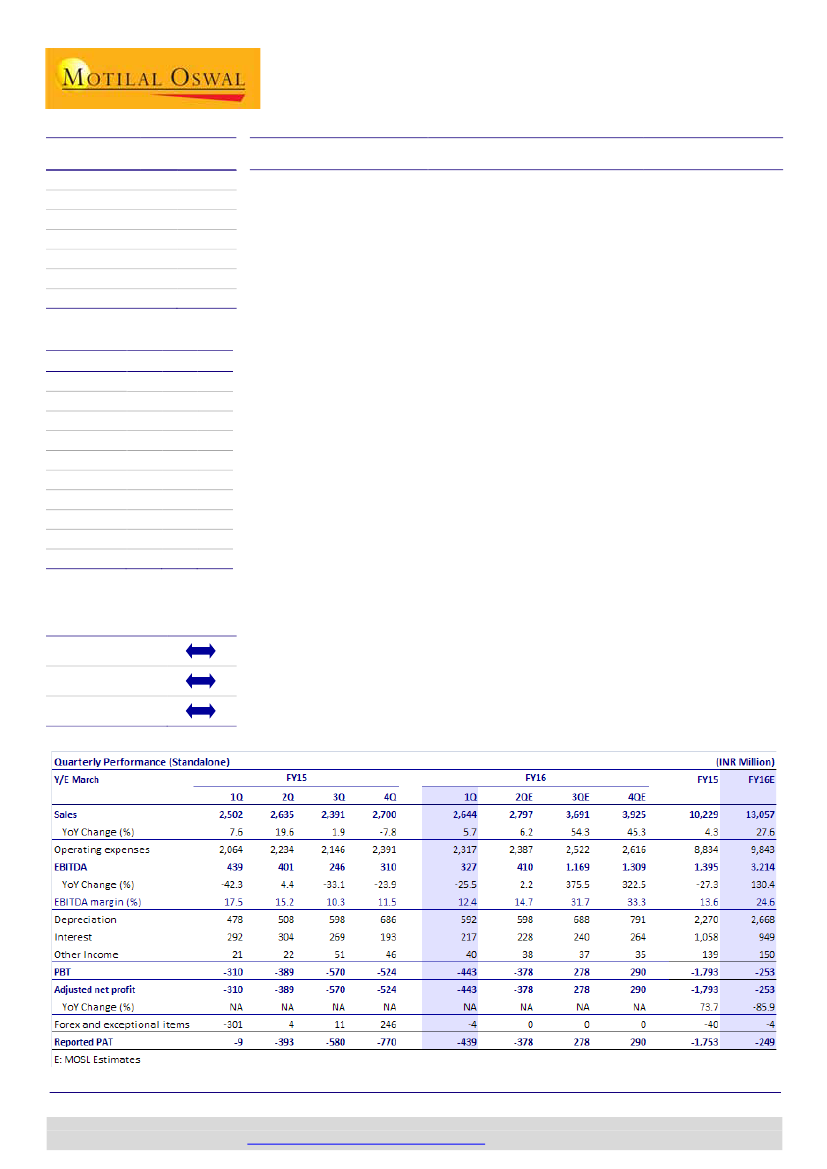

EBITDA in line; subscription miss offset by placement/broadband

1QFY16 EBITDA in line:

Hathway’s 1QFY16 standalone EBITDA grew 6% QoQ to

INR327m (v/s estimate of INR331m). Adjusted for activation revenue, EBITDA

grew 9% QoQ to INR273m (v/s estimate of INR271m). Standalone revenue

declined 2% QoQ to INR2.64b, broadly in line. Cable subscription revenue

remained flat QoQ (net of feed income) at INR1.05b (v/s estimate of INR1.09b).

Placement/broadband revenue increased 8%/13% QoQ and was 7%/3% above

estimates. The management estimates consolidated EBITDA at ~INR410m.

Margin in line despite impact of lower other revenue and license fee provision:

EBITDA margin (ex-activation) stood at 10.3%, broadly in line, despiteINR38m

decline in ‘other revenue’ and INR52m provision toward license fee for

broadband business (8% of revenue). Reported content cost grew 9% YoY but

declined 13% QoQ to INR933m (v/s our estimate of INR971m). However,

adjusted for the feed income in 4QFY15, content cost was flat QoQ.

STB seeding remains muted; standalone net debt at INR10.4b:

Set-top box (STB)

seeding remained muted, with additions of 0.1m. Since March 2014, HATH has

cumulatively seeded ~0.6m STBs, largely on a voluntary basis. Standalone gross

debt stands at INR11.37b while net debt stands at INR10.41b. HATH currently

has an inventory of 0.5m STBs and has tied up financing for the phase III rollout.

Continued strong revenue growth in Broadband (BB):

Broadband revenue grew

56% YoY and 13% QoQ to INR651m (v/s our estimate of INR635m). Broadband

revenue growth continues to be largely led by ARPU increase. Of the 0.46m BB

subscribers, 0.17m are now on the DOCSIS 3.0 platform.

Valuation and view:

We expect digital subscriber base to increase from 8.5m in

FY15 to 14.6m in FY18, driving 31% CAGR in net ARPU (from INR55 to INR124)

and 100%+ CAGR in recurring EBITDA/subscriber (from INR6 to INR52). We

maintain our estimates and DCF-based target price of INR70. HATH trades at

proportionate EV/recurring EBITDA of 27.2x/12.6x FY16E/FY17E. Maintain

Buy.

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

EBITDA #

Adj. NP

Adj. EPS (INR)

Adj. EPS Gr. (%)

P/E (x)

EV/EBITDA (x)*

EV/EBITDA(x)*#

2015 2016E 2017E

18.3

2.6

1.7

-2.3

-2.9

NA

25.2

38.6

21.7

4.9

2.5

-0.5

-0.6

28.5

8.6

5.5

1.8

2.1

22.8

8.0

12.6

n

n

NA -460.5

14.0

27.2

-16.7 -82.2

EV/Sub (INR)* 5,527 5,013 4,847

* Based on attributable EBITDA and

subs post minority stake

# (ex-activation)

Estimate change

TP change

Rating change

n

n

Shobhit Khare

(Shobhit.Khare@MotilalOswal.com); +91 22 3982 5428

Jay Gandhi

(Jay.Gandhi@MotilalOswal.com); +91 22 3089 6693

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.