14 August 2015

1QFY16 Results Update | Sector: Metals

SAIL

BSE SENSEX

28,067

Bloomberg

Equity Shares (m)

M.Cap. (INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float

Financials & Valuation (INR b)

Y/E Mar

Sales

EBITDA

NP

Adj. EPS

EPS Gr(%)

BV/Sh.INR

RoE (%)

P/E (x)

P/BV

EV/EBITDA(x)

2015 2016E 2017E

461.2 469.9 561.9

51.8

21.1

5.1

25.1

-10.7

-2.6

66.2

8.4

2.0

S&P CNX

8,519

SAIL IN

4,130.1

231.3/3.6

91/54

-3/-21/-41

303/4033

25.0

CMP: INR56

TP: INR33 (-41%)

Sell

First EBITDA loss in 12-13 years; focus on operations still missing

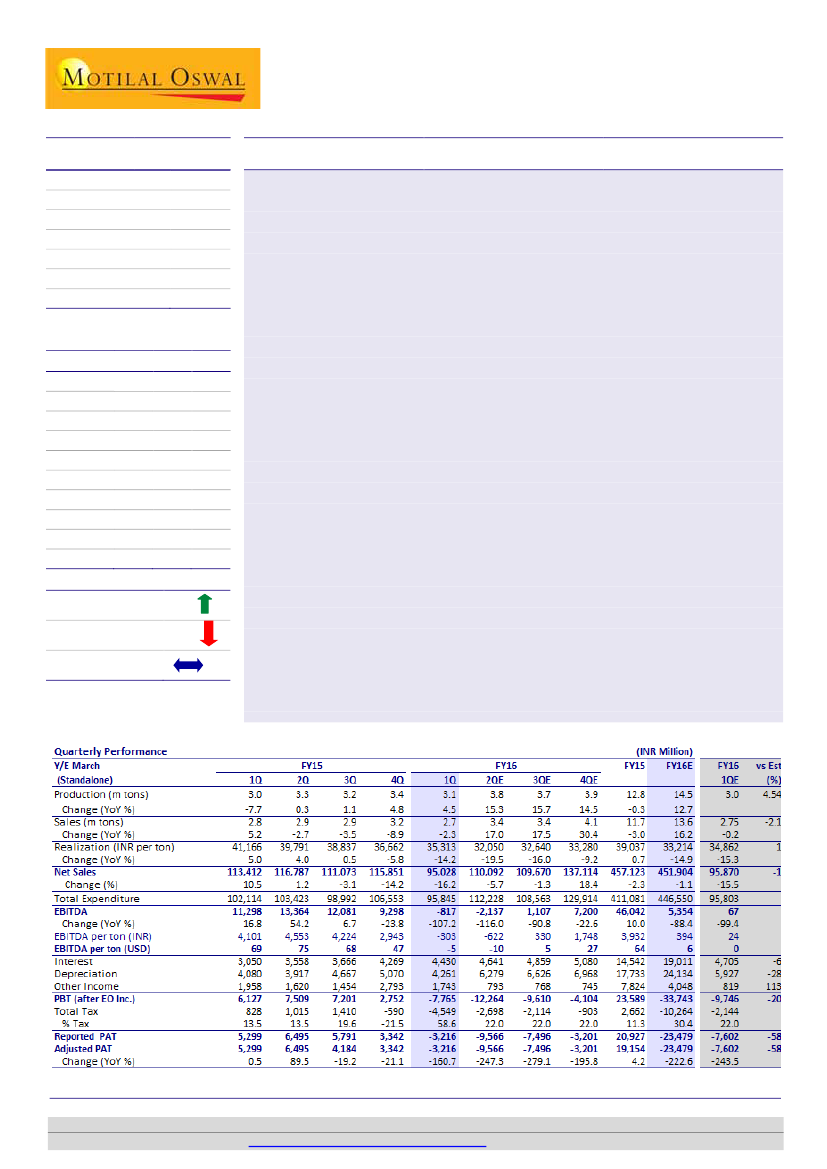

SAIL reported EBITDA loss of INR817m (est. INR67m) under pricing pressure and poor

sales volumes. NSR declined 4% QoQ and volumes 2% YoY. The company added 250kt

to the inventories. Depreciation was lower by INR839m due to increase in useful life

of assets on reassessment. Further, the interest and depreciation were down on

lower capitalization. Loss before tax at INR7.8b was lower than our estimate of

INR9.5b. Although the cash taxes were nil, there was a deferred tax asset on account

of investment-related tax benefit. Loss after tax was INR3.2b.

n

Operating matrix disappoints again:

It is disappointing to see that there is no

reduction in production cost despite weak trend in input costs. Further, SAIL is

still struggling to increase steel production despite commissioning of two new

blast furnaces over last few years. Although the company is guiding for 13%

growth in production to 14.5mt for FY16, this appears to be an uphill task—given

the high inventories, continued pricing and import pressure.

n

Will safeguard duty help SAIL?

Indian steel industry is lobbying for a safeguard

duty to protect against cheaper imports; while this will provide interim relief,

provided import prices become stable, it will not address the challenges SAIL

faces because of high fixed costs. We are not sure whether the safeguard duty

will really protect Indian steel industry in the medium to long run because

international prices will flow through backdoor in the guise of cheaper steel scrap

imports. Globally, scrap melting is becoming unviable. Recently, Tata Steel’s

Southeast Asian arm substituted scrap by cheaper Chinese billets.

n

Focus on operational efficiencies still missing:

SAIL needs to focus aggressively

on reducing costs and inventories, increasing production to take advantage of

operating leverage, and manage working capital more efficiently by bringing in

supply chain automation; so far, we don’t see any of these initiatives.

Sell

11.1 -150.9 -178.4

106.9 101.9 101.6

4.8

5.4

0.5

9.8

-2.5

0.4

0.5

23.0

2.0

4.2

0.6

9.7

Estimate change

TP change

Rating change

7%

-10%

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.