14 August 2015

1QFY16 Results Update | Sector:

Automobiles

Amara Raja Batteries

BSE SENSEX

28,067

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,519

AMRJ IN

170.8

995/527

10/17/73

214/279

47.9

CMP: INR972

TP: INR1,099 (13%)

Buy

Revenues disappoint, but EBITDA margins surprise at 18.2% (v/s est.

17.6%)—highest since 4QFY10

AMRJ’s in-line PAT at INR1.2b was driven by strong revenue growth in the automotive

segment and favorable lead prices. FY16 is an inflection year for AMRJ—with new

capacities driving top-line (~22% CAGR) and benign lead prices driving margins

(+240bp by FY17), translating into ~34% EPS CAGR (FY15-17) after muted FY15. Stable

competitive environment, significant FCF generation (~INR7b over FY16-17) and

improving RoE (4pp by FY17 to ~31%)—coupled with potential shift from unorganized

to organized players due to GST—would continue to drive stock re-rating.

n

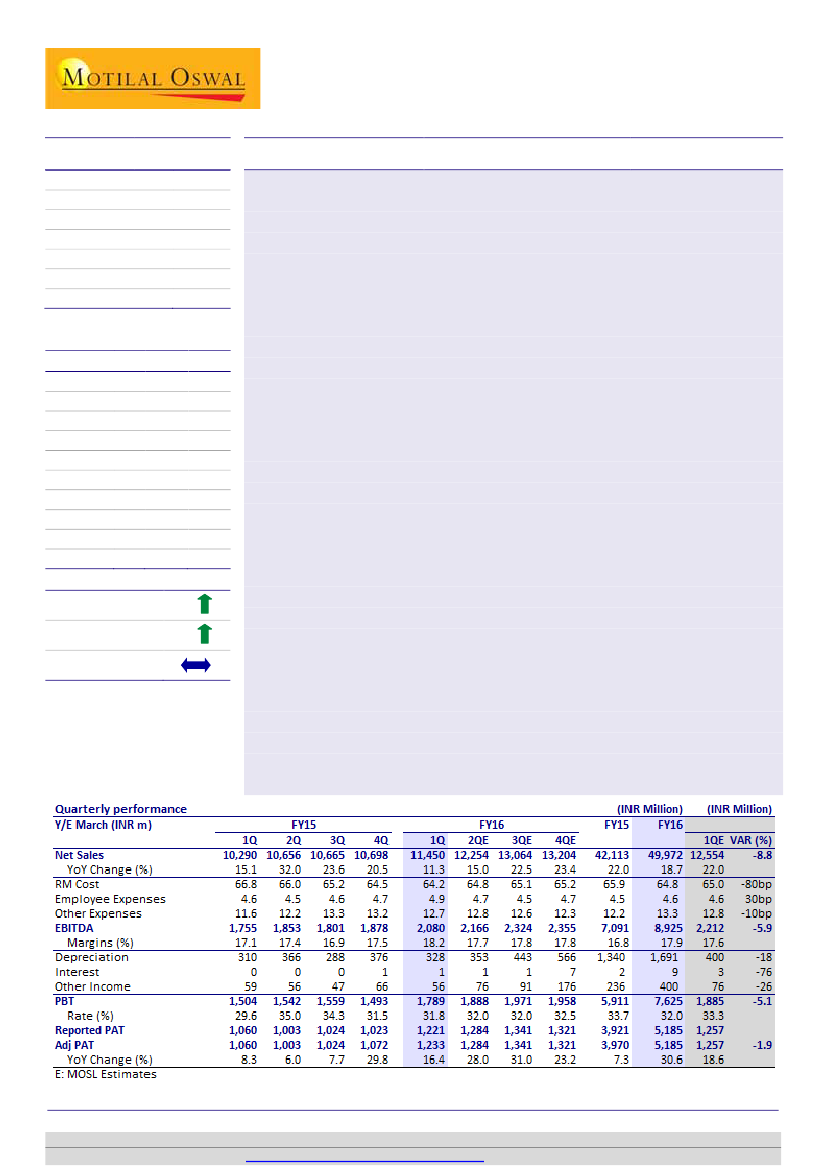

Net sales grew 11.3% YoY (+7% QoQ) to INR11.5b (v/s est. INR12.5b), driven by

~20% revenue growth in auto (OEM saw higher single digit growth and

replacement was up by ~25%) and 17% growth in 2W (OEM/Replacement both

up by 17% YoY). However, telecom saw lower single digit growth and UPS/

inverter battery segments de-grew of 7%/8% YoY.

n

RM Cost declined 260bp YoY (-30bp QoQ) to 64.2% on account of lower lead cost.

n

EBITDA margins improved 110bp YoY (70bp QoQ) to 18.2% (v/s est. of 17.6%) in

1QFY16, driven by lower RM cost benefit. EBITDA at ~INR2b (v/s est. INR2.2b)

grew ~19% YoY (10.8% QoQ).

n

Lower tax rate of 31.8% boosted adj. PAT to INR1.2b, up 16% YoY (15% QoQ).

Takeaways from management interaction:

a) Telecom market share stable at 60%

despite EXIDE’s market share rising to ~22% in 1QFY16 v/s ~8% in 1QFY15 and AUTO

replacement market share at 27% (v/s 25% last year), b) Lead cost at INR129-130 per

kg (v/s INR132 in 4QFY15, INR140 in 3QFY15); the management expects lead prices to

rise from 2QFY16. c) Upcoming 2W capacity to have 1-2 dedicated lines for HMSI; the

company is also negotiating with other 2W OEMs. d) Capex of INR6b in FY16 (INR3.5b

for tubular battery, INR0.6b for LVRLA and INR0.5b for 2W capacity expansion, and

the rest for regular maintenance).

Valuation and view:

We value AMRJ at ~25x FY17E EPS of INR44 to factor in for

higher visibility of sustained superior competitive positioning and capital efficiencies.

Buy

with a TP of ~INR1,099.

M.Cap. (INR b) / (USD b) 166.1/2.6

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

42.1

7.1

4.2

24.3

12.3

99.5

27.2

37.6

39.9

9.8

50.0

8.9

5.2

30.4

24.7

123.3

27.2

37.8

32.0

7.9

62.3

12.0

7.5

44.0

44.9

157.7

31.3

42.6

22.1

6.2

Estimate change

TP change

Rating change

3%

3%

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Jay Shah

(Jay.Shah@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.