14 August 2015

1QFY16 Results Update | Sector:

Utilities

RattanIndia Power

BSE SENSEX

28,067

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD

b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val,(INRm)/Vol ‘000

S&P CNX

8,519

RTPOW IN

2,952.9

26.4/0.4

14 / 6

-11/-25/-35

29/2691

42.5

CMP: INR7

TP: INR14 (+88%)

Buy

Stabilization, one-offs impact performance

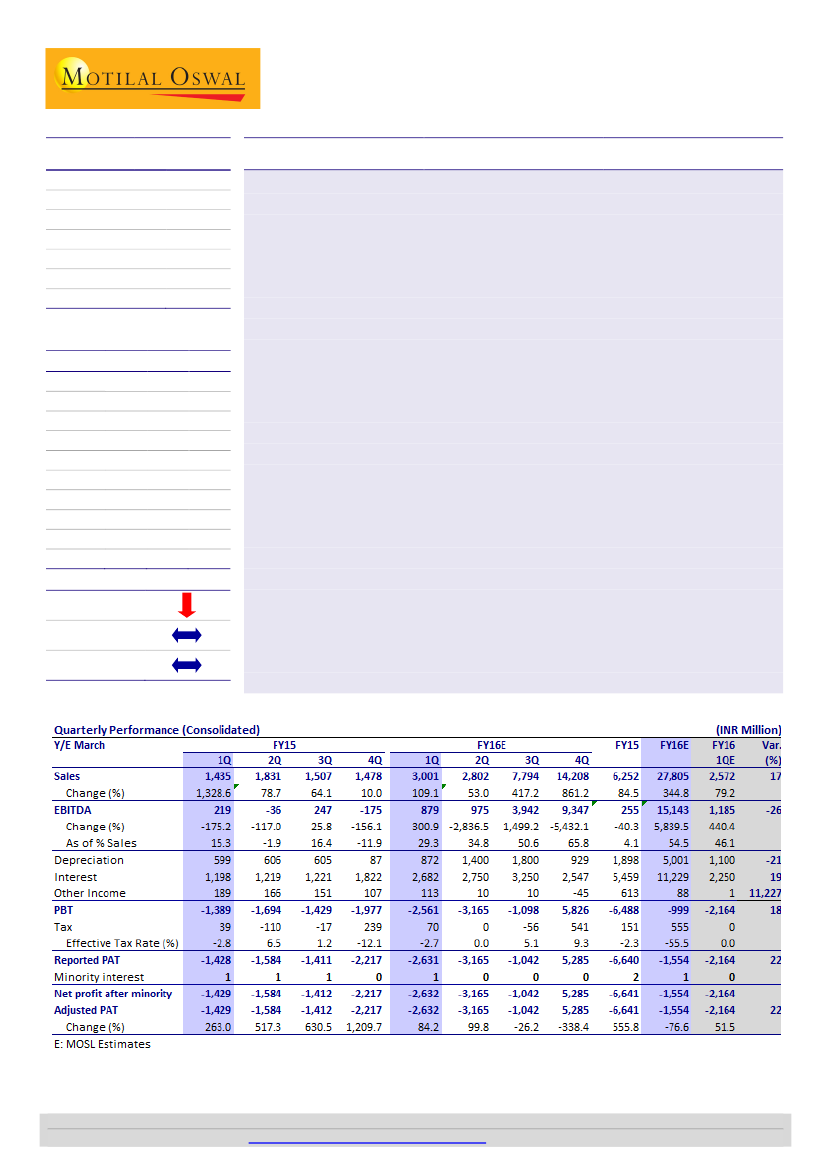

Consolidated EBIDTA below estimate:

RattanIndia Power (formerly Indiabulls

Power) reported consolidated revenue of INR3b, higher than estimate of

INR2.6b—partly led by high net generation at ~544MUs v/s estimate of 510MUs.

RTPOW also booked prior period revenue and compensatory tariff totaling to

~INR800m. However, consolidated EBIDTA stood at INR879m v/s estimate of

INR1.2b led by higher fuel cost (INR2.8/unit v/s estimate of INR1.7/unit).

Stabilization of three units commissioned at Amaravati project in March 2015

increased fuel cost.

Higher interest cost, deferred tax liability led to higher PAT loss:

Interest cost

inched up due to capitalization of three units at Amaravati, while depreciation was

lower due to change in accounting policy. PBT loss, thus, stood at INR2.6b v/s

estimate of INR2.2b. We had assumed NIL tax, while RTPOW provided for deferred

tax liability of INR70m—driving PAT loss to INR2.6b v/s estimate of INR2.2b.

Amravati PLF up in July; 2QFY16 operational performance to look up:

In 1QFY16,

Amravati average PLF was ~20% as Unit-1 ran at full load with available coal

supply. Coal supply improved to 0.3m tons in July and further in August (2-3

rakes/day being received v/s 4-5 rakes/day requirement); thus, generation/PLF is

expected to look up in 2QFY16 as all units achieve full load. For July 2015 itself, the

average PLF increased to 45%.

Cut estimate:

We lower our FY16/17 estimates to factor higher project cost and

slower ramp-up in operations. We now expect loss of INR1.6b in FY16 (v/s

INR1.4b earlier) and PAT of INR5.5b in FY17 (v/s INR7b earlier). Commissioning of

Nashik project by March 2016 and signing of PPA are the key triggers/monitorable.

The stock trades at P/E of 3.5x and P/BV of 0.4x on FY17E basis.

Free float (%)

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

2015

6.3

0.3

(6.6)

(2.5)

-

2016E 2017E

27.8

15.1

(1.6)

(0.6)

(77)

17.2

(3.4)

6.0

(12.6)

0.4

67.8

29.0

5.5

2.1

(456)

19.0

11.6

12.8

3.5

0.4

BV/Sh.(INR) 17.8

RoE (%)

(13.2)

RoCE (%)

P/E (x)

P/BV (X)

(0.6)

(2.9)

0.4

Estimate change

TP change

Rating change

Nalin Bhatt

(NalinBhatt@MotilalOswal.com); +91 22 3982 5429

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.