21 August 2015

1QFY16 Results Update | Sector: Agri

Monsanto India

BSE SENSEX

27,366

Bloomberg

S&P CNX

8,300

MCHM IN

CMP: INR2,866

TP: INR3,200 (+12%)

Buy

Earnings recovery to be back-ended; 2HFY16 to see a rebound in growth

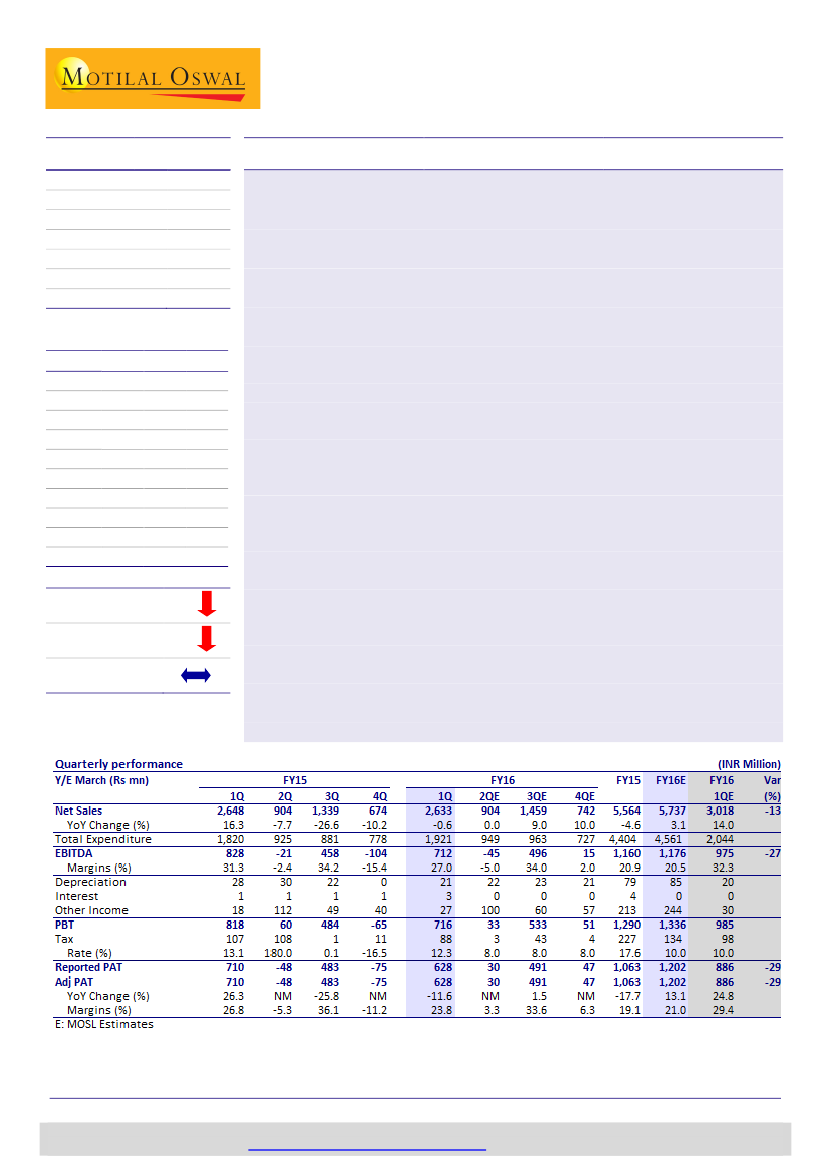

Results below expectations:

MCHM reported overall revenue of INR2,633m (est. of

INR3,108m) in 1QFY16 as against INR2,648m in 1QFY15, marking a YoY de-growth of

0.6%. EBITDA declined to INR712m (est. of INR975m) and margins contracted from

31.3% in 1QFY15 to 27% (est. of 32.3%) in 1QFY16. Our interaction with the

management suggests that margin contraction is largely on account of price correction

of ~20% in glyphosate selling price which led to inventory losses. Consequently, PAT

de-grew 11.6%— from INR710m in 1QFY15 to INR628m (est. of INR886m) in 1QFY16.

Earnings recovery to be back-ended; 2HFY16 to see a rebound in growth:

1QFY16

witnessed ~10% volume de-growth in corn seeds as a result of lower acreage;

however, due to higher share of new high-value products, value growth in corn seeds

was largely flat YoY. The management highlighted that glyphosate has seen a price

correction of ~20%; however, price correction led to strong volume growth (especially

in June)—leading to a minor overall decline in value growth. Our interaction with the

management suggests corn seeds as well as glyphosate are experiencing low growth

owing to below-normal monsoon in July 2015 (on a YoY basis). Accordingly, we expect

2QFY16 to witness flat growth and -5% margins. However, we expect growth to

rebound in 2HFY16—led by favorable base of glyphosate revenues and favorable

outlook for corn seed sales in Rabi.

Higher contribution from newly launched hybrids to drive margins higher:

Margins in

newly launched hybrids are higher as compared to old products by ~500 bps. We

believe improvement in mix in favor of newly launched hybrids will drive overall

margin improvement to the extent of 300bp in FY17.

Valuation and view

We cut our EPS estimates by 25% for FY16 and 19% for FY17 to factor in the impact of

weak monsoon, lower corn acreages and lower profitability in the glyphosate division.

Maintain

Buy

with a TP of INR3,200 (35x FY17E EPS).

Equity Shares (m)

17.3

M.Cap. (INR b) / (USD

46.3/0.8

b)

52-Week Range (INR) 3,756/2,000

1, 6, 12 Rel. Per (%)

-4/-9/30

Avg Val INRm/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr (%)

2015

5.6

1.2

1.1

61.6

-17.6

2016E 2017E

5.6

1.2

1.2

68.6

11.3

225.4

31.0

34.5

42.0

12.8

6.7

1.6

1.6

92.1

34.3

245.3

39.1

43.5

31.3

11.7

138/46

27.9

BV/Sh.INR 216.9

RoE (%)

29.6

RoCE (%)

P/E (x)

P/BV (X)

36.0

46.8

13.3

Estimate change

TP change

Rating change

19%

8%

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.