15 October 2015

2QFY16 Results Update | Sector: Technology

BSE SENSEX

27,010

Bloomberg

Equity Shares (m)

M.Cap. INR b / USD b

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val INRm/Vol ‘000

Free float (%)

S&P CNX

8,180

MTCL IN

83.7

102.8/1.6

1589 / 870

-2/13/33

282/214

86.3

MindTree

CMP: INR1,403

TP: INR1,400

Neutral

Blockbuster growth; sanguine deal wins; yet commentary on 2H muted

Financials & Valuation (INR b)

Y/E Mar

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA(x)

Estimate change

TP change

Rating change

2015 2016E 2017E

35.6

7.1

5.4

63.9

18.6

29.4

32.8

21.9

15.2

46.1

8.4

6.1

73.1

14.5

27.9

31.3

19.2

13.4

56.3

10.9

7.8

93.2

27.5

29.3

34.4

15.0

10.0

239.5 285.4 349.6

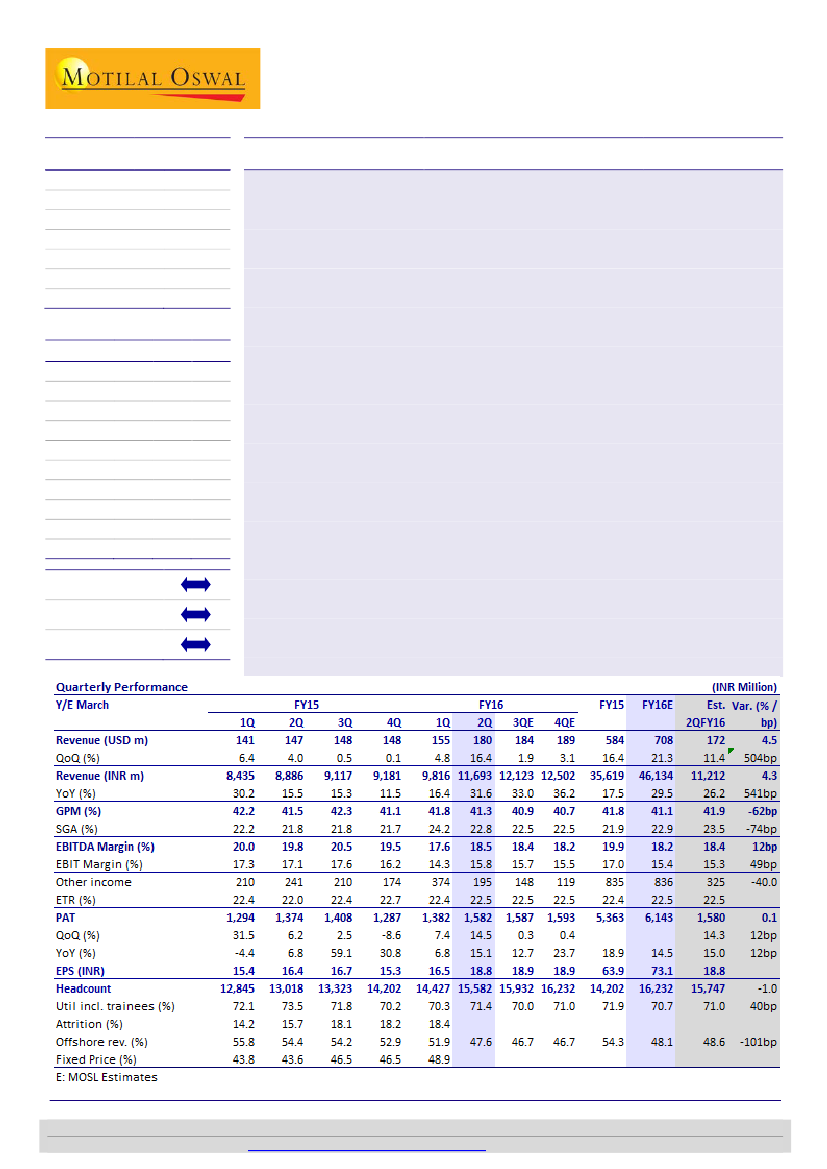

Strong revenue beat…:

MTCL’s 2QFY16 revenues at USD180.3m were higher than

our estimate of USD172.5m. Excluding the revenues from acquisition of Bluefin

and Relational Solutions, organic revenue growth stood at 8.1% QoQ, which was

higher than our expectation of 5.4%. That said, in a stance similar to INFO’s MTCL

remains muted in terms of its expectations for 2H, despite USD105m wins in

Digital, which see a quicker conversion to revenues.

…drove recovery in profitability:

EBITDA margins expanded 90bp QoQ to 18.5%,

in line with our estimate of 18.4%. During the quarter, the impact of wage hikes

was offset by INR depreciation, and operational efficiency. PAT at INR1.58b grew

14.5% QoQ, in line with our expectation, led by lower-than-expected forex gains.

Digital continues to drive:

MTCL saw 9.6% growth in digital revenues, which now

constitute to 36.6% of total revenues. Deal wins reflected continued strength in

digital; which contributed USD105m of the USD193m TCV.

Seasonality to weigh on 2H:

On account of seasonal weakness, and furloughs,

MTCL expects 3Q revenue growth to be soft. It indicated that USD revenue growth

would be higher than what it was in 3QFY15 (0.5% QoQ). With lower revenue

growth, part impact of wage hikes, and not factoring any currency benefits, it

expects margins to sequentially decline in 3Q.

Inching estimates higher:

We have increased our revenue estimates for

FY16E/FY17E by 2.6%/2.8%, to factor in higher organic growth momentum in 2Q

and visibility from deal wins. Our earnings estimates for FY16E/17E are up by

0.4%/2.9% to INR73.1/INR93.2, mainly on the back of revenue upgrade. Our price

target of INR1,400 discounts FY17E EPS by 15x. MTCL currently trades at 19.2x/

15x FY16E/17E EPS. While it remains our most preferred company in terms of

fundamentals within tier-II IT, we remain

Neutral

on valuations.

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 3982 5585