21 October 2015

2QFY16 Results Update | Sector:

Logistics

Container Corporation

BSE SENSEX

27,288

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

8,252

CCRI IN

195.0

287.4/4.4

1944 / 1204

1/-7/10

375

38.2

CMP: INR1,470

TP: INR1,700 (+16%)

Buy

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

NP

EPS (INR)

2015

61.5

14.0

10.5

54.1

2016E 2017E

60.4

12.6

9.2

47.2

-12.7

418.5

11.8

15.7

31.2

3.5

66.4

15.4

11.4

58.4

23.6

459.3

13.3

17.4

25.2

3.2

EPS Gr. (%) 11.7

BV/Sh(INR) 385.5

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

14.7

18.2

27.3

3.8

Estimate change

TP change

Rating change

EBITDA, volumes in line with estimates, expect better volumes in 2H

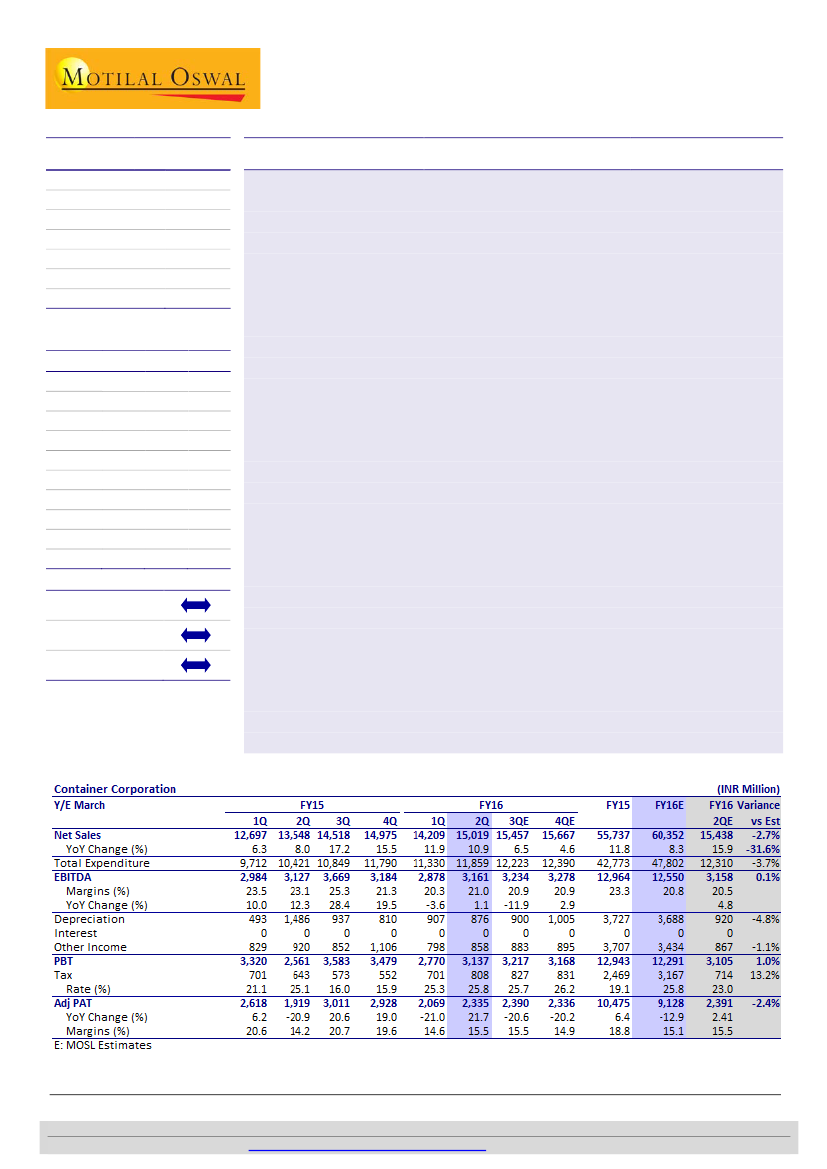

Container Corporation (CCRI IN) reported largely in-line EBITDA at INR3.2b (+1%

YoY, +10% QoQ). Despite marginally lower revenue at INR15.0b (est. INR15.4b;

+11% YoY, +6% QoQ), EBITDA was in-line led by improved profitability in both,

EXIM as well as domestic segments.

Adj. PAT stood at INR2.3b (est. INR2.4b; +22% YoY, +13% QoQ), impacted by

higher-than-expected tax rate at 25.8% (est. 23.0%) and lower-than-expected

other income at INR858m (est. INR867m; -7% YoY, +8% QoQ).

Overall volumes stood at 0.75m teu (-6% YoY and +4% QoQ), led by EXIM at 0.6m

teu (-4% YoY, +6% QoQ) and domestic at 0.1m teu (-14% YoY, -3% QoQ). The

domestic decline was mainly due to 26-28% increase in haulage charge. We

model flat YoY volumes in FY16. Management indicated that they will review

their volume growth guidance of ~8% growth at end-3QFY16.

Realization (in INR/teu) in EXIM stood at 19,070 (+19% YoY, +1% QoQ) and

domestic at 25,445 (+16% YoY, +4% QoQ). The YoY increase in realization was led

by higher haulage rates.

EBIT per unit (in INR/teu) in EXIM stood at 3,660 (+38% YoY, +5% QoQ) and

domestic at 489 (-43% YoY, +25% QoQ).

Valuation and view

While DFC (Dedicated Freight Corridor) completion (expected in 2018/2019) will

be a significant efficiency driver for CCRI, its investments in long-gestation

MMLP’s will impact near-term ratios though.

The stock trades at 25.3x FY17E EPS of INR58. While the near term profitability

remains subdued with weak volume growth, expect CCRI to continue to trade at

rich valuations led by long term DFC led upsides in volume (market share gain

from road) and profitability (double stacking and efficiency benefit). We use DCF-

based (WACC 11.9%, TGR 5%) valuation to arrive at a fair value of INR1,700/sh for

CCRI imply 16% upside. Maintain

Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Rajat Agarwal

(Rajat.Agarwal@MotilalOswal.com); +91 22 3982 5558

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.