23 October 2015

2QFY16 Results Update | Sector: Automobiles

Bajaj Auto

BSE SENSEX

27,288

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

NP

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015

216.1

41.2

30.5

(6.0)

369.5

30.0

42.7

23.9

6.8

2016E 2017E

241.2

50.9

38.0

131.3

24.7

422.7

33.2

47.6

19.2

6.0

277.5

59.1

48.2

166.6

26.9

499.2

36.1

48.3

15.1

5.0

S&P CNX

8,252

BJAUT IN

289.4

728.7/11.2

2690 / 1914

6/28/2

984

50.7

CMP: INR 2,518

TP: INR 3,118 (+24%)

Buy

Above estimate; gross margins at 33.5%—highest since 2QFY10

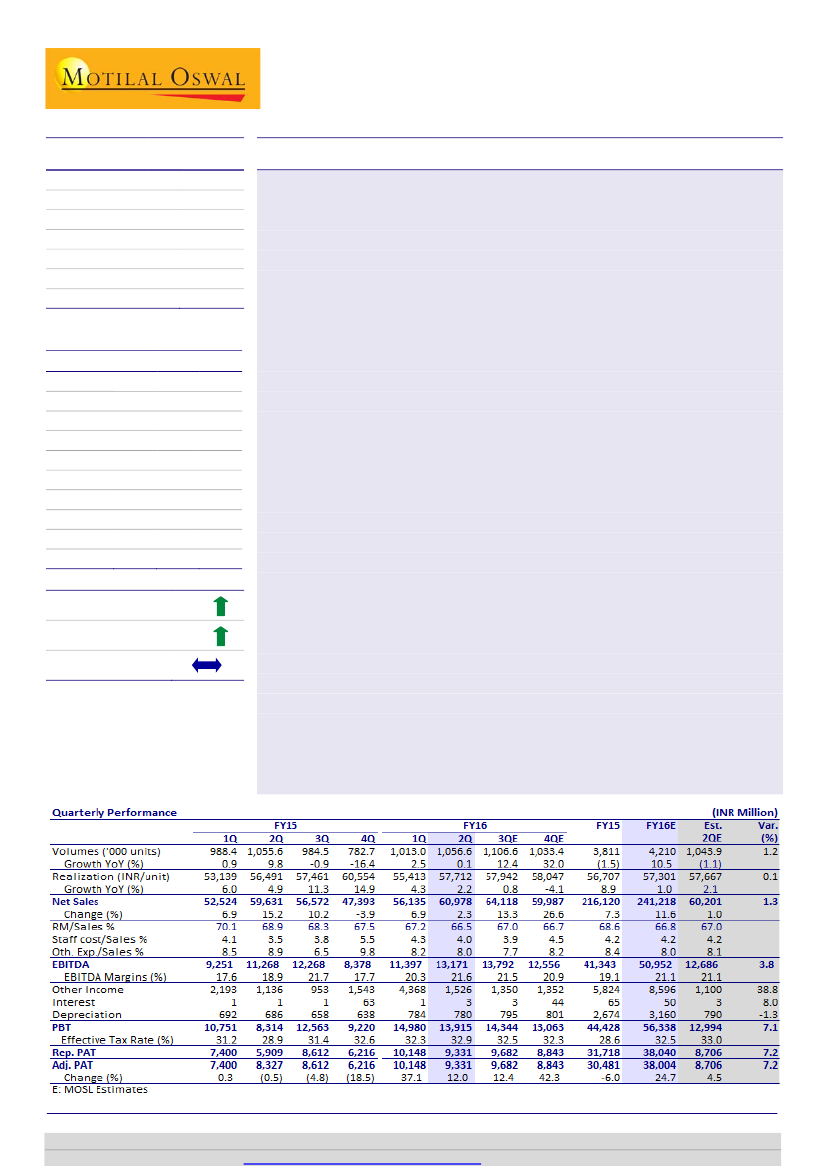

Bajaj Auto’s (BJAUT) 2QFY16 numbers were above estimate—EBITDA of ~INR13.2b

(est. of ~INR12.7b) and PAT at ~INR9.3b (est. of ~INR8.7b). We believe BJAUT’s

volume recovery is on track in domestic (new product led) and export markets

(demand normalization in key markets); this—coupled with favorable Fx, new

product launches and operating leverage—would drive ~26% EPS CAGR (FY15-17).

Better mix and favorable forex drive realization:

Net sales grew ~2% YoY (8.6%

QoQ) to INR61b (est. of INR60.2b) on the back of improved mix (higher 3Ws and

premium motorcycles) and higher USD realization at INR65.2 (v/s INR63.9 in

1QFY16). Also, the company has undertaken price increase in the domestic

market (ex-CT100) to the tune of INR500-2,000 for motorcycles and up to

INR2,000 for domestic 3Ws, effective September 1, 2015.

EBITDA margins up due to forex benefit and positive operating leverage:

Gross

margins improved ~70bp QoQ, driven by favorable Fx (~70bp QoQ benefit).

EBITDA margins improved 270bp YoY (+130bp QoQ) to 21.6% (v/s est. of

~21.1%), driven by favorable forex and operating leverage benefit (~50bp QoQ).

Higher other income of INR1.5b (v/s est. of INR1.1b) drove PAT to INR9.3b (v/s

est. of INR8.7b).

Management commentary:

a) Ganpati and Navratri festive retails on like-to-like

basis were down 7-8% for the motorcycle industry, impacted by weak rural

demand; b) post the launch the of the new Avenger range, the company expects to

sell 12k units per month by Feb-16 (v/s 3.5k/month currently); c) domestic

motorcycle exit market share target of 21% (v/s the current ~18%); d) ~150k

permits have been opened up in Maharashtra, but benefit to come from 4QFY16; e)

part benefit of forex passed on in the export market w.e.f October 1, 2015; f)

doesn’t expect any further benefit from commodity prices.

Valuation and view:

We raise our EPS estimates for FY16/17 by 3%/2% to factor in

for higher EBITDA margins due to better forex realization and higher other income.

The stock trades at 19.2x/15.1x FY16E/FY17E EPS. We value BJAUT at INR3,118 (18x

FY17E EPS and add INR119/share for its KTM stake post 20% HoldCo discount).

Maintain

Buy.

Adj.EPS(INR) 105.3

Estimate change

TP change

Rating change

2-3%

2-3%

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Jay Shah

(Jay.Shah@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.