4 November 2015

3QCY15 Results Update | Sector: Technology

BSE SENSEX

26,553

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INR m)

Free float (%)

S&P CNX

8,040

HEXW IN

300.9

74.0/1.2

335/131

-4/1/30

406

28.7

Hexaware Technologies

CMP: INR246

TP: INR250 (2%)

Upgrade to Neutral

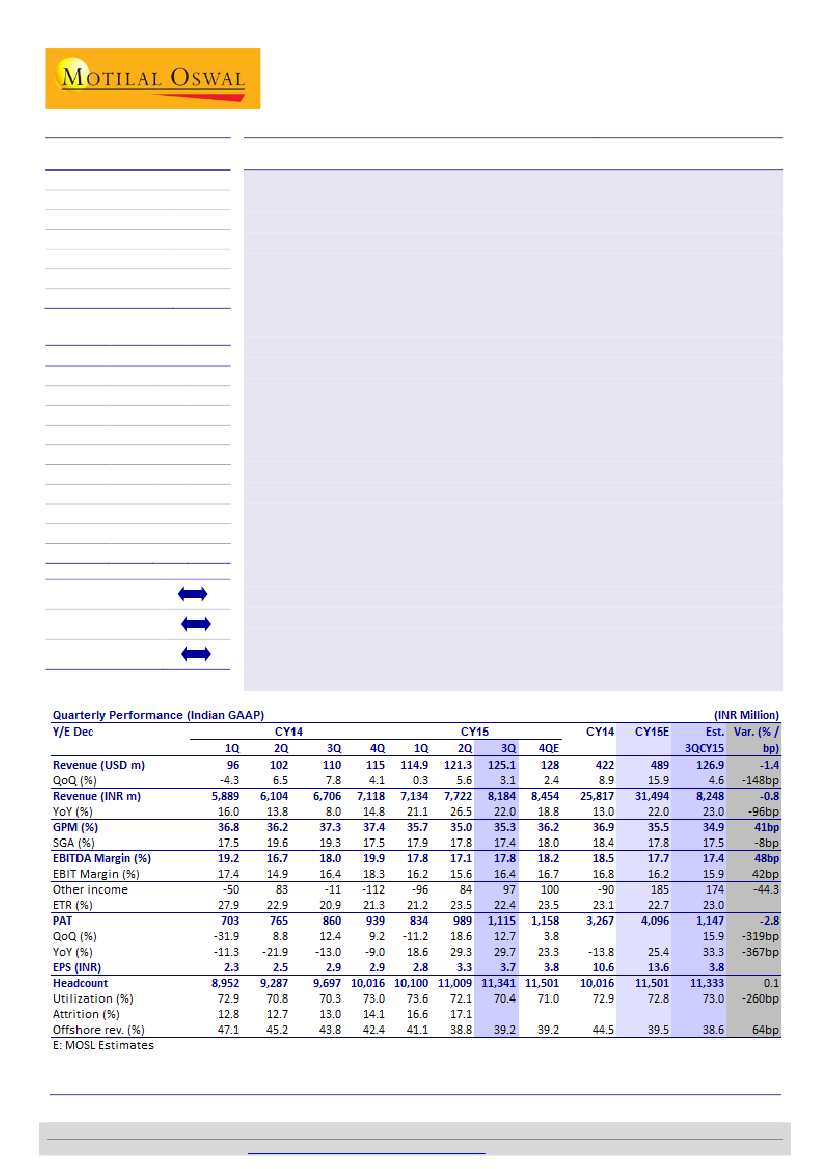

Revenue growth bogged down by 6.5% decline in top client

Revenue growth back on track:

HEXW’s 3QCY15 revenues grew 3.1% QoQ to

USD125.1m, below our estimate of 4.6% growth. Revenue growth was weighed

upon by weakness in the top account (-6.5% QoQ). In the last four quarters,

growth has been mainly driven by top 10 accounts, led by HEXW’s client mining

efforts (74% of incremental revenues).

Margin expansion despite partial wage hikes:

EBITDA margin grew 80bp to

17.8%, marginally ahead of our estimate of 17.4%. Factors affecting gross margin:

[1] Calendar days (72bp), [2] Utilization (-132bp), [3] One time 2Q termination

cost (+82bp), [4] One time 2Q H1B visa cost (+59bp), [5] Currency (+56bp), [6]

Offshore wage hike (-38bp), and [7] Gratuity and other cost increase (-39bp).

SG&A costs were 40bp lower QoQ despite an addition of 30 marketing personnel.

Strong deal wins from new accounts:

While the growth in HEXW has largely been

driven by top accounts so far, it announced deals wins from new accounts at a

TCV of USD100m in 9MCY15. These are expected to ramp up largely in CY16; thus

adding to prospective growth, apart from traction in top accounts.

Upgrade to Neutral after valuation correction:

Post 3Q, our estimates change

marginally, to account for the revenue growth miss and beat on margins. Earnings

estimates have changed by -1.8% and -0.3% for CY15 and CY16 respectively.

HEXW has corrected by ~20% in the last quarter, and currently trades at 15.2x

CY16E, thereby eliminating the downside implied to our price target of INR250.

HEXW enjoys a premium to most tier-II peers, primarily supported by healthy

dividend payout (dividend yield of 4% on CY16E earnings), and above-industry-

average growth rates (16.1% revenue CAGR and 23% EPS CAGR over CY14-16E).

Our target price discounts CY16E EPS by 15x. Upgrade to

Neutral.

Financials & Valuation (INR b)

Y/E DEC

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

RoE (%)

RoCE (%)

Payout (%)

P/E (x)

EV/EBITDA(x)

2014 2015E 2016E

25.8

4.8

3.3

10.6

-15.6

25.7

28.2

77.4

23.1

14.1

31.5

5.6

4.1

13.6

27.9

29.9

28.8

61.1

18.1

12.2

38.0

7.0

4.9

16.2

19.0

32.3

33.5

57.9

15.2

9.8

Estimate change

TP change

Rating change

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.