Sector Update | 6 November 2015

Financials

Please refer to our on Utilities

dated on 29 October, 2015

Lightening the power sector

“UDAY” - Right combination of carrot and sticks

Union Cabinet has approved a scheme

“UDAY”

(Ujwal DISCOM Assurance Yojna) for

turnaround of financially distressed DISCOMs. If accepted by states (optional as of

now) this will help resolve problem of aggravating SEB debt. Effective implementation

of the “UDAY” scheme is based on the 4 pillars of a) Reduction in cost of power, b)

Improving operational efficiency to reduce AT&C losses, c) Reducing interest cost of

discoms and, d) Enforcing financial discipline through alignment with states. Key

takeaways:

Debt of SEBs has increased to INR4.8t as on September 2015. The scheme’s

proposal of state governments taking over 75% of debt of SEBs by March 2016

and guaranteeing the remaining will significantly reduce cost of borrowing,

improving SEBs financial health. Not allowing bank funding for future losses is a

key measure which, in our view, could force SEBs to reform their operations.

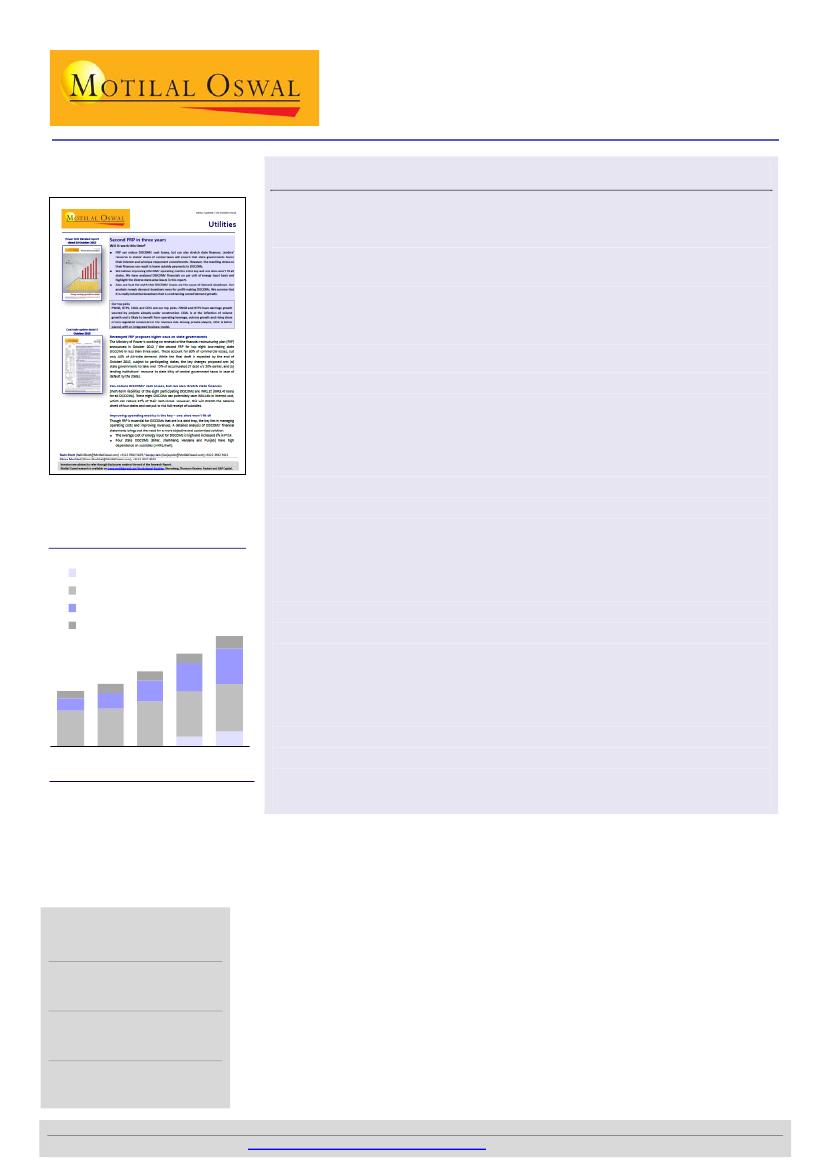

Total debt of Discom has doubled

over FY11-15 (INR t)

FRP bonds

Banks

PFC/REC

State government loans / Others

0.5

0.4

1.4

0.4

1.1

0.4

0.8

0.3

0.6

0.5

1.9

1.8

1.8

1.5

1.4

0.6

0.4

2011

2012

2013

2014

2015

Scheme will lead to ~20bp CET1 release and reduce ~15% of net stress loans for

state owned banks. Expected fall in NIMs will largely be compensated by

reversals of provisions in the first year thus; earnings are unlikely to be impacted

meaningfully. RECL/POWF are likely to be impacted the most as we expect ROEs

to come down to ~16% from ~20%

Within the power sector, we see key beneficiaries to be NTPC (higher PLF), Power

Grid (focus on lower power purchase cost by moving energy through grid than

rail) and JSPL (in the longer-term pit-head power plants).

Within the capital goods space key beneficiaries are Inox Wind and Crompton

Greaves. BHEL, L&T and Thermax would benefit with a revival in orders for power

generation equipment over the medium term. Negative for diesel generator set

suppliers like Cummins India, Kirloskar Oil Engines (as demand declines as power

supply improves).

Success of UDAY lies in willingness on the part of States to reform. With right

combination of carrots and sticks we believe there is a high probability that

States are likely to find themselves pushed into corner to accept UDAY.

Sanjay Jain

(SanjayJain@MotilalOswal.com);

+91 22 3982 5412

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com);

+91 22 3982 5415

Nalin Bhatt

(NalinBhatt@MotilalOswal.com);

+91 22 3982 5429

Ankur Sharma

(ankur.vsharma@motilaloswal.com);

+91 22 3982 5449

Proposal to transfer 75% of DISCOM liabilities to states

st

th

DISCOMs total debt of as on 31 March 2015 and 30 Sept 2015 was INR4.3t

and INR4.8t. Under the optional scheme “UDAY”, States shall take over 75% of

DISCOM debt as on 1HFY16 over two years - 50% in FY16 and 25% in FY17.

Remaining 25% of DISCOM debt can be funded by state guaranteed DISCOM

bonds/loans at the prevailing market rates which shall be equal to or less than

bank base rate plus 0.1%. This can bring down the cost of debt from as high as

14-15% to 8-9%.

State government Bonds will have non SLR status and will be priced at 10year G-

Sec+50bp+premium for non SLR status. Thus, it works out to be 8.25-8.5%

Incremental future losses post FY17 will be taken over by states

(5%/10%/25%/50% in FY18/19/20/21 respectively)

States will issue non-SLR (including SDL) bonds, which will not be counted in the

states’ fiscal deficit for FY16 and FY17.

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.