9 November 2015

2QFY16 Results Update | Sector:

Capital Goods

Voltas

BSE SENSEX

26,121

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

7,915

VOLT IN

330.7

98.9/1.5

360 / 227

3/3/17

712

69.7

CMP: INR275

TP: INR345 (+25%)

Buy

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

51,831 54,657 63,207

4,100 4,216 5,972

3,381 3,512 4,826

10.2

37.5

64

16

21.9

22.6

3.6

10.6

3.9

71

16

15.2

26.2

3.9

14.6

37.4

82

19

18.1

18.8

3.3

Estimate change

TP change

Rating change

Operating performance below expectations; UCP sales disappoint

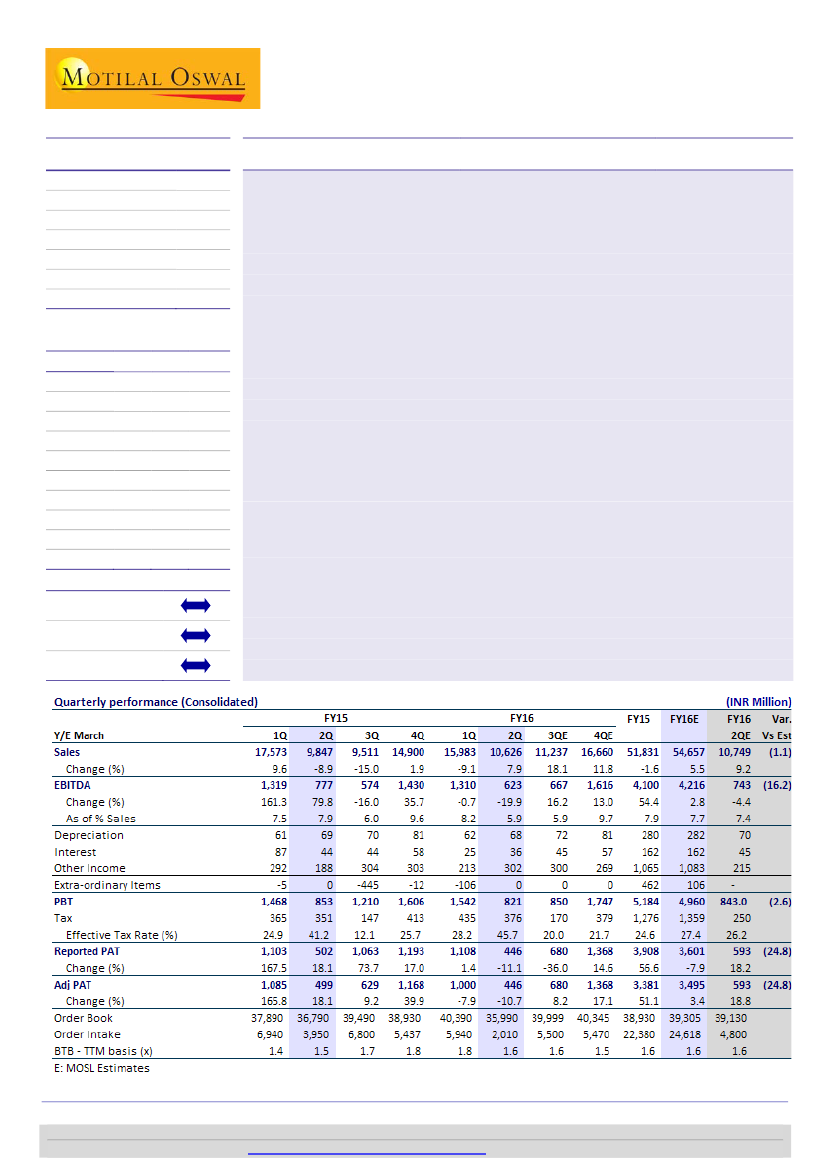

2QFY16 performance below expectations:

Revenue grew 7.9% YoY to INR10.6b (our

estimate: INR10.7b). EBITDA declined 20% YoY to INR623b (our estimate: INR743m).

Adjusted net profit declined 11% YoY to INR446m (our estimate: INR593m).

UCP

segment reported revenue decline of 9% YoY to INR3.1b. Room air conditioner

volumes were weak due to erratic weather and the commercial refrigeration

segment too was subdued. Adjusted for one large order in commercial refrigeration

(Rs0.15b), UCP sales were down 5% YoY. EBIT margin was 11.3% v/s 12.4% in

2QFY15. VOLT maintains its market leadership, with 20.8% share.

EMP

segment reported revenue of INR6.2b, up 18% YoY led by improvement in pace

of execution of three large projects (two international and one domestic). EBIT

margin was 1.7%; this is the sixth consecutive quarter of positive EBIT in the EMP

business. Importantly, capital employed corrected meaningfully from INR8b in

2QFY15 to INR5.8b in 2QFY16 (stable QoQ). Thus, asset turn improved from the lows

of 3.1x in 2QFY15 to the present 3.9x.

Project business witnesses weak order intake; book-to-bill ratio at 1.6x:

Order inflow

was down 49% YoY at INR2b. Drop in oil prices, increased competition, unviable

commercial terms and muted business environment have impacted order inflow. Order

book stands at INR36.6b and is down 2% YoY. Book-to-bill stands at 1.6x down from

1.9x in 1QFY16.

Maintain earnings; retain Buy:

We maintain Buy with a revised SOTP-based price

target of INR345 (UCP business at 25x FY17E EPS, MEP at 20x, and engineering products

at 20x). We expect growth rates in UCP business to rebound in the medium term, led

by (i) possible inflexion point in the AC segment, (ii) pent-up demand in FY16, and (iii)

incremental growth from air coolers. VOLT trades at 26x FY16E and 19x FY17E EPS.

Ankur Sharma

(ankur.vsharma@motilaloswal.com); +91 22 3982 5449

Amit Shah

(amit.shah@motilaloswal.com); +91 22 3029 5126

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.