26 November 2015

Dr. Reddy’s Lab

BSE Sensex

25,776

S&P CNX

7,832

Update | Sector: Healthcare

CMP: INR3,388

TP: INR3,500 (+3%)

Downgrade to Neutral

Stock Info

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

AvgVal,(INR m)

Free float (%)

Warning letters observations on US FDA website

DRRD IN

170.4

560.1/8.5

4383/3010

-19/-2/1

1,391

74.5

Observations include data integrity and quality control issues at these plants

which increases the probability of warning letter getting converted into import

alert.

Remediation plan to include third party audit which would entail additional cost.

Apart from this corrective measures may lead to supply disruption in near term.

Financial Snapshot (INR Billion)

Y/E Mar

2015 2016E 2017E

Sales

EBITDA

Net Profit

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

148.2 162.4 175.5

33.5

22.2

4.5

19.9

16.9

26.0

5.2

41.9

27.3

22.9

20.3

19.7

21.2

4.3

41.8

27.3

0.0

17.4

17.0

21.2

3.7

FDA released the warning letter given to DRRD on the three plants (US

FDA

Link).

Notably, observations at the three facilities include CGMP deviations and

violations. Concerns cited by FDA include issues related to data integrity and

quality control which enhances the risk of import alert on these plants. The

agency has questioned the effectiveness of the current corporate quality

system and has asked DRRD to take global corrective action.

Key concerns raised by US FDA:

FDA highlighted that the processes

implemented at these facilities do not conform to CGMP. One of the key

observations raised at the Srikakulam facility was that US FDA found existence

of an uncontrolled ‘Custom QC laboratory’. Presence of this lab was unknown to

US FDA. These concerns along with other issues raised by US FDA (see

subsequent pages for detail related to other observations) enhance the risk of

products supplied from these facilities to be adulterated.

Remediation plan would entail additional cost and risk of supply disruption:

FDA has asked DRRD to put in place a remediation plan which should ensure

direct corporate oversight over the quality and operations functions of this

facility. They have recommended that DRRD hire a third-party auditor to assist

DRRD regarding overall compliance with CGMP. We think this will entail

additional cost and time to get the facilities fully FDA complaint.

Lower probability of adverse action at Bachupalli plant:

Though it cannot be

ruled but probability of adverse action at Bachupally plant (which got inspected

by US FDA in Jun-15 with some 483 observations) is low now as it did not

receive warning letter along with above mentioned facilities. This is a key

facility for DRRD as it contributes >50% to current US sales.

Regulatory concerns caps upside potential; Downgrading to Neutral:

Sales

contribution from these facilities to US market is ~10-12% of total sales

(~USD250m). We believe the speed with which DRRD is able to resolve these

issues with the FDA is going to be critical (unlikely before FY18, in our view).

Though long term fundamental remain intact, the stock will remain range

bound in the near term due to regulatory concerns. We downgrade the stock to

Neutral with TP of Rs3,500 (@ 20x 1HFY18E PER) and have cut our FY17/18E

EPS by 11-14%. The cut in EPS is attributed to higher remediation cost and

supply disruptions required to take corrective actions.

130.2 160.0 160.0

653.2 789.8 921.7

Shareholding pattern (%)

As on

Sep-15 Jun-15 Sep-14

Promoter

DII

FII

Others

25.5

5.2

55.0

14.4

25.5

5.9

54.8

13.8

25.5

5.4

55.5

13.7

Note: FII includes depository receipts

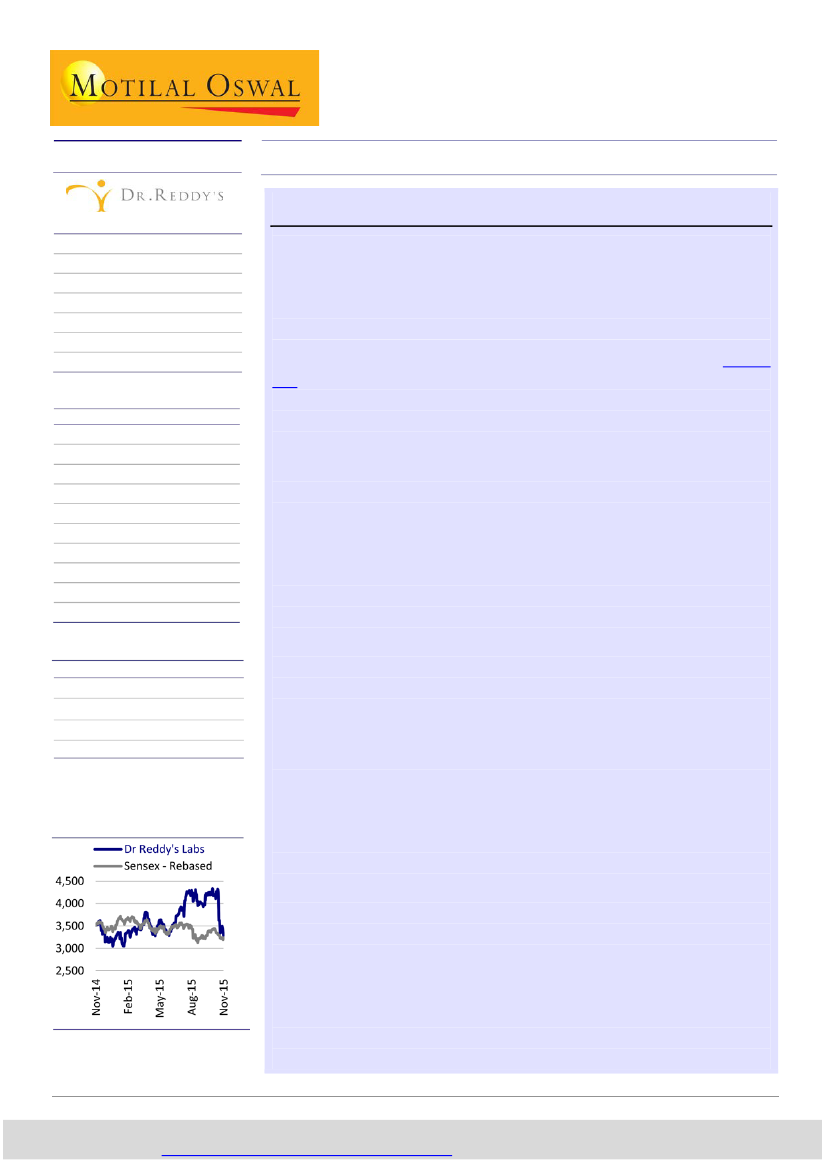

Stock Performance (1-year)

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 3982 5584

Amey Chalke

(Amey.Chalke@MotilalOswal.com); +91 22 3982 5423

Investors are advised to refer through important disclosures made at the last page of the Research Report, Motilal Oswal

research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.