Hindustan Unilever

BSE SENSEX

25,310

S&P CNX

7,702

8 December 2015

Update

| Sector:

Consumer

CMP: INR826

TP: INR810 (-2%)

Neutral

Maneuvering pricing in a deflationary environment

Delayed winter a risk for 3Q performance

Stock Info

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

M.Cap. (INR b)/(USD b)

Avg Val ( INR m)

Free float (%)

HUVR IN

2,163.5

979/744

7/6/11

1,787.1/26.8

1,427

32.8

Financials Snapshot (INR b)

Y/E March

2015 2016E 2017E

Sales

301.7 320.5 357.3

EBITDA

51.0

56.9

62.3

Adj. PAT

37.9

40.8

44.4

Adj. EPS (INR)

17.5

18.9

20.5

EPS Gr. (%)

6.4

7.9

8.8

BV/Sh.(INR)

17.2

16.4

12.9

RoE (%)

108.1 112.4 140.2

RoCE (%)

137.6 148.1 186.2

Payout (%)

85.7

89.5

99.8

Valuations

P/E (x)

47.2

43.8

40.2

P/BV (x)

48.0

50.4

63.9

EV/EBITDA (x)

34.4

30.9

28.1

Div. Yield (%)

1.8

2.0

2.5

Shareholding pattern (%)

As On

Promoter

DII

FII

Others

Sep-15 Jun-15 Sep-14

67.2

13.9

4.8

14.1

67.2

14.6

4.2

14.0

67.2

15.1

3.9

13.8

FII Includes depository receipts

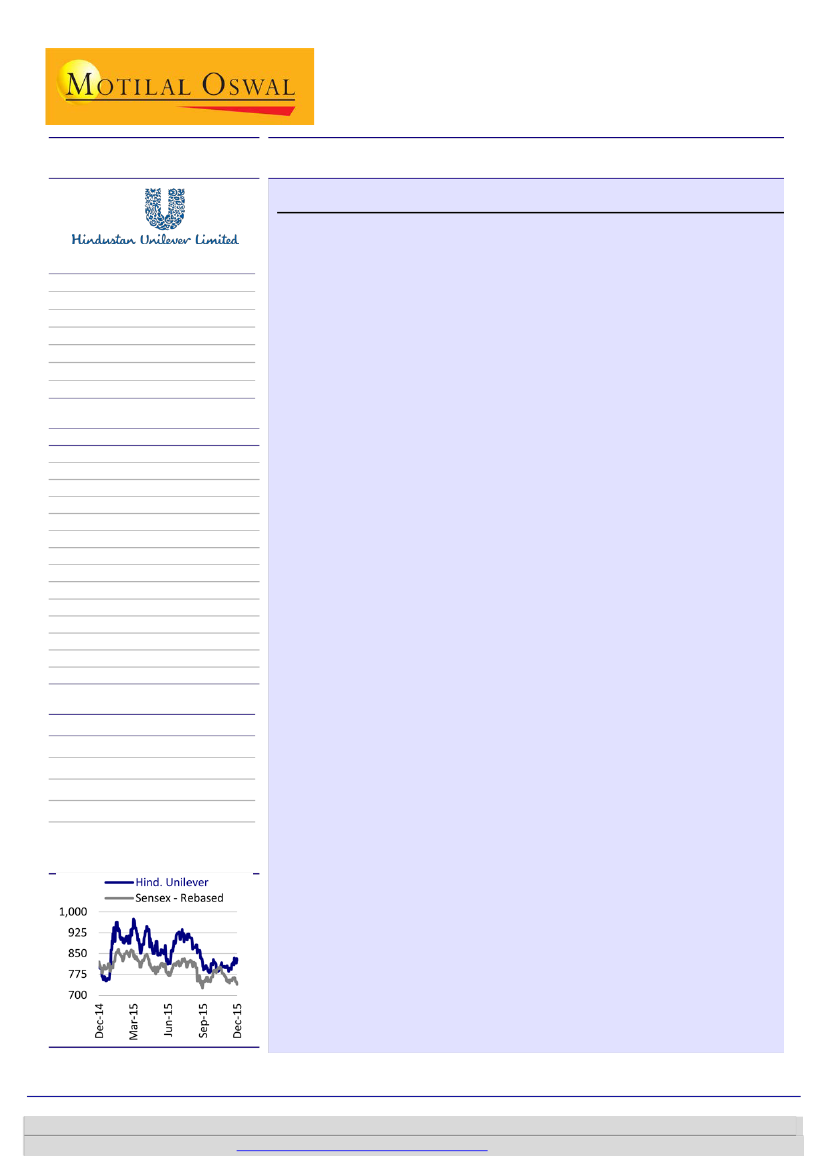

Stock Performance (1-year)

We interacted with the management of Hindustan Unilever—Mr Sanjiv

Mehta (CEO &MD) and Mr. P.B.Balaji (CFO)—on the sidelines of IND-AS

session, hosted by HUVR. Following are the key takeaways:

Flexing the pricing muscle?:

HUVR is using pricing power as a tool in the

prevailing deflationary environment. Selectively, it is making pricing changes

in several categories depending on its market positioning. For example,

overall, YTD, HUVR has hiked prices in ~50% of its portfolio and reduced

prices for the other half. As per the management, innovation will drive pricing

growth in the near term—given the largely benign commodity pricing

dynamics.

Flood disruption in Tamil Nadu + Delayed Winter may impact 3Q16:

Though

the management did not provide color on the near-term demand

environment, it indicated that disruption in Tamil Nadu due to floods could

impact performance as the state is an important market for HUVR. Also, we

believe delayed commencement of winter will have a bearing on

performance of its Personal Care portfolio. Nonetheless, the management

remains confident of long-term consumption opportunity and continues to

see premiumization in various product categories—e.g., Surf Excel is now the

largest brand for HUVR in Detergents (earlier Wheel, its mass market

offering, was the largest brand).

Rural growth = Urban growth:

For

HUVR, rural consumption trends have

incrementally softened—reflecting the lagged impact of lower rural wage

growth and weak MSP increases. With rural growth now being equal to urban

growth, HUVR is gradually driving increased assortment in rural markets to

drive mix improvement (category, brand, SKUs and channel).

Other takeaways:

a)

Internal philosophy for consistent profit growth:

Volume growth<sales growth<EBIT growth<cash profit growth. b)

Oral Care:

Pepsodent’s performance has not seen any material improvement even as

Close-Up continues to do well. c)

GST:

The impact of GST would depend on

Revenue Neutral Rate; however, it will certainly provide a level playing field—

with unorganized players coming under the tax ambit and reduction in

operational inefficiencies, which will aid in the ease of doing business.

HUVR—India AS Class 101:

The management had detailed discussion on the

new accounting standards to be implemented w.e.f. April 1, 2016. These are

still provisional and may undergo changes before being actually

implemented. Key changes in HUVR’s financial reporting as a consequence of

new standards are: a) Reclassification of excise duty from the current practice

of netting off from gross sales to inclusion in the cost of goods sold. b) Sales

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(manish.poddar@motilaloswal.com); +91 22 3027 8029/

Vishal Punmiya

(vishal.punmiya@motilaloswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.