Reliance Industries

BSE SENSEX

24,480

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol ‘000

Free float (%)

S&P CNX

7,435

RIL IN

3,239.2

3,375 / 50.4

1,090/797

9/13/32

418.9 / 0.4

54.8

20 January 2016

Q3FY16 Results Update | Sector: Oil & Gas

CMP: INR1,044

TP: INR1,092(+5%)

Neutral

Financials & Valuation (INR b)

Y/E Mar

2015 2016E

Net Sales

3,291

2,701

EBITDA

316.0

406.3

PAT

227.2

276.8

EPS (INR)

70.2

85.4

Gr. (%)

3.2

21.7

BV/Sh INR

738.5

819.3

RoE (%)

11.0

12.1

RoCE (%)

10.2

11.5

P/E (x)

14.9

12.2

P/BV (x)

1.4

1.3

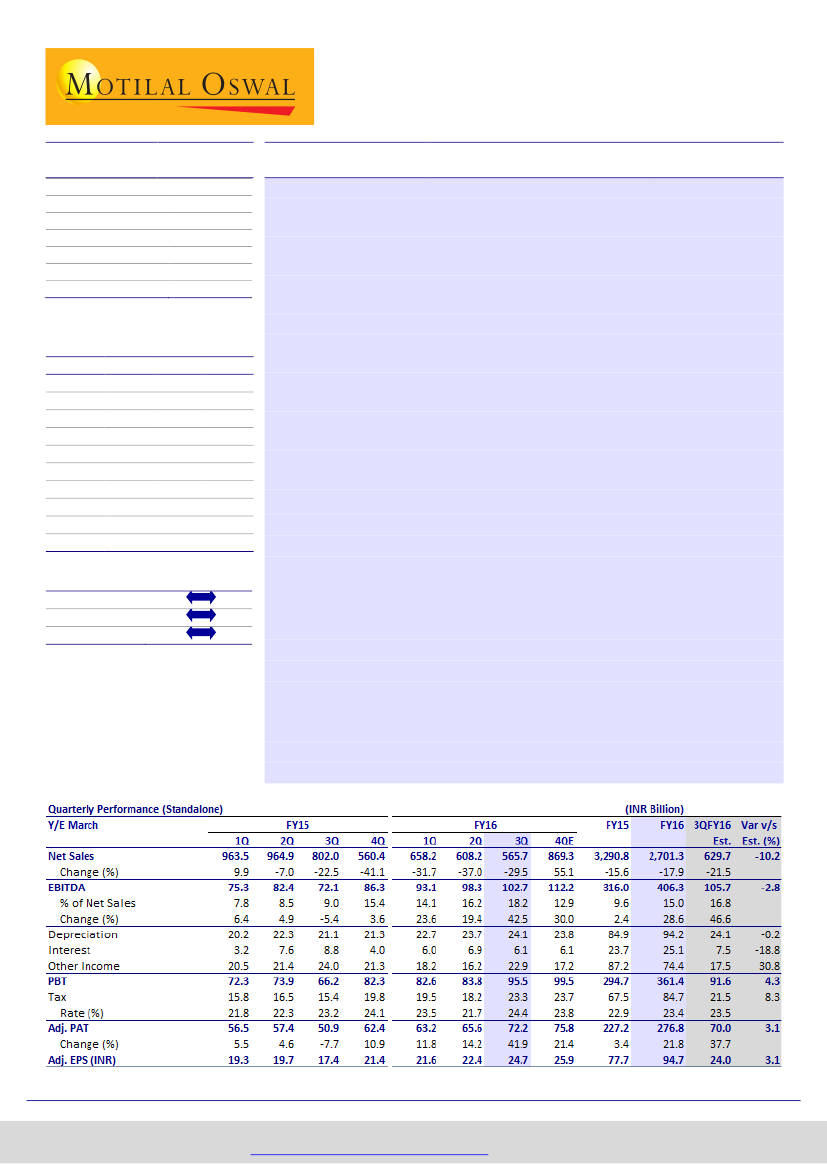

Reliance Industries’ (RIL) reported largely in-line 3QFY16 EBITDA at INR103b (43% YoY

and 5% QoQ), and PAT at INR72b (42% YoY and 10% QoQ). Higher other income at INR23b

(+42% QoQ) led by profit on sale of investments was partly negated by higher tax rate at

24.4%. GRM was in line at USD11.5 (v/s est 11.6), supported by efficient crude sourcing

and higher petchem margins. Core projects are largely on track for full commissioning in

FY17. RIL indicated that telecom business will be launched in next few weeks/months,

but did not give any specific timelines. Jio service trials are on full swing and indicate that

early feedback is positive. FY17 will be a big year for RIL with >USD34b core and non-core

projects start commissioning.

2017E

2,678

494.4

318.6

97.3

13.8

901.1

12.6

11.9

10.7

1.2

GRM in line; Petchem beats expectations:

3QFY16 GRM at USD11.5/bbl (+58%

YoY, +9% QoQ) boosted by shift in crude sourcing away from Brent-linked crude,

and higher product cracks. Refining EBIT stood at INR63b (+98% YoY, +17% QoQ).

Petchem EBIT at INR26b (+18% YoY, +3% QoQ) with EBIT margin at 14.4% was

supported by strong polymer segments and sale from polyester expansion. KG-D6

gas production declined ~7% QoQ to 10.6mmscmd.

Jio ready for roll out; Core projects largely on track

Full scale telecom commercial launch soon:

We are impressed by Jio

disclosures and believe it could disrupt data as well as voice market given its

non-legacy infrastructure (>INR1t capex) and zero dependence on voice. With

current trial runs with >60K RIL employees, expect full commercial launch soon.

Core USD17b capex largely are on track.

With 85% spent till date, core projects

largely on track for full commissioning by end 2016. RIL remains confident on

economics of petcoke gasification, ethane sourcing and off-gases cracker

projects.

Consolidated net debt stayed flat

at INR863b from INR870b in 2QFY16.

Organized retail

reached 3,043 stores in 371 cities. Sales at INR60b (+29% YoY,

+19% QoQ), EBITDA of INR2.4b (+7% YoY, +16% QoQ) and EBIT margin of 2.4%.

Valuation and view:

On FY17E basis, the stock trades at 9.7x adj. EPS of INR107

and EV/EBITDA of 7.5x. SOTP-based target price stands at INR1,092/share.

Estimate change

TP change

Rating change

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Rajat Agarwal

(Rajat.Agarwal@MotilalOswal.com); +91 22 3982 5558

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.