Eveready Industries

BSE SENSEX

24,486

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

7,436

EVRIN IN

72.7

18.3 / 0.3

375 / 186

-10/-16/33

102

56.0

25 January 2016

3QFY16 Results Update | Sector: Others

CMP: INR252

TP: INR387(+54%)

Buy

LED business shines; margins expand due to operating leverage

Financials & Valuation (INR b)

Y/E Mar

2016E 2017E 2018E

13.4

16.0

18.7

Net Sales

1.3

1.8

2.2

EBITDA

0.7

1.1

1.4

PAT

9.3

14.7

19.5

EPS (INR)

8.7

58.1

33.2

Gr. (%)

90.9 100.4 113.7

BV/Sh (INR)

10.5

15.3

18.2

RoE (%)

14.7

19.9

24.5

RoCE (%)

28.5

18.0

13.5

P/E (x)

2.9

2.6

2.3

P/BV (x)

Estimate change

TP change

Rating change

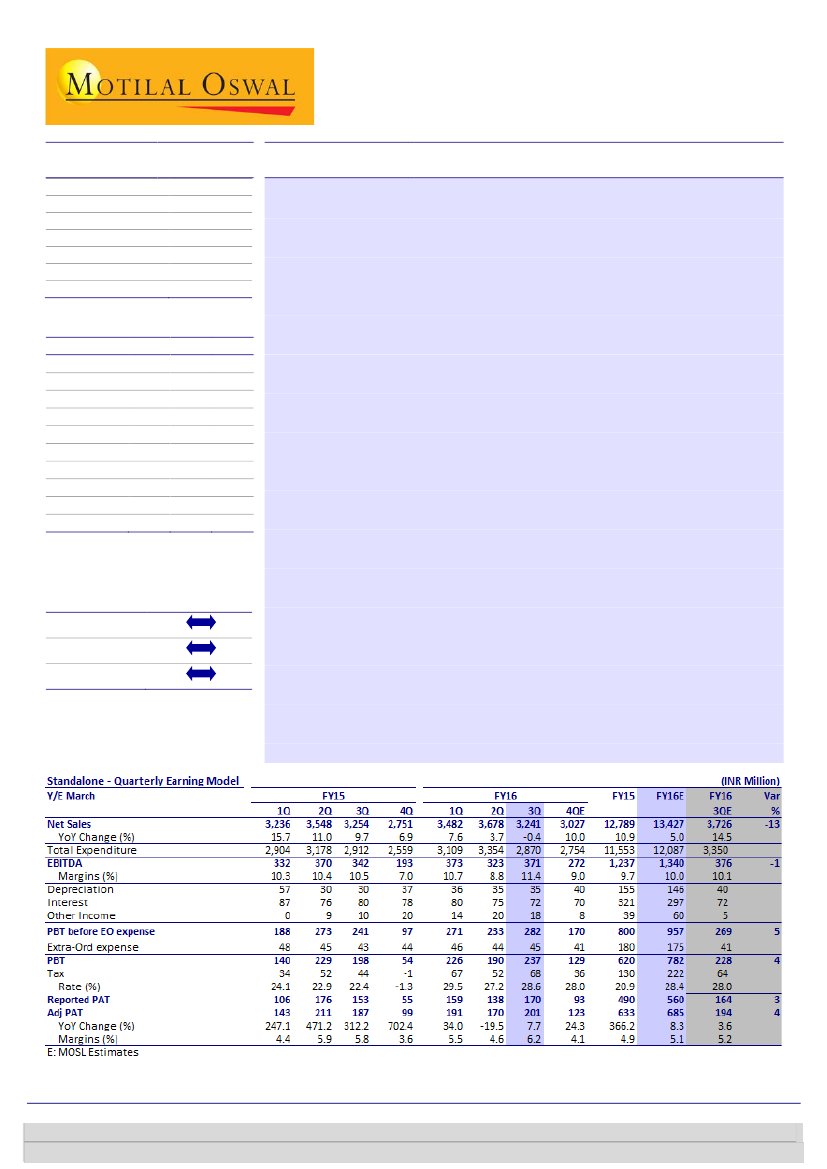

Higher margins offset revenue miss:

EVRIN’s 3QFY16 revenue remained flat at

-0.4% and was INR3,241m (est. of INR3,726m) on the back of flattish growth in

battery business and sharp decline in flashlights—compensated by healthy

growth in LED business, which recorded INR250m worth of sales in 3QFY16.

EBITDA grew 8.6% to INR371m (est. of INR376m); EBITDA margin expanded

90bp to 11.4% (est. of 10.1%) due to lower raw material cost and benefits of

operating leverage. Adjusted PAT grew 7.7% to INR201m (est. of INR194m).

Participation in government LED projects to boost LED sales:

Eveready

recently bid for Madhya Pradesh government’s LED bulb tender—its first for a

government order. The company has been declared L2 and expects order of

7m bulbs to be executed over the next six months. The bid price is INR64.6 per

LED bulb and its impact on revenue is expected to reflect in 1Q and 2QFY17. As

per industry sources, the total LED tender opportunity available in the next 12

months stands at 150m bulbs, which will be either in 7W or 9W category. The

company intends to participate in more such orders during FY17. Driven by

government LED orders and retail sales, we expect the revenue CAGR of 180%

in LED business over FY15-18.

Flashlights growth impacted due to poor monsoon:

Flashlights witnessed

~13% volume decline in 3QFY16 as it is a largely rural-driven business adversely

impacted by poor monsoon. The company has also launched economy range

flashlights, which are expected to gradually pick up in terms of growth in FY17.

Valuation and view:

We expect 13.5% revenue CAGR along with 190bp EBITDA

margin expansion over FY15-18, driving 32% PAT CAGR. Although we cut our

FY16 PAT estimates by 9%, we maintain FY17 and FY18 estimates as

participation in government LED business is expected to provide operating

leverage benefits. We like the company because of its leadership in the battery

segment, robust growth in the LED business, margin expansion and high RoCE,

which we believe justifies a target PE valuation of 20x on FY18E EPS. We

maintain

Buy

with a target price of INR387 (54% upside).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 39825000

Chintan Modi

(chintan.modi@motilaloswal.com); +91 22 3982 5422