Container Corporation

BSE SENSEX

24,492

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

7,438

CCRI IN

195.0

235.6 / 3.5

1,944/1,125

-2/-15/2

402

38.2

27 January 2016

Q3FY16 Results Update | Sector: Logistics

CMP: INR1,209

TP: INR1,605 (+33%)

Buy

Financials & Valuation (INR b)

Y/E Mar

2015 2016E 2017E

Net Sales

61.5

57.5

62.9

EBITDA

14.0

11.9

14.4

PAT

10.5

8.7

10.6

EPS (INR)

54.1

44.8

54.2

Gr. (%)

11.7 -17.1

20.8

BV/Sh (INR)

385.5 416.8 454.6

RoE (%)

14.7

11.2

12.4

RoCE (%)

18.2

14.8

16.3

P/E (x)

22.4

27.0

22.3

P/BV (x)

3.1

2.9

2.7

Estimate change

TP change

Rating change

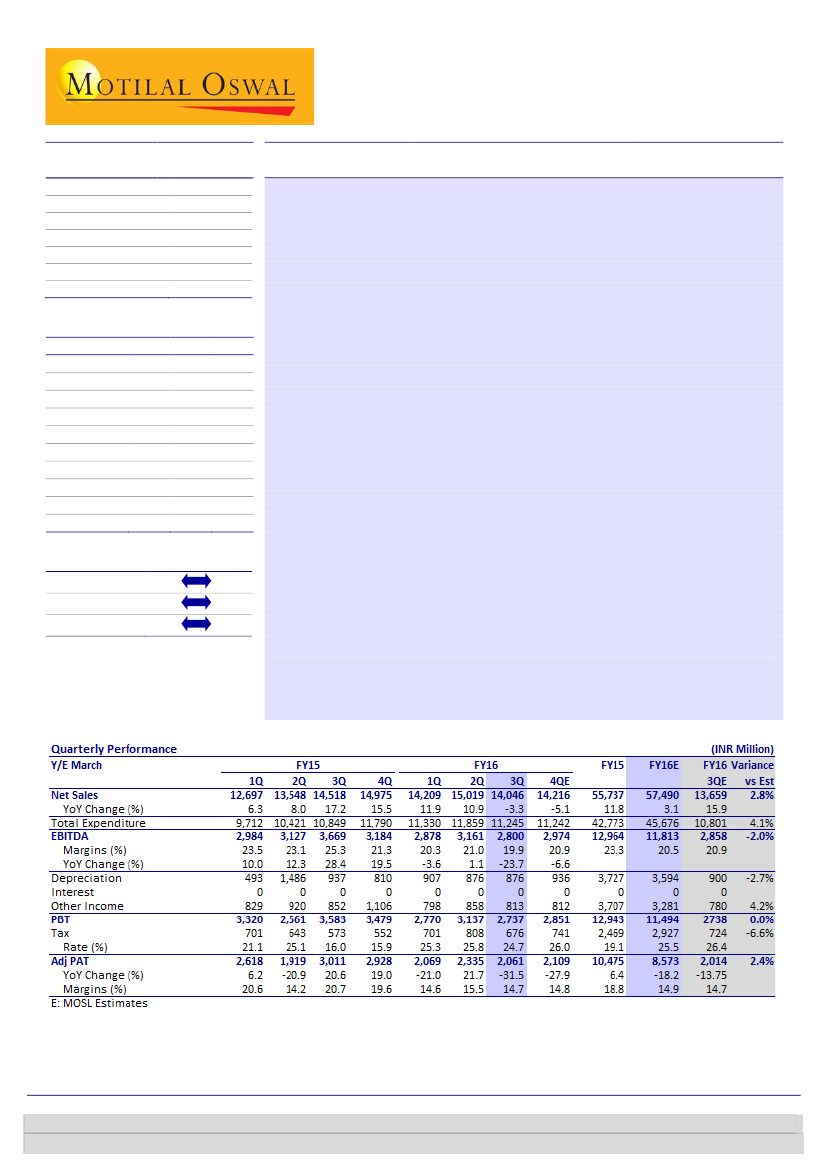

EBITDA and PAT in line; domestic business up QoQ; EXIM disappoints

Container Corporation (CCRI IN) reported in-line EBITDA at INR2.8b (est. of

INR2.9b; -24% YoY, -11% QoQ). Revenue was also largely in line at INR14.0b

(est. of INR13.7b; -3% YoY, -6% QoQ).

Adjusted PAT was in line at INR2.1b (est. of INR2.0b; -32% YoY, -11% QoQ). Tax

rate was 24.7% (est. of 26.4%) while other income was higher-than-estimate at

INR813m (est. of INR780m; -5% YoY, -5% QoQ).

Employee expenses increased 7% QoQ to INR396m.

Overall volumes stood at 0.71m teu (-9% YoY and -6% QoQ), led by EXIM at

0.6m teu (-10% YoY, -8% QoQ) and domestic at 0.11m teu (-4% YoY, +6% QoQ).

The domestic increase was primarily due to startup of Pantnagar operations.

Realization (in INR/teu) in EXIM stood at 18,897 (+6% YoY, -1% QoQ) and

domestic at 24,515 (+7% YoY, -4% QoQ). YoY increase in realization was led by

higher haulage rates.

EBIT (in INR/teu) in EXIM stood at 3,498 (-20% YoY, -4% QoQ) and domestic at

481 (-60% YoY, -2% QoQ).

Valuation and view

While DFC (Dedicated Freight Corridor) completion (expected in 2018/2019)

will be a significant efficiency driver for CCRI, its investments in long gestation

MMLP’s will impact near-term ratios.

We cut our FY17 earnings by 3% on the back of lower volume growth

assumption of ~7% in EXIM and domestic in FY17.

We value CCRI on DFC-based valuation (WACC: 12.6%, TGR: 5%) to arrive at a

fair value of INR1,605/sh (v/s INR1,636/sh earlier). The stock trades at a rich

valuation of 22.3x FY17E EPS of INR54.2, with continued near-term volume

growth concerns. Maintain

Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Rajat Agarwal

(Rajat.Agarwal@MotilalOswal.com); +91 22 3982 5558

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.