28 January 2016

3QFY16 Results Update | Sector:

Financials

BSE SENSEX

24,470

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

7,425

SKSM IN

126.3

67.6/1.0

590 / 369

16/5/40

863

97.3

CMP: INR535

TP: INR619 (16%)

SKS Microfinance

Buy

Firing on all cylinders; scorching performance continues

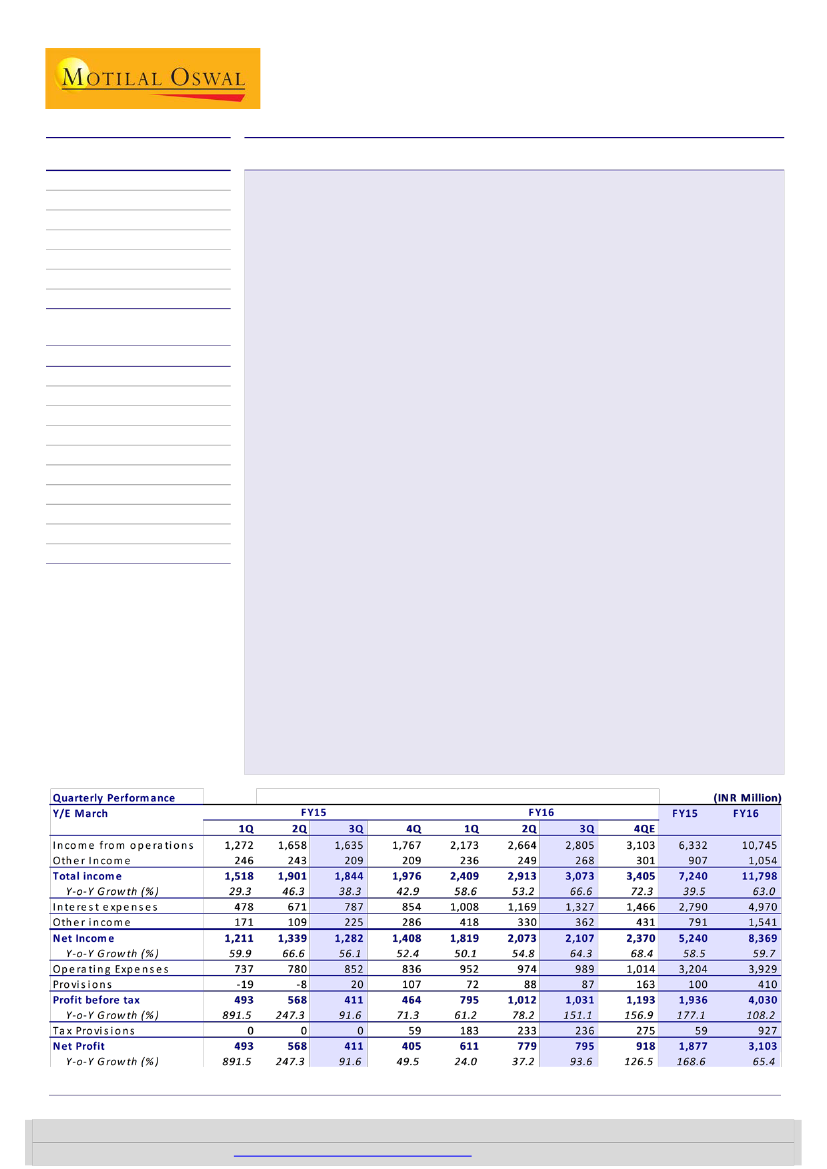

SKSM 3QFY16 PAT was up 94% YoY to INR795m (in line with est.), driven by strong

operating performance. Stellar AUM growth of 93% YoY, stable asset quality,

increase in average incremental ticket size to above INR15,000 improving

operating leverage and marginal cost of funds at sub 10% were the key highlights

for the quarter.

AUM during the quarter grew at a scorching pace of 93% YoY and 13% QoQ, driven

by customer additions and traction in long-term loans. Ticket size increase was

also led by RBI’s regulation allowing MFIs to lend higher amount to existing

borrowers. Long-tenure loans (typically of two years) now constitute 32% of the

total loan book v/s ~28% in the last quarter. Disbursements during the quarter

were at INR29.8b (up 93% YoY and 12% QoQ).

Marginal cost of borrowings (both on and off balance sheet) now stands at 10% v/s

11.9% in FY15 on the back of reduction in base rates by banks during the quarter,

further helped by MUDRA loan of INR1b—which SKS availed at 10% during the

quarter. Strong PAT performance was driven by operating leverage as costs were

kept under control—evident from C/I ratio, which remained below 50% (at 47%)

for the second consecutive quarter. Asset quality improved as absolute GNPA

declined to INR63m v/s INR75m in the last quarter. %GNPA stood at 0.1% (stable

YoY) and NNPA at 0.1%.

Valuation and view:

Large unmet demand, low competitive intensity, supportive

regulations, strong balance sheet and best-in-class operating metrics have put

SKSM on a high growth path. SKSM currently trades at 3.8x FY17E and 3.0x FY18E

BV. While the valuations appear high, we believe they are justified—given the high

medium-term growth visibility, strong profitability and superior asset quality.

Current valuations should sustain and could improve, given the strong profitability

(42% PAT CAGR over FY15-18), healthy asset quality and capitalization. We

increase our FY17/FY18 estimates marginally by 1.4%/2.6% to account for higher

growth. Maintain

Buy

with a target price of INR619 (3.5x FY18E BV).

Financials & Valuation (INR Billion)

Y/E March

NII

PPP

PAT

EPS (INR)

BV/Sh. (INR)

RoA on AUM

(%)

2016E 2017E 2018E

5,774 7,629 10,445

4,440 5,912 8,071

3,103 4,329 5,786

24.6

5.1

25.8

21.8

5.0

34.3

5.2

27.5

15.6

3.8

45.8

5.5

28.8

11.7

3.0

107.4 141.7 176.8

RoE (%)

P/E (x)

Valuations

P/BV (x)

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) /

Harshvardhan Agrawal

(Harshvardhan.Agrawal@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.