Pidilite Industries

BSE SENSEX

24,871

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

7,564

PIDI IN

512.7

290.2 / 4.4

638/508

8/13/14

224

30.3

30 January 2016

3QFY16 Results Update | Sector: Consumer

CMP: INR566

TP: INR660 (+17%)

Buy

Financials & Valuations (INR b)

Y/E Mar

2015 2016E 2017E

Net Sales

48.8

52.5

61.1

EBITDA

8.0

11.9

13.4

PAT

5.1

7.6

8.4

EPS (INR)

10.0

14.9

16.4

Gr. (%)

13.2

48.5

10.2

BV/Sh (INR)

44.3

55.5

66.3

RoE (%)

24.3

29.8

26.9

RoCE (%)

30.9

39.4

36.7

P/E (x)

56.5

38.0

34.5

P/BV (x)

12.8

10.2

8.5

Estimate change

TP change

Rating change

Sharp beat on profits; Raise estimates; one of our preferred FMCG ideas

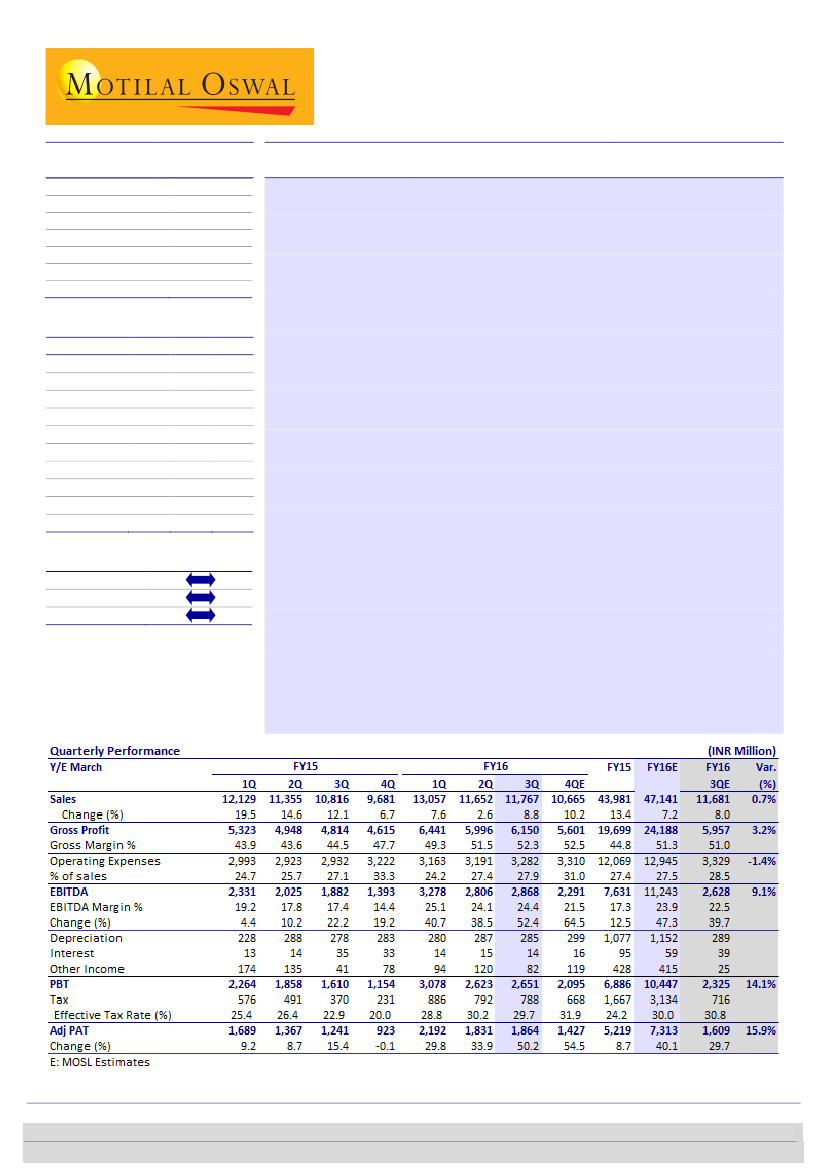

PIDI’s 3QFY16

revenues was in-line with expectation while PAT came in 16%

ahead of expectations. Standalone sales grew 8.8% YoY to INR11.8b (est.

INR11.7b), with 6-7% volume growth in the Consumer Bazaar segment, in our

view. EBITDA grew 52.4% to INR2.9b (est. INR2.6b) and adjusted PAT posted

50.2% growth to INR1.86b (est. INR1.61b, 16% above estimates).

Benign input costs drive sharp margin expansion:

PIDI’s gross margin

expanded 780bps YoY to 52.3% (est. 51%; highest in 31 quarters), led by benign

input costs (VAM prices down 16% YoY) and carryover of earlier price hikes.

However higher other expenses (up 70bps) and increased staff costs (up 10bps)

curtailed EBITDA margin expansion to 700bps YoY to 24.4% (est. 22.5%).

Segment performance:

Consumer Bazaar posted 10.8% revenue growth, with

underlying EBIT margin expansion of 750bps YoY to 29%. Industrial segment

revenues grew tepid 3.1% while EBIT margin expanded 600bps YoY to 17.5%.

Consolidated

Sales, EBITDA and Adj. PAT grew 11.4%, 53% and 49%

respectively. Gross margin and EBITDA margin expanded 750bps and 600bps

resp. Imputed subsidiary posted 35% revenue growth, with Adj. PAT of INR2m.

9MFY16

Sales, EBITDA and PAT grew 6.3%, 43.5% and 37% resp. Gross margin

and EBITDA margin expanded 750bps and 630bps resp.

Valuation and view:

We revise our estimates upwards by 3% to bake in

3QFY16 beat and benign input cost environment. Pidilite is one of the biggest

beneficiaries of correction in crude prices, in our view. Pidilite offers a high

quality play on urban consumption with strong competitive positioning (quasi

monopoly shares in mainstay Adhesives) and an impeccable track record of

generating long term shareholder value over multiple periods. We are also

enthused by Mr. Puri’s strategy of making Pidilite an innovative Indian MNC

and his agenda of expanding product portfolio. Maintain BUY, with an

unchanged target price of INR660. Spike in input costs is a key downside risk.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(manish.poddar@motilaloswal.com); +91 22 3027 8029/

Vishal Punmiya

(Vishal.Punmiya@motilaloswal.com)