30 January 2016

3QFY16 Results Update | Sector: Healthcare

BSE SENSEX

24,871

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/ USD

b)

52-Week Range (INR)

1, 6, 12 Rel.Per (%)

AvgVal,(INR m)

Free float (%)

S&P CNX

7,564

GNP IN

271.3

209.2/3.1

1,262/705

-13/-12/23

1,042

53.5

Glenmark Pharma

CMP: INR771

TP: INR900 (+17%)

Neutral

Results below estimates; LatAm and US underperform

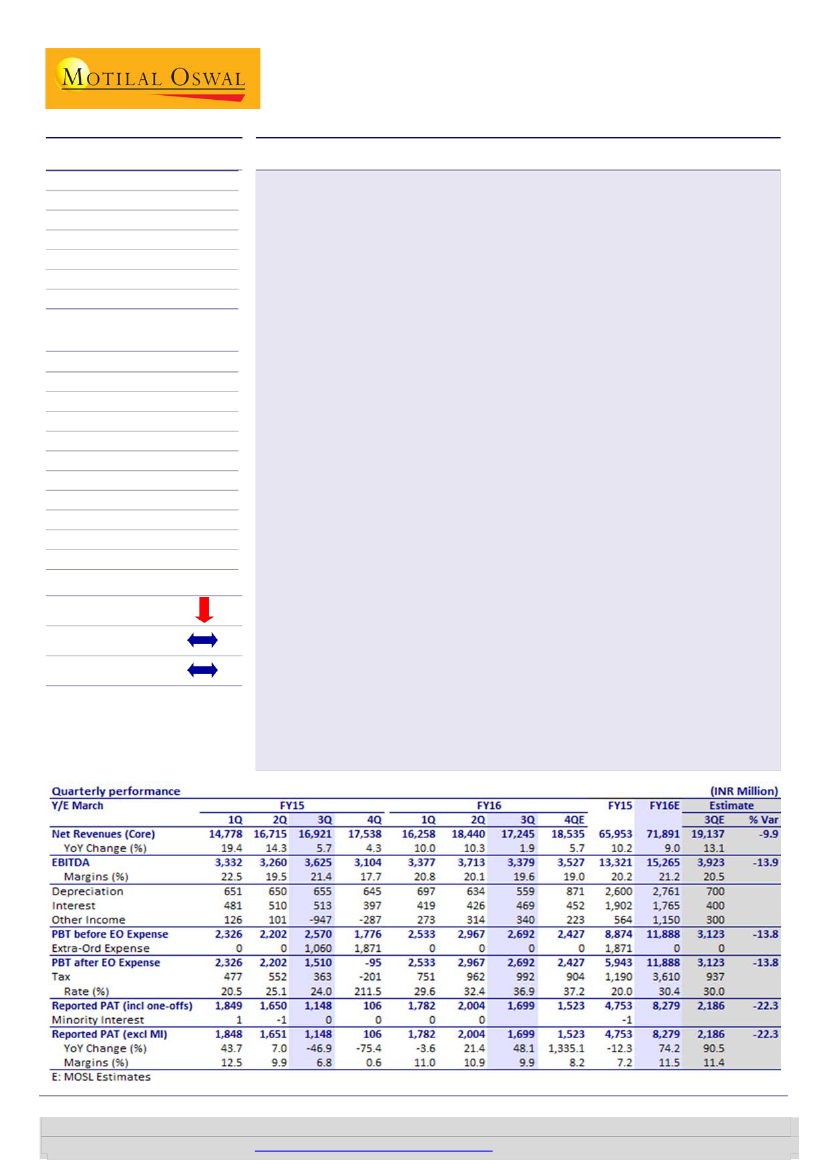

Glenmark’s (GNP) 3QFY16 performance was largely below our estimates. Revenue

grew 2% YoY (10% miss) and EBITDA 7% YoY (14% miss). PAT stood at INR1.7b (48%

growth; 22% miss).

Latam and weak US affect 3Q:

US business grew 20%YoY to INR6.1b (6% miss) on

the back of continued pricing pressure on existing portfolio and lower traction in

newly launched products during the quarter. Stoppage of supplies to Venezuela

market and steep depreciation in Brazilian currency resulted in LatAm market sales

declining 47% YoY to INR1.2b (24% miss) in 3Q. India business reported 12.7 %YoY

growth on account of loss of sales of Sitagliptin products. Despite forex headwinds

in Russia/CIS region, SRM segment grew 14% YoY (in line). We estimate GNP to

post 16% revenue CAGR over FY15-18 (v/s 10% in FY15).

EBITDA margin disappoints:

EBITDA margin at 19.6% was 90bp below our

estimates on higher other expenses in 3Q. Other expenses at 31% of sales were

300bp higher than our estimates, mainly on account of negative operating leverage

on lower sales. Surprisingly, gross margin at 70.6% was 350bp higher than 3QFY15.

R&D spends stood at INR1.7b in 3Q, 9.2% of sales. Going forward, we expect

margin to improve from 21.4% in FY16 to 25% in FY18 on the back of improved

operating leverage and niche product launches in the US.

Earnings call highlights:

1) Venezuela sales are likely to become negligible going

ahead. 2) Gross debt increased to INR34.5b in Dec’15 from INR32b in Sep’15 on the

back of Tarka liability (INR2.1b). 2) Net forex losses stood at INR270m in 3Q. 3) The

company doesn’t anticipate any AG product launch with Zetia. 4) GNP has signed

50:50 profit share agreement with its partner for Zetia.

Maintain Neutral

:

Post the recent correction in stock price (down ~20% in the

last one month), valuations are not expensive. Having said that, currency volatility

in emerging markets and potential risk of write-off of cash in Venezuala (~USD35m)

will keep multiples range-bound. We have cut our FY16-18E EPS by 6-9% as we

build zero sales from Venezuala going forward. Though Zetia exclusivity will bring

debt under check, pick-up in US base business is the key to maintain sustainable

growth. Maintain

Neutral

(TP: INR900, 18x on FY18E EPS + INR20 NPV for Zetia).

Big In-licensing deal in innovation business could act as a positive catalyst.

Financials & valuations (INR b)

Y/E Mar

Sales

EBITDA

Net Profit

AdjEPS(INR)

)

EPS Gr. (%)

BV/Sh(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015

66.0

11.8

4.8

17.5

-12.3

110.6

15.8

14.4

44.0

7.0

2016E 2017E

71.9

15.4

8.4

29.8

70.4

17.9

18.6

25.8

4.6

87.9

23.4

11.3

39.9

33.7

18.6

26.6

19.3

3.6

166.4 214.5

Estimate change

TP change

Rating change

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 3982 5584

Amey Chalke

(amey.chalke@motilaloswal.com); +91 22 39825423

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.