2 February 2016

2QFY16 Results Update | Sector: Cement

Shree Cement

Neutral

BSE SENSEX

24,539

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

7,456

SRCM IN

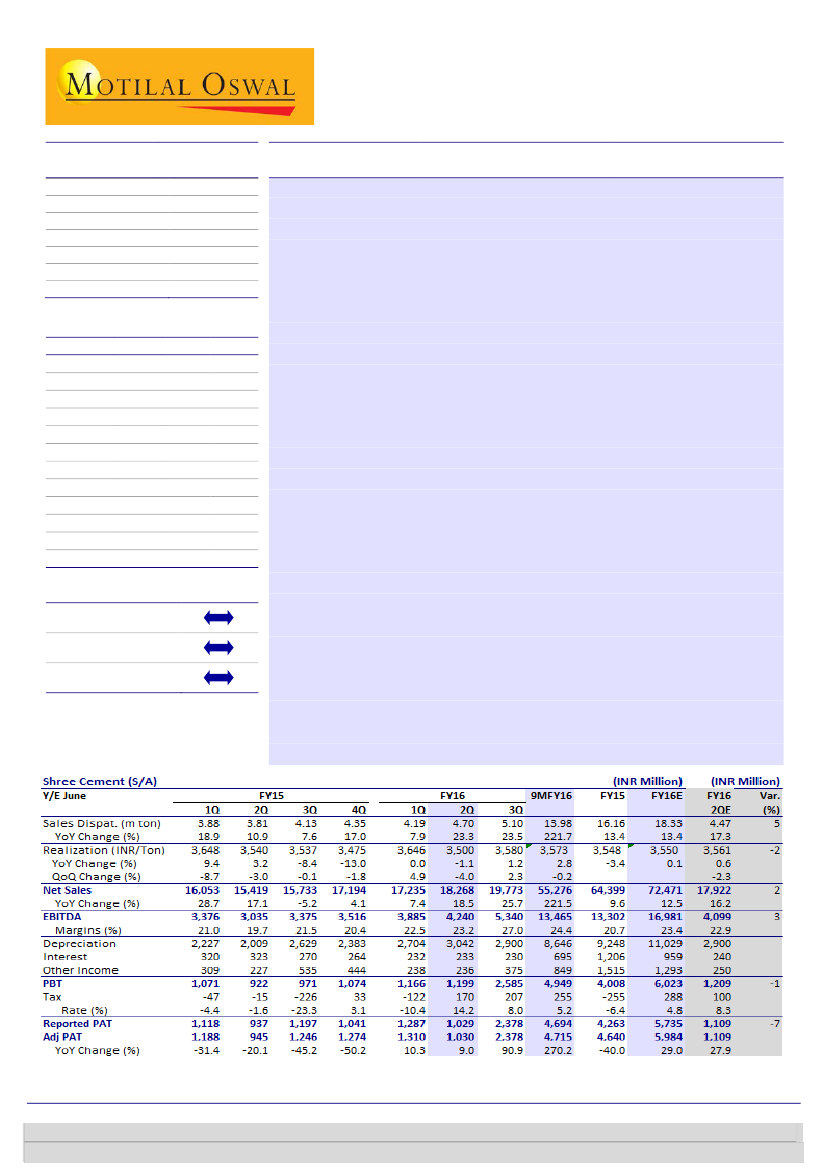

14-quarter high growth amidst; Cost savings negates realization hit

34.8

14-quarter high growth amidst pricing dip:

SRCM’s 2QFY16 EBITDA stood in

361.4 / 5.3

line at INR4.2b, +40% YoY (est INR4.1b) led by strong volume growth and

13345 / 9350

duality of softening realization getting offset by cost savings. On the back east

-2/2/11

240

expansion, SRCM posted 23% YoY (+12% QoQ) growth in volume at 4.7mt (est

35.2

4.5mt), albeit dismal realizations (down 4% QoQ v/s est -2.5%) highlights

CMP:INR10,375 TP: INR11,634(12%)

Financials & Valuations (INR b)

Y/E June

2015

2016E 2017E

Net Sales

64.4

72.5

85.0

EBITDA

13.3

17.0

21.7

PAT

4.6

6.0

10.8

EPS (INR)

133.2

171.8

309.8

Gr. (%)

-40.0

29.0

80.3

BV/Sh (INR) 1,514.6 1,614.5 1,883.6

RoE (%)

9.3

11.0

17.7

RoCE (%)

9.4

11.6

18.2

P/E (x)

77.9

60.4

33.5

P/BV (x)

6.8

6.4

5.5

EV/EBITDA(x) 26.3

20.3

15.4

EV/Ton(USD) 211

193

186

Estimate change

TP change

Rating change

competitive intensity prevailing. Cement revenue was at INR16.5b, +22% YoY

(4% beat), while merchant power revenue stood at INR1.8b (est INR2b), led by

lower realizations of INR3.37/unit (-8% QoQ) and stable volume.

Cost savings negates realization hit, profitability in line:

EBITDA margin stood

at 23.2% (+0.7pp QoQ, +3.5pp YoY) despite dip in realizations. Cost/ton was

lower 4-5% QoQ/YoY led by (a) savings in energy (sharp decline in pet coke

price), (b) freight (lower lead distance, down -10% YoY), and (c) positive

operating leverage. Cement EBITDA stood at INR796 (flat QoQ, +11% YoY).

Power EBITDA stood below est with EBITDA/unit of INR0.93 (v/s INR1.1 QoQ)

Marginal cut in estimates:

Higher depreciation (UP grinding commission) and

tax (no MAT credit) led PAT at INR1.03b (est INR1.1b). We cut FY16 (9M)

EBITDA by 1-3% after factoring in lower pricing trends, higher volume (13% v/s

11% earlier in FY16) and lower energy and freight cost. It translates into

FY16/17E cement EBITDA/ton of INR808/INR941 (INR744 in FY15).

Valuation premium came off, maintain neutral:

The stock trades at

15.4x/10.9x EV/EBITDA on FY17/18E and EV of US$169/ton FY17E (adjusting

for Merchant Power assets), which is 5- 10% premium to UTCEM at various

valuation parameters. The premium valuation has contracted post recent

underperformance. While we consider SRCM as one of resilience bet to play

cement up cycle, we continue to maintain our neutral stance still we get

visibility on sectoral growth sustenance. We value SRCM at SOTP based TP of

INR11,600/share (EV at USD200/ton and 12.5x FY18E EV/EBITDA), 12% upside.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Aashumi Mehta

(aashumi.mehta@motilaloswal.com);