Amara Raja Batteries

BSE SENSEX

24,539

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

7,456

AMRJ IN

170.8

147.1 / 2.2

1132 / 773

5/1/13

265

47.9

2 February 2016

3QFY16 Results Update | Sector: Automobiles

CMP: INR861

TP: INR1,100 (+28%)

Buy

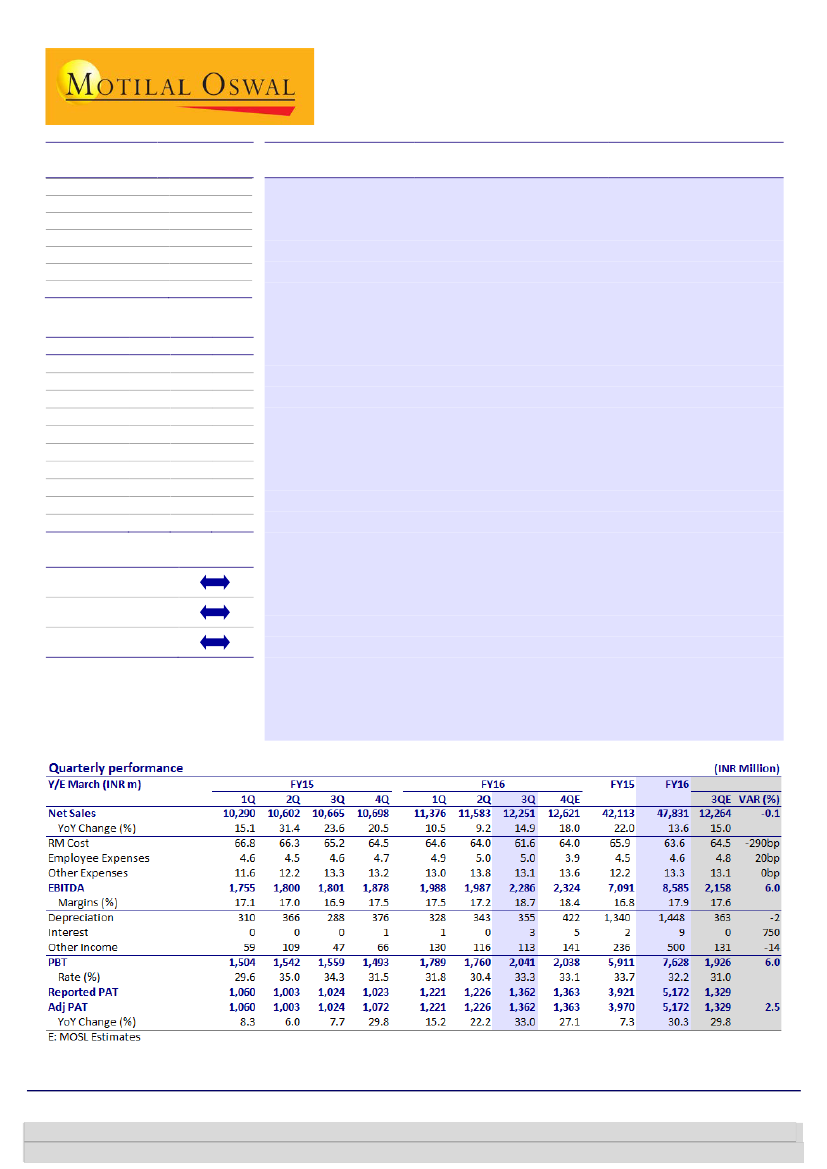

In-line; Highest ever EBITDA margins (18.7% v/s est 17.6%) off-set by

higher taxes

Net sales grew 15% YoY (+6% QoQ) to INR12.25b (in-line), driven by strong

growth in 4W replacement segment (driven by new capacities) and double digit

growth in the industrial segment.

EBITDA margins improved 180bp YoY (+150bp QoQ) to 18.7%, translating into

EBITDA growth of ~27% YoY (+15% QoQ).

RM Cost declined 240bp QoQ (-360bp YoY) to 61.6%, benefitting from lag

impact of ~9% correction in spot lead prices in 2QFY16. However, higher other

expenses (+150bp QoQ) due to higher marketing expense.

However, higher tax rate at 33.3% restricted adj. PAT to INR1.36b (v/s est

~INR1.33b) up 33% YoY (+11% QoQ).

Takeaways from Press Release:

a) Significant investment in brand building was

initiated during 3QFY16, driving further market share gains in aftermarket business

in both 2W and 4W. b) It has started making deeper penetration in the domain of

the unorganized sector. c) Ramping up of new capacities is faster than expected,

enabling it to plan further capacity expansion which would be finalized by March

2016. d) New tubular battery plant is expected to commission operations by end

4QFY16, which would reduce dependence on trading operations in tubular

batteries. e) With improving power situation in the country, it has redesigned its

tubular battery plant making it fungible to produce products for different

applications. It is evaluating new technologies in energy storage space through

which it is realigning its business strategy.

Valuation and view:

We will review our estimates post interaction with

management, however, we see limited change on our estimates. The stock trades

at 21.4x/17.6x FY17/18 EPS. Maintain Buy with a TP of ~INR1,100 (~22.5x FY18E

EPS).

Financials & Valuations (INR b)

Y/E Mar

2015 2016E 2017E

Net Sales

42.1

47.8

56.5

EBITDA

7.1

8.6

10.5

PAT

4.2

5.2

6.9

EPS (INR)

24.3

30.3

40.3

Gr. (%)

12.3

24.4

33.3

BV/Sh (INR)

99.5 135.2 182.9

RoE (%)

27.2

25.8

25.4

RoCE (%)

37.6

36.1

33.6

P/E (x)

35.4

28.5

21.4

P/BV (x)

8.7

6.4

4.7

Estimate change

TP change

Rating change

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.