4 February 2016

3QFY16 Result Update | Sector: Capital Goods

Lakshmi Machine Works Ltd.

BSE SENSEX

24338

Shares O/s (cr)

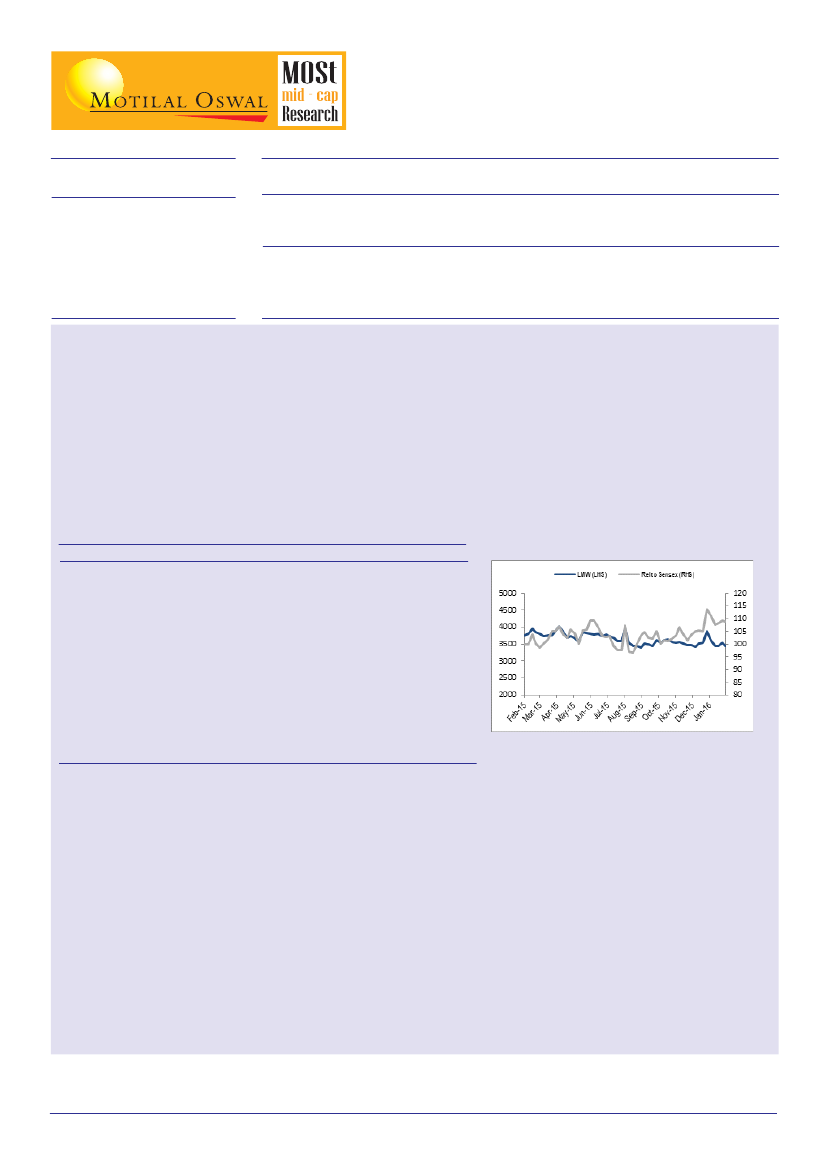

52-W H/L Range (INR)

1/6/12m Rel. Perf. (%)

Market Cap. (INR cr)

Market Cap. (US$ m)

NIFTY

7404

1.1

4199/ 3275

-4 /10 /8

3985

595

CMP: INR3515

YEAR

END

SALES APAT

A.EPS

EPS

Gr.(%)

18%

24%

18%

PE

(INRCr) (INRCr) (INRCr)

217

251

289

198.2

245.5

198.2

TP: INR4800

P/BV EV/EBITDA

(X)

3.2

2.5

3.2

(X)

7.9

5.5

7.9

Div yld

(%)

1.0

1.3

1.0

ROE

(%)

18.9

18.5

18.9

(X)

18.2

14.7

18.2

Buy

ROCE

(%)

21.3

22.5

21.3

FY15A 2,385

FY16E

FY17E

2,576

2,879

Result Highlights

LMW numbers were above our estimates.

Revenue grew 15% on account of 31% growth in Machine Tood division and 12% growth in revenues for textile

machinery.

Margins have risen on accout of lower raw material cost with the Textile division seeing margins grow by 340bps to

13.3%.

Backlog for the Textile Machinery business at December end for the domestic business is close to FY15 end

backlog with revenues booked being equivalent to orders that have been bagged. Export backlog is now being

considered closer to delivery as LCs get raised. The entry into new export markets is paying off with exports at 22%

of revenues.

QEDec-14

589.3

518.7

70.6

26

23.3

0.3

73.3

26.5

46.8

12.0

36.1

QESep-15

564.2

499.0

65.2

24

23.2

0.0

66.0

22.2

43.9

11.6

33.6

QEDec-15

619.8

547.8

72.0

29

19.3

0.1

81.1

24.7

56.5

11.6

30.4

% y/y

5%

6%

2%

9%

-17%

-54%

11%

-7%

21%

% q/q

10%

10%

10%

N.A.

-17%

683%

23%

11%

29%

INRCr

Revenue

Expenditure

OP

Other Income

Depreciation

Interest

Profit before tax

Tax

RPAT

OPM(%)

Tax rate (%)

Valuation and view

Our rationale for recommending to BUY LMW was:

LMW has a market share of 60% in value-terms and 70% in volume terms.

LMW's target customers - Textile companies have reported good profits . Most of these companies are working at

optimum capacity utilization and need to invest to grow further. LMW, as a market leader in equipment, stand to

benefit. The Gujarat government's make in Gujarat policy is seeing textile capacity come back into the state and

orders on this front will continue to drive revenues well into FY17

LMW's balance sheet is strong given a net cash and cash equivalent of ~Rs.968 cr as of end September 2015 and

zero debt.

The domestic customer base is witnessing overcapacity and could be impacted by events in China. This is our only

worry for LMW.

We recommend to BUY for an one year target of INR4800 at 1% yield on our expected FY16 dividend.

Ravi Shenoy

(ravi.shenoy@MotilalOswal.com); Tel: +91 22 30896865