5 February 2016

Q3FY16 Results Update | Sector: Technology

Mphasis

Neutral

BSE SENSEX

24,617

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

7,489

MPHL IN

210.2

92.4 / 1.4

534/335

-7/16/39

97

39.5

CMP: INR439

TP: INR520(+18%)

The leaking bucket continues to hurt

Delivering in the focus areas, but Digital Risk to languish:

MPHL reported

revenue decline of 3.4% QoQ to USD229m. Direct International segment grew

2.5% QoQ CC, continuing the momentum in its focus area. LTM deal TCV of

USD309m lends visibility of above-industry growth in 2/3rd of the business.

Revenue in Digital Risk however was flat at ~USD40m. This is expected to head

to its foundational size of ~USD30m run-rate over the next two quarters

Margins in-line with estimate:

EBIT margin declined by 70bp QoQ to 13.2%, in

line with our estimate of 13.3%. The impact of annual salary hike, furloughs

and Chennai was countered by growth in the Direct international business and

better revenue mix (with the sale of domestic BPO business). The management

maintained its guided EBIT margin range of 13-15% for FY17.

Improvement in overall revenue mix:

HP channel declined by 11% QoQ and

now constitutes to 24% of total revenue (35% in the previous year). The

revenue decline was also led by the selling of MPHL’s domestic BPO business.

With increasing share of Direct International revenue, marked improvement

can be expected in the company’s revenue mix and margin profile.

Valuation and view:

We expect revenue CAGR of 6.6% and EPS CAGR of 10.6%

over FY16-18E. Our estimates have been revised downwards by 5.5/6.6% for

FY17/18E given the accelerating decline in HP and shrinkage anticipated in

Digital Risk. While valuations at 11.4x/10.4x FY17E/18E are at a steep discount

to peers (particularly after factoring the cash balance), overall revenue growth

improvement is imperative to bridging the same. We maintain our target price

to INR520 discounting forward operating PAT by 11x added to net cash on

book of INR140/share (compared to INR112 at present).

Neutral.

Financials & Valuations (INR b)

Y/E Mar

2015 2016E 2017E

Net Sales

57.9

60.9

64.4

EBITDA

8.7

9.0

10.2

PAT

6.8

7.3

8.1

EPS (INR)

32.3

34.6

38.5

Gr. (%)

-8.6

7.3

11.4

BV/Sh (INR)

260.8 277.1 290.4

RoE (%)

12.8

12.9

13.6

RoCE (%)

13.1

13.3

14.6

P/E (x)

13.6

12.7

11.4

P/BV (x)

1.7

1.6

1.5

Estimate change

TP change

Rating change

5-7%

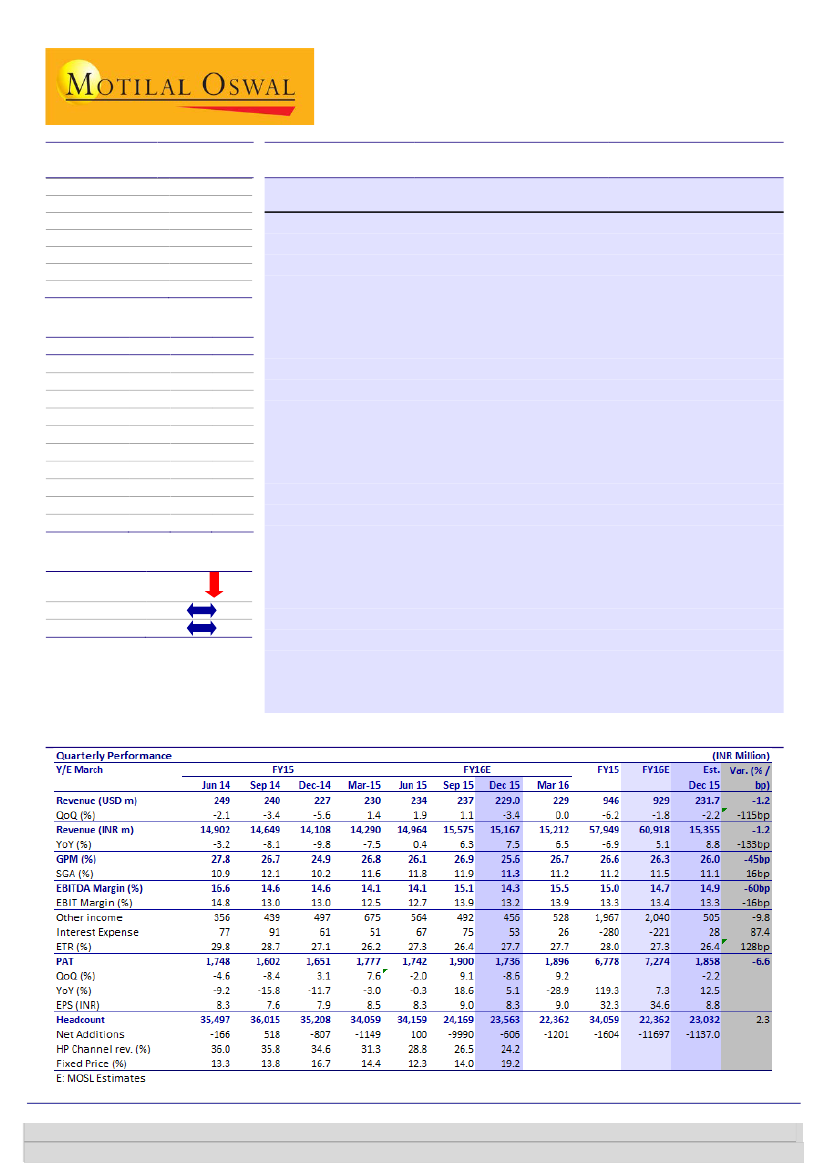

Quarterly Performance (Consolidated)

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.