5 February 2016

Q3FY16 Results Update | Sector: Consumer

Radico Khaitan

Buy

BSE SENSEX

24,617

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

7,489

RDCK IN

133.0

15.0 / 0.2

131 / 78

2/27/35

49

59.5

CMP: INR113

TP: INR150(+32%)

In-line, de-focus on lower end brands in TN impacts volumes

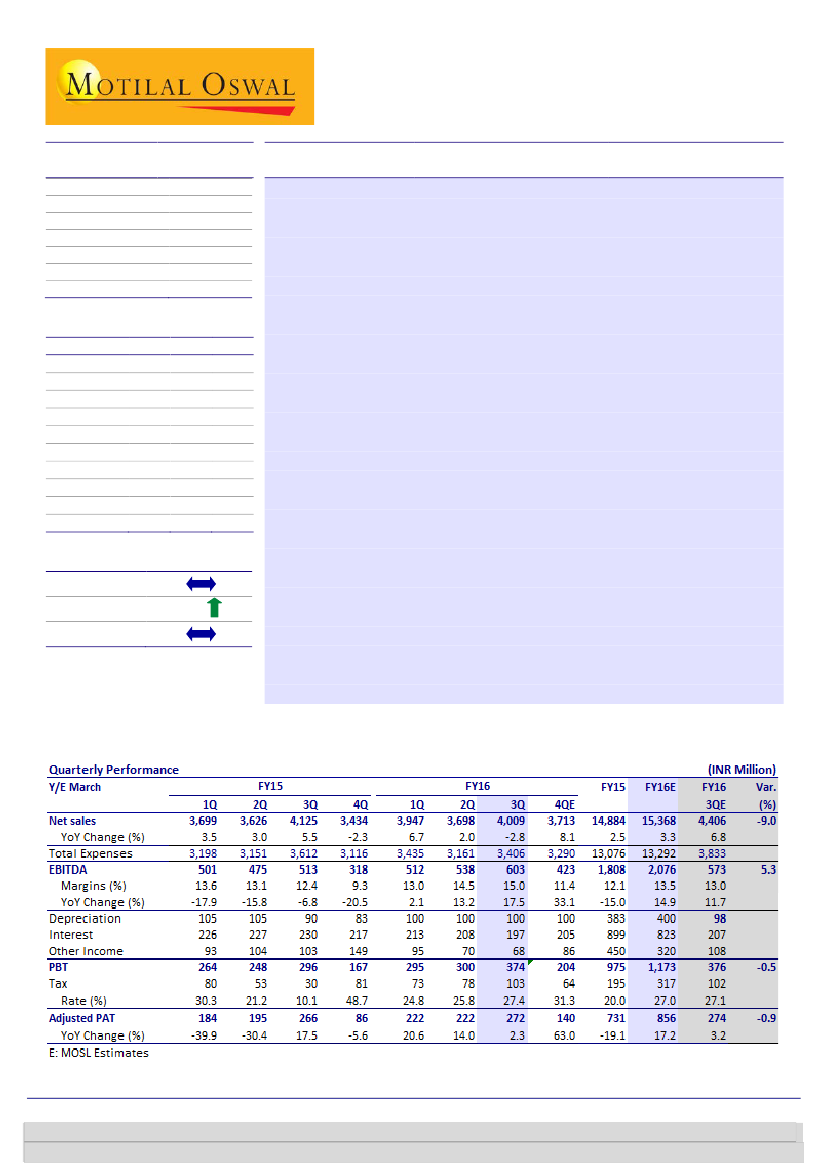

RDCK’s net sales declined 2.8% YoY

to INR4b (est. of INR4.4b), with underlying

volume decline of 3.8% YoY to 4.8m cases. EBITDA posted 17.5% YoY growth to

INR603m (est. INR573m; aided by soft base wherein EBITDA declined 6.8%).

However lower other income (down 34% YoY) and higher tax rate (up 1720bps

YoY) dragged Adj. PAT growth of 2.3% to INR272m (est. INR274m).

Gross sales were up 8.2% YoY to INR9.7b

while excise duties increased 16.1%

YoY (excise duties now constitute 59.5% of gross sales, up 410bps YoY). Overall

volumes declined 3.8% YoY to 4.8m cases due to de-focus on lower-end brands

(TN volumes declined by 69% YoY). Premium brands volumes grew 10.7% YoY

to 1.2m cases and now form 24.6% of portfolio volumes (up 320bps YoY).

In 3QFY16, gross margin expanded

due to reduced raw material consumption

costs, on account of excise duty impact on the increased inventory of bottled

IMFL stock at the Rampur facility. The corresponding impact of which is

negated by increase in rates and taxes included under other expenditure.

Lower selling expenses (down 80bps YoY) further aided EBITDA margin

expansion of 260bps YoY to 15% (est. 13%).

Management Call takeaways:

1) Market share across brands is growing with

premium brands registering healthy growth, 2) As per market interactions,

Royal Challenge brand is doing well however UNSP has re-launched the brand

at lower price point. 3) No pricing actions yet, however it expects to get prices

increase in Southern states in FY17. 4) Net debt stood as on 3QFY16 is INR8.2b.

Valuation and view:

We revise our estimates marginally by 3%/4% and build in

10.2% sales CAGR and 18.1% PAT CAGR. RDCK is focusing on driving premium

portfolio given the challenging margin dynamics of Regular portfolio. We roll

forward our estimates and maintain BUY with a revised target price of INR150

(16x Sept’17 EPS. Spike in ENA prices and excise duty increase are key risks.

Financials & Valuations (INR b)

Y/E Mar

2015 2016E 2017E

Net Sales

14.9

15.4

17.4

EBITDA

1.9

2.1

2.5

PAT

0.9

0.9

1.1

EPS (INR)

6.6

6.4

8.5

Gr. (%)

4.2

-3.0

31.5

BV/Sh (INR)

64.7

71.4

78.4

RoE (%)

10.5

9.5

11.3

RoCE (%)

8.6

9.2

10.8

P/E (x)

17.1

17.6

13.4

P/BV (x)

1.8

1.6

1.4

Estimate change

TP change

Rating change

11%

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(manish.poddar@motilaloswal.com); +91 22 3027 8029 /

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.