Ipca Laboratories

BSE SENSEX

24,287

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

7,387

IPCA IN

126.2

81.7 / 1.2

888/560

-2/-2/20

202

54.1

8 February 2016

Q3FY16 Results Update | Sector: Healthcare

CMP: INR647

TP: INR680 (+5%)

Neutral

Significant miss, US FDA resolution remains a key

Financials & Valuation (INR b)

Y/E Mar

2015 2016E 2017E

Net Sales

31.4

29.2

35.4

EBITDA

5.3

3.7

6.5

PAT

2.5

1.4

3.3

EPS (INR)

19.8

10.9

26.0

Gr. (%)

-47.7 -44.9 137.7

BV/Sh (INR)

175.0 181.8 203.9

RoE (%)

12.0

6.1

13.5

RoCE (%)

14.2

6.9

13.7

P/E (x)

32.7

59.2

24.9

P/BV (x)

3.7

3.6

3.2

Estimate change

TP change

Rating change

-12-14%

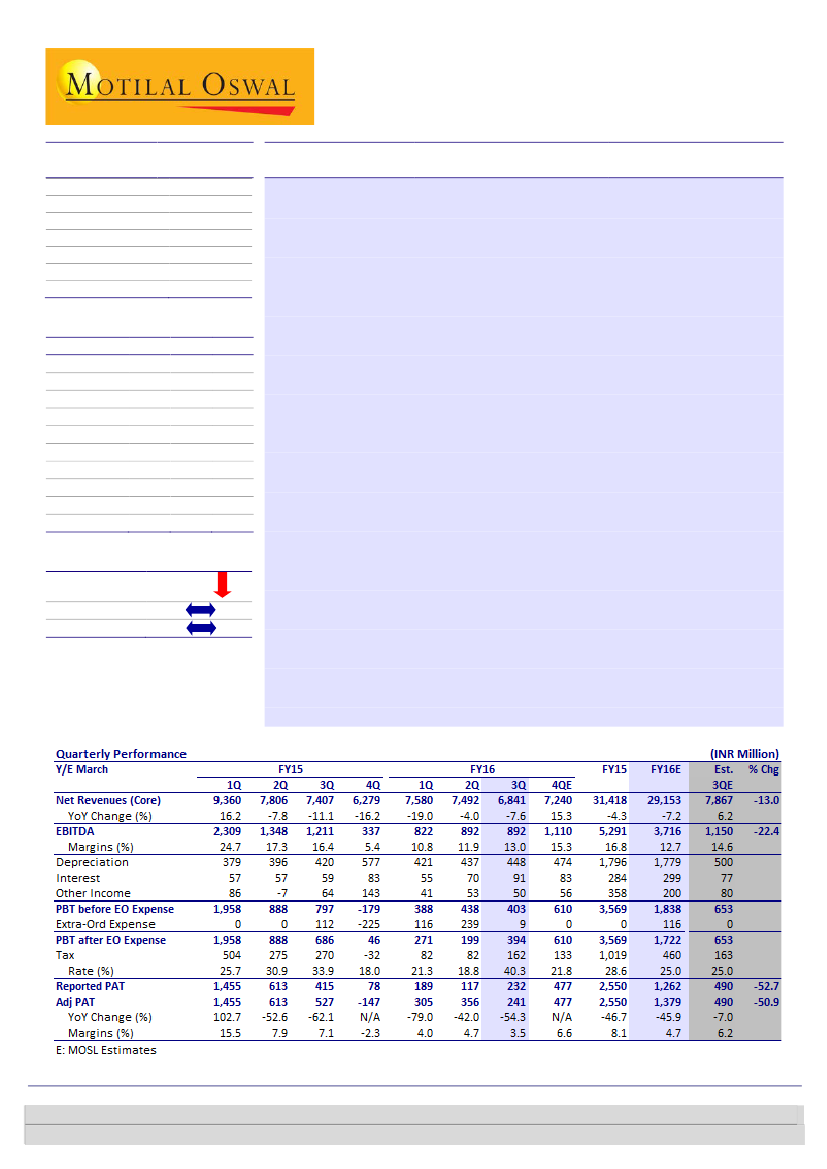

IPCA’s 3Q PAT at INR232m (54%YoY decline) was significantly below expectations

due to sharp revenue disappointment (@INR6.8b, 13% miss) and inventory write of

INR240m. EBITDA also declined 26%YoY (22% miss), driven by negative operating

leverage and inventory write offs in 3Q.

Revenue recovery remained sluggish:

US business sales stood at INR220m led

by resumption of HCQ supplies in 3Q. The company has guided for steady ramp up

in the US sales going ahead. However, absence of Global fund contracts affected

institutional business as it declined 71%YoY to INR240m. Even though global fund

tenders sales are expected to pick up from next quarter, there has been significant

price erosion (~60%) in these contracts; as a result, ramp up would be much slower

than earlier estimates. India formulation business, affected by restructuring of

various marketing divisions and lower malaria sales; it grew 11%YoY to INR3.1b.

Branded promotional business declined 19%YoY to INR600m, driven by steep

currency depreciation in key markets.

Inventory write off affects profitability:

3Q EBITDA margins at 13% (down

340bp YoY) was a significant miss due to (a) lower revenues (hurt operating

leverage) and (b) inventory write-off worth INR240m during this quarter. Adjusted

for write offs, EBITDA margins stood at ~16% in 3Q.

Balanced risk-reward, earnings turnaround largely factored:

Post 3Q miss,

we cut our FY17/18E EPS est. by 14/12% respectively mainly on delay in US FDA

resolution and slower ramp up in Institutional business. At CMP, stock trades at

25x/16x FY17E/18E EPS, at a discount to 3 year average P/E. We believe that an

earnings rebound (26% EPS CAGR) is largely factored in. However, early resolution

of the USFDA-banned facilities could provide further trigger to our estimates.

Retain

Neutral

on IPCA with target price of INR680 (17x FY18E, 20% discount to

mid-cap peers).

Key risks:

Delay in resolving regulatory issues and slower market

share gains in US (on exempted products).

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 3982 5584

Amey Chalke

(amey.chalke@motilaloswal.com); +91 22 39825423

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.